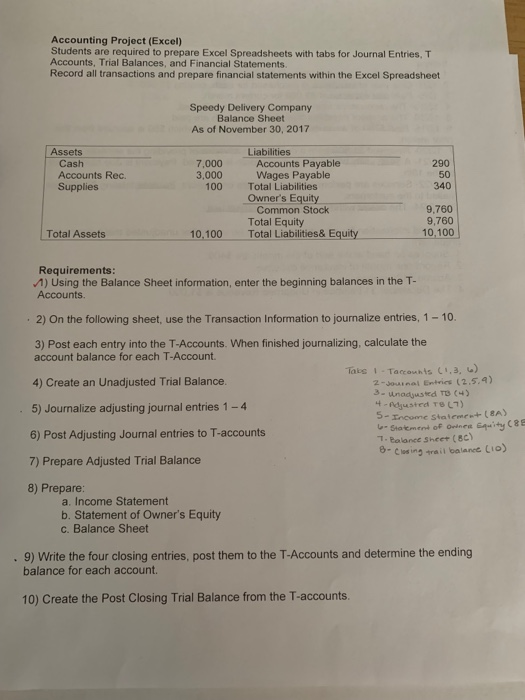

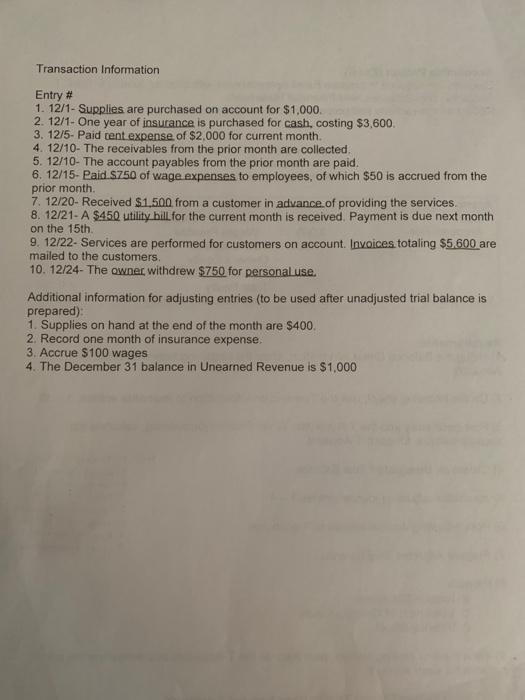

Accounting Project (Excel) Students are required to prepare Excel Spreadsheets with tabs for Journal Entries, T Accounts, Trial Balances, and Financial Statements. Record all transactions and prepare financial statements within the Excel Spreadsheet Speedy Delivery Company Balance Sheet As of November 30, 2017 Assets Liabilities Accounts Payable Wages Payable 7,000 3,000 100 Cash 290 Accounts Rec. Supplies 50 340 Total Liabilities Owner's Equity Common Stock Total Equity Total Liabilities& Equity 9,760 9,760 10,100 Total Assets 10, 100 Requirements: ) Using the Balance Sheet information, enter the beginning balances in the T- Accounts. 2) On the following sheet, use the Transaction Information to journalize entries, 1-10. 3) Post each entry into the T-Accounts. When finished journalizing, calculate the account balance for each T-Account Taks 1-Taccouhis (, 3, ) 2-Journal Entrics (2,5.4) 3- unadyustrd TB (4) 4-Adjusted Te LT) 5-Income Statemet (8A) -Staement of Oninea Gquity C8E 7- Balanee Sheet (8c) 6-Closing rail balanec LIO) Unadjusted Trial Balance 4) Create an 5) Journalize adjusting journal entries 1-4 6) Post Adjusting Journal entries to T-accounts 7) Prepare Adjusted Trial Balance 8) Prepare: a. Income Statement b. Statement of Owner's Equity c. Balance Sheet 9) Write the four closing entries, post them to the T-Accounts and determine the end ing balance for each account 10) Create the Post Closing Trial Balance from the T-accounts. Transaction Information Entry # 1. 12/1- Supplies are purchased on account for $1,000. 2.12/1- One year of insurance is purchased for cash, costing $3,600. 3. 12/5- Paid cent expense of $2,000 for current month. 4. 12/10- The receivables from the prior month are collected. 5. 12/10- The account payables from the prior month are paid. 6. 12/15- Paid S750 of wage expenses to employees, of which $50 is accrued from the prior month. 7.12/20- Received $1,500 from a customer in advance.of providing the services. 8. 12/21- A $450 utility bill for the current month is received. Payment is due next month on the 15th. 9. 12/22- Services are performed for customers on account. Invoices totaling $5.600 are mailed to the customers. 10. 12/24- The owner withdrew $750 for personal use. Additional information for adjusting entries (to be used after unadjusted trial balance is prepared): 1. Supplies on hand at the end of the month are $400. 2. Record one month of insurance expense. 3. Accrue $100 wages 4. The December 31 balance in Unearned Revenue is $1,000