Question

On December 11, 2019, shares amounting to 1.5% of Aramcos value began trading only on the Tadawul, Saudi Arabias stock exchange. The IPO will, in

On December 11, 2019, shares amounting to 1.5% of Aramco’s value began trading only on the Tadawul, Saudi Arabia’s stock exchange. The IPO will, in fact, raise nearly $26 billion for the kingdom, at a price that values Aramco at $1.7 trillion.

Aramco is the world’s most profitable company, with nearly twice the earnings of number-two company Apple in 2018. However, Aramco operates differently than the public companies we’re all familiar with. Saudi Arabia is the primary swing producer in the Organization of the Petroleum Exporting Countries (OPEC), cutting oil production to prop up prices and balance markets when needed. It also keeps oil production capacity in reserve to call upon in times of shortage. These decisions are made for market stabilization and political reasons; a company focused on maximizing shareholder value would be unlikely to act in this way. The decision making process will not change in the wake of the IPO.

With respect to valuation, several factors are currently spooking oil markets and reducing Aramco’s perceived value. Oil markets are currently pessimistic about future demand, in the short term owing to the ongoing trade war between the United States and China, and in the longer term due to the world’s need to move away from fossil fuels to avert the worst impacts of climate change. At the same time, oil production in the United States is still growing rapidly. Aramco’s production costs are much lower than those in the United States, but a price war to push out U.S. producers would be more painful than helpful, as seen during the oil price crash of 2014-16.

Required Question:

Project the share price of Saudi Aramco within 1 year timeframe.

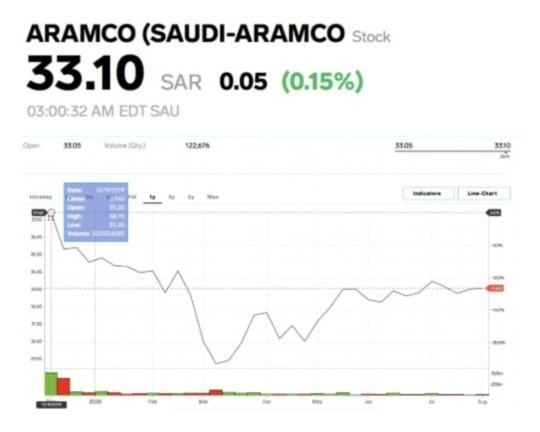

ARAMCO (SAUDI-ARAMCO Stock 33.10 SAR 0.05 (0.15%) 03:00:32 AM EDT SAU 310 -Chert

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Saudi Aramco is worth between 16tn and 17tn according to the prelimin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started