Answered step by step

Verified Expert Solution

Question

1 Approved Answer

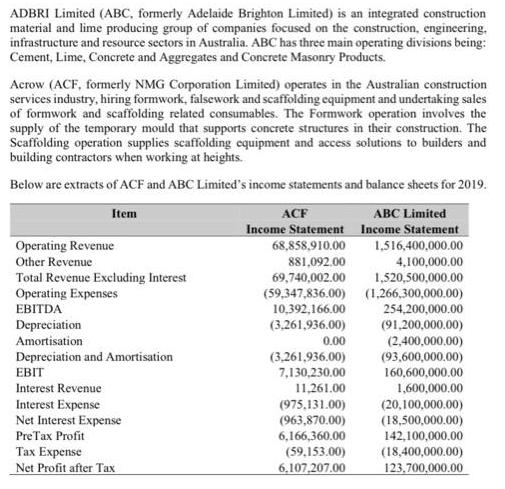

ADBRI Limited (ABC, formerly Adelaide Brighton Limited) is an integrated construction material and lime producing group of companies focused on the construction, engineering. infrastructure

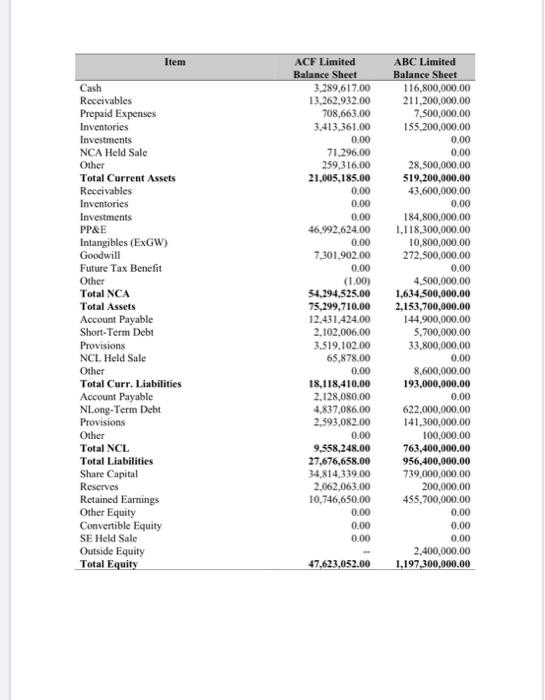

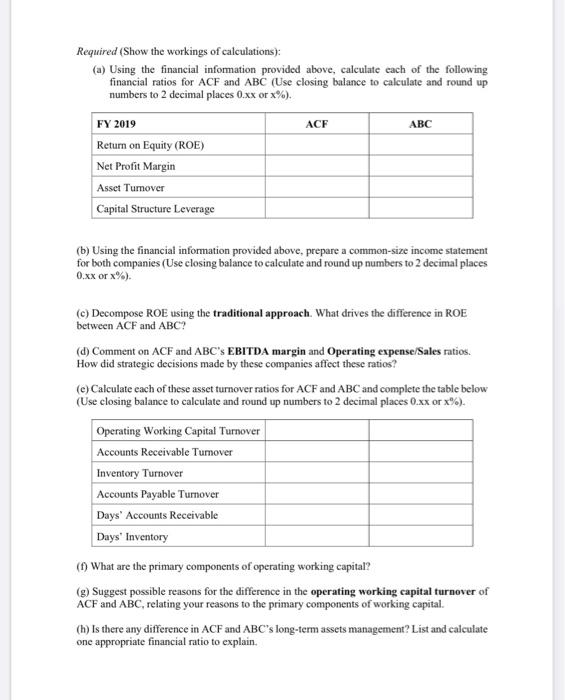

ADBRI Limited (ABC, formerly Adelaide Brighton Limited) is an integrated construction material and lime producing group of companies focused on the construction, engineering. infrastructure and resource sectors in Australia. ABC has three main operating divisions being: Cement, Lime, Concrete and Aggregates and Concrete Masonry Products. Acrow (ACF, formerly NMG Corporation Limited) operates in the Australian construction services industry, hiring formwork, falsework and scaffolding equipment and undertaking sales of formwork and scaffolding related consumables. The Formwork operation involves the supply of the temporary mould that supports concrete structures in their construction. The Scaffolding operation supplies scaffolding cquipment and access solutions to builders and building contractors when working at heights. Below are extracts of ACF and ABC Limited's income statements and balance sheets for 2019. Item ACF ABC Limited Income Statement Income Statement Operating Revenue 68,858,910.00 1,516,400,000.00 Other Revenue 881,092.00 4,100,000.00 Total Revenue Excluding Interest Operating Expenses EBITDA 69,740,002.00 1,520,500,000.00 (59,347,836.00) (1,266,300,000.00) 10,392,166.00 254,200,000.00 Depreciation Amortisation Depreciation and Amortisation (3.261,936.00) (91,200,000.00) (2,400,000.00) 0.00 (3,261,936.00) (93,600,000.00) EBIT 7,130,230.00 11,261.00 160,600,000.00 1,600,000.00 Interest Revenue Interest Expense Net Interest Expense (975,131.00) (20,100,000.00) (18,500,000.00) 142,100,000.00 (963,870.00) PreTax Profit 6,166,360.00 Expense Net Profit after Tax (59,153.00) (18,400,000.00) 6,107,207.00 123,700,000.00 Item ACF Limited Balance Sheet ABC Limited Balance Sheet 3,289,617.00 13,262,932.00 116,800,000.00 211,200,000.00 Cash Receivables Prepaid Expenses 708,663.00 7,500,000.00 Inventories 3,413,361.00 0.00 71,296.00 259,316.00 21,005,185.00 155,200,000.00 Investments 0.00 NCA Held Sale 0.00 Other 28,500,000.00 Total Current Assets 519,200,000.00 Receivables 0.00 43,600,000.00 0.00 0.00 0.00 184,800,000.00 1,118,300,000.00 Inventories Investments PP&E 46,992,624.00 Intangibles (EXGW) Goodwill 10,800,000.00 272,500,000.00 0.00 7,301,902.00 Future Tax Benefit 0.00 0.00 Other Total NCA (1.00) 54,294,525.00 75,299,710.00 12,431,424.00 2,102,006.00 3.519,102.00 65,878.00 0.00 4,500,000.00 1,634,500,000.00 2,153,700,000.00 144,900,000.00 5,700,000.00 33,800,000.00 Total Assets Account Payable Short-Term Debt Provisions NCL Held Sale 0.00 Other 8,600,000.00 Total Curr. Liabilities 18,118,410.00 2,128,080.00 4,837,086.00 2,593,082.00 193,000,000.00 0.00 622,000,000.00 141,300,000.00 100,000.00 763,400,000.00 956,400,000.00 Account Payable NLong-Term Debt Provisions Other 0.00 Total NCL 9,558,248.00 27,676,658.00 Total Liabilities Share Capital Reserves 34,814,339.00 2,062,063.00 10,746,650.00 0.00 0.00 0.00 739,000,000.00 200,000.00 455,700,000.00 Retained Earnings Other Equity Convertible Equity SE Held Sale 0.00 0.00 0.00 Outside Equity 2,400,000.00 Total Equity 47,623,052.00 1,197,300,000.00 Required (Show the workings of calculations): (a) Using the financial information provided above, calculate cach of the following financial ratios for ACF and ABC (Use closing balance to calculate and round up numbers to 2 decimal places 0.xx or x%). FY 2019 ACF Return on Equity (ROE) Net Profit Margin Asset Turnover Capital Structure Leverage (b) Using the financial information provided above, prepare a common-size income statement for both companies (Use closing balance to calculate and round up numbers to 2 decimal places 0.xx or x%). (e) Decompose ROE using the traditional approach. What drives the difference in ROE between ACF and ABC? (d) Comment on ACF and ABC's EBITDA margin and Operating expense/Sales ratios. How did strategic decisions made by these companies affect these ratios? (e) Calculate cach of these asset turnover ratios for ACF and ABC and complete the table below (Use elosing balance to calculate and round up numbers to 2 decimal places 0.xx or x%). Operating Working Capital Turnover Accounts Receivable Tumover Inventory Turnover Accounts Payable Turnover Days' Accounts Receivable Days' Inventory () What are the primary components of operating working capital? (g) Suggest possible reasons for the difference in the operating working capital turnover of ACF and ABC, relating your reasons to the primary components of working capital. (h) Is there any difference in ACF and ABC's long-term assets management? List and calculate one appropriate financial ratio to explain.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Ratio ACF ABC Formula applied Return on Equity 018 009 Net profitShareholderss equity Net profit margin 013 008 Net profitRevenue Asset turnover 057 069 RevenueTotal assets Capital structure leverag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started