Answered step by step

Verified Expert Solution

Question

1 Approved Answer

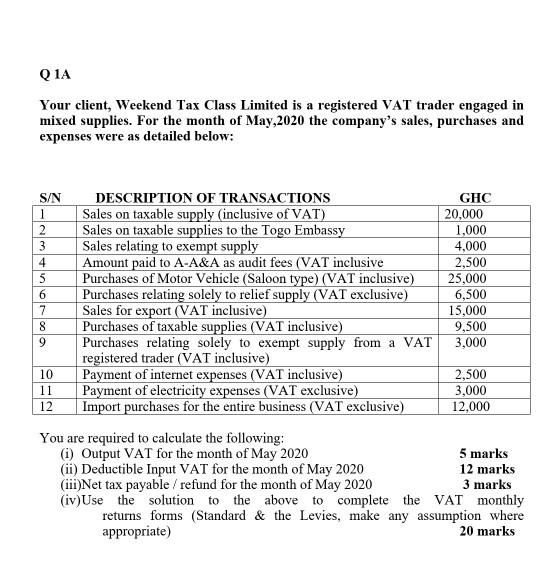

Q 1A Your client, Weekend Tax Class Limited is a registered VAT trader engaged in mixed supplies. For the month of May,2020 the company's

Q 1A Your client, Weekend Tax Class Limited is a registered VAT trader engaged in mixed supplies. For the month of May,2020 the company's sales, purchases and expenses were as detailed below: S/N DESCRIPTION OF TRANSACTIONS GHC Sales on taxable supply (inclusive of VAT) Sales on taxable supplies to the Togo Embassy Sales relating to exempt supply Amount paid to A-A&A as audit fees (VAT inclusive Purchases of Motor Vehicle (Saloon type) (VAT inclusive) Purchases relating solely to relief supply (VAT exclusive) Sales for export (VAT inclusive) Purchases of taxable supplies (VAT inclusive) Purchases relating solely to exempt supply from a VAT registered trader (VAT inclusive) Payment of internet expenses (VAT inclusive) Payment of electricity expenses (VAT exclusive) Import purchases for the entire business (VAT exclusive) 20,000 1,000 4,000 3 2,500 25,000 6,500 15,000 9,500 3,000 2,500 3,000 12,000 10 11 12 You are required to calculate the following: (i) Output VAT for the month of May 2020 (ii) Deductible Input VAT for the month of May 2020 (iii)Net tax payable / refund for the month of May 2020 (iv)Use the solution to the above to complete the VAT monthly returns forms (Standard & the Levies, make any assumption where appropriate) 5 marks 12 marks 3 marks 20 marks 45678a

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i output vat details supplies value amount Sales on taxable supply 20000 16116 27586 Sales on taxabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started