Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We developed formula on how to calculate price of PUT or CALL under uniform distribution Mean absolute deviation of a random vanable is the

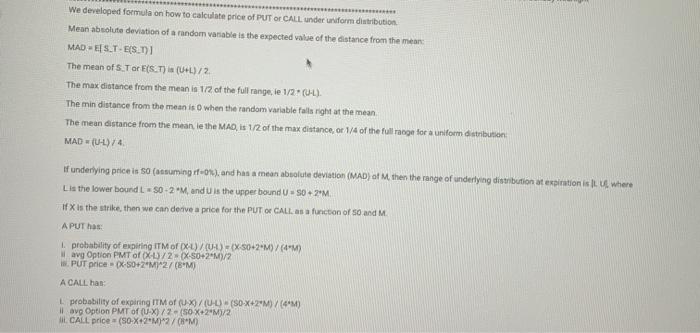

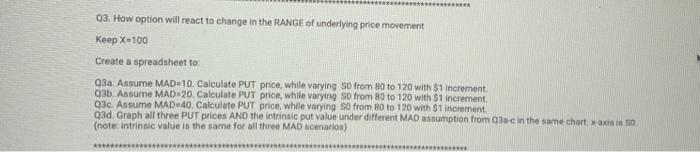

We developed formula on how to calculate price of PUT or CALL under uniform distribution Mean absolute deviation of a random vanable is the expected value of the distance from the mean MAD EI ST-E(S_T)] The mean of S.T or E(S.T) is (U+L)/2 The max distance from the mean is 1/2 of the full range, ie 1/2 (UL) The min distance from the mean is 0 when the random variable falls right at the mean The mean distance from the mean, ie the MAD, is 1/2 of the max distance, or 1/4 of the full range for a uniform distribution MAD= (U-L)/4. If underlying price is 50 (assuming rf-0%), and has a mean absolute deviation (MAD) of M, then the range of underlying distribution at expiration is L U where Lis the lower bound L=S0-2M, and U is the upper bound U - S0+2+M If X is the strike, then we can derive a price for the PUT or CALL as a function of 50 and M APUT has: 1. probability of expiring ITM of (XL)/ (UL) - (X-50+2+M)/(4M) avg Option PMT of (XL)/2-(X-50+2 M)/2 1. PUT price (X-S0+2 M)^2/(8 M) A CALL has: L probability of expiring ITM of (U-X)/(UL) - (S0-X+2*M)/ (4M) il avg Option PMT of (U-X)/2 (50-X+2+M)/2 CALL price= (S0-X+2 M)^2/(8 M) Q3. How option will react to change in the RANGE of underlying price movement Keep X-100 Create a spreadsheet to: Q3a. Assume MAD-10. Calculate PUT price, while varying 50 from 80 to 120 with $1 increment. Q3b. Assume MAD-20. Calculate PUT price, while varying S0 from 80 to 120 with $1 increment. Q3c. Assume MAD-40, Calculate PUT price, while varying S0 from 80 to 120 with $1 increment. Q3d. Graph all three PUT prices AND the intrinsic put value under different MAD assumption from Q3a-c in the same chart. x-axis is SO (note: intrinsic value is the same for all three MAD scenarios) ***********

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Q1 The BlackScholesMerton model is a mathematical model used to determine the price of a Europeanstyle call or put option The model takes into account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started