Answered step by step

Verified Expert Solution

Question

1 Approved Answer

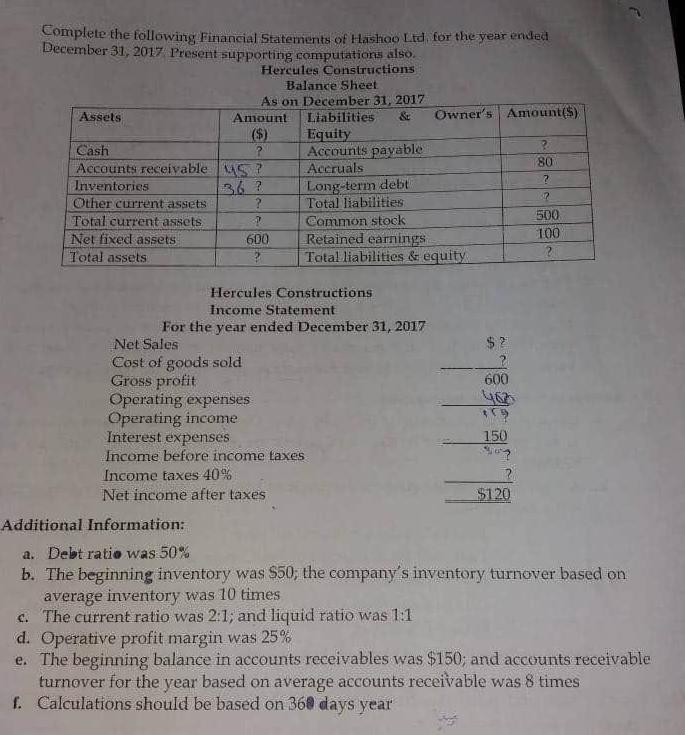

Complete the following Financial Statements of Hashoo Ltd, for the year ended December 31, 2017 Present supporting computations also. Hercules Constructions Balance Sheet As

Complete the following Financial Statements of Hashoo Ltd, for the year ended December 31, 2017 Present supporting computations also. Hercules Constructions Balance Sheet As on December 31, 2017 & Liabilities Owner's Amount($) Assets Amount (S) Equity Cash Accounts payable 80 Accounts receivable uS? Accruals 36? ? Long-term debt Total liabilities Inventories Other current assets Total current assets Net fixed assets Total assets 500 100 Common stock Retained earnings Total liabilities & equity 600 Hercules Constructions Income Statement For the year ended December 31, 2017 Net Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expenses Income before income taxes $? 600 150 Income taxes 40% Net income after taxes $120 Additional Information: a. Debt ratio was 50% b. The beginning inventory was S50; the company's inventory turnover based on average inventory was 10 times c. The current ratio was 2:1; and liquid ratio was 1:1 d. Operative profit margin was 25% e. The beginning balance in accounts receivables was $150; and accounts receivable turnover for the year based on average accounts receivable was 8 times f. Calculations should be based on 368 days year

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Hercules Construction Income Statement For the Year ended 31122017 Net Sales Cost of goods sold Gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started