Answered step by step

Verified Expert Solution

Question

1 Approved Answer

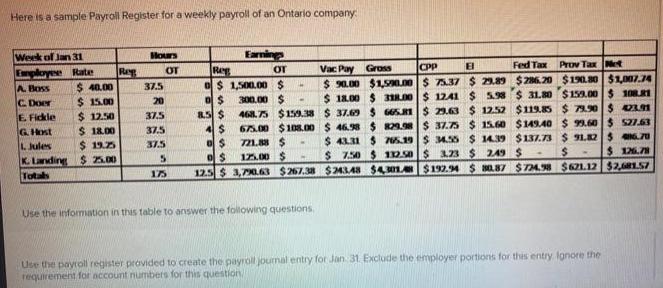

Here is a sample Payroll Register for a weekly payroll of an Ontario company Earning Ra Week of Jan 31 Hours CPP Fed Tax

Here is a sample Payroll Register for a weekly payroll of an Ontario company Earning Ra Week of Jan 31 Hours CPP Fed Tax Prov Tax Met El Vac Pay $ 90.00 $1,SL00$ 75.37 $ 29.89 $286.20 $1980 $1,007.74 $ 18.00 $ 31R00$ 1241 Reg OT Gross Eployee Rate $ 40.00 $ 15.00 $ 12.50 $ 18.00 $ 19.25 K. Landing $ 500 OT O$ 1,500.00S $ 8S $ A Boss 37.5 5.98 $ 31.80 $159.00$ 10RR1 300.00 $ 468.75 $159.38 $ 37.69 S 6SRI$ 29.63 $ 12.52 $119.85 $ 71.90$ 91 65.00 $108.00 $ 46.98 $ R29.98$ 37.75 $ 15.60 $149.40 $ 99.60 $ S7.63 721. $ 125.00 $ C. Doer E Fidkle 20 37.5 G Host 37.5 $ 41.31 $ 75.19$ M55 $ 1439 $137.73 $ 9LK2$ .7U $ 14.7 L. Jules 37.5 $ 7.50 $ 12.s0$ 123 $ 249 $ Totals 12.5 $ 3,7.63 $267.38 $4LA8 $401 $192.94 $ 87 $TA8 $621.12 $2,1S7 175 Use the information in this table to answer the following questions. Use the payroll register provided to create the payrol journal entry for Jan 31. Exclude the employer portions for this entry Ignore the requirement for account numbers for this question

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The Journal Entry in the books of Ontario Company as of 31st January was as follows D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started