Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Q,No.1. Many new cost terms have been introduced in this chapter. It will take you some time to learn what each term means and

Accounting

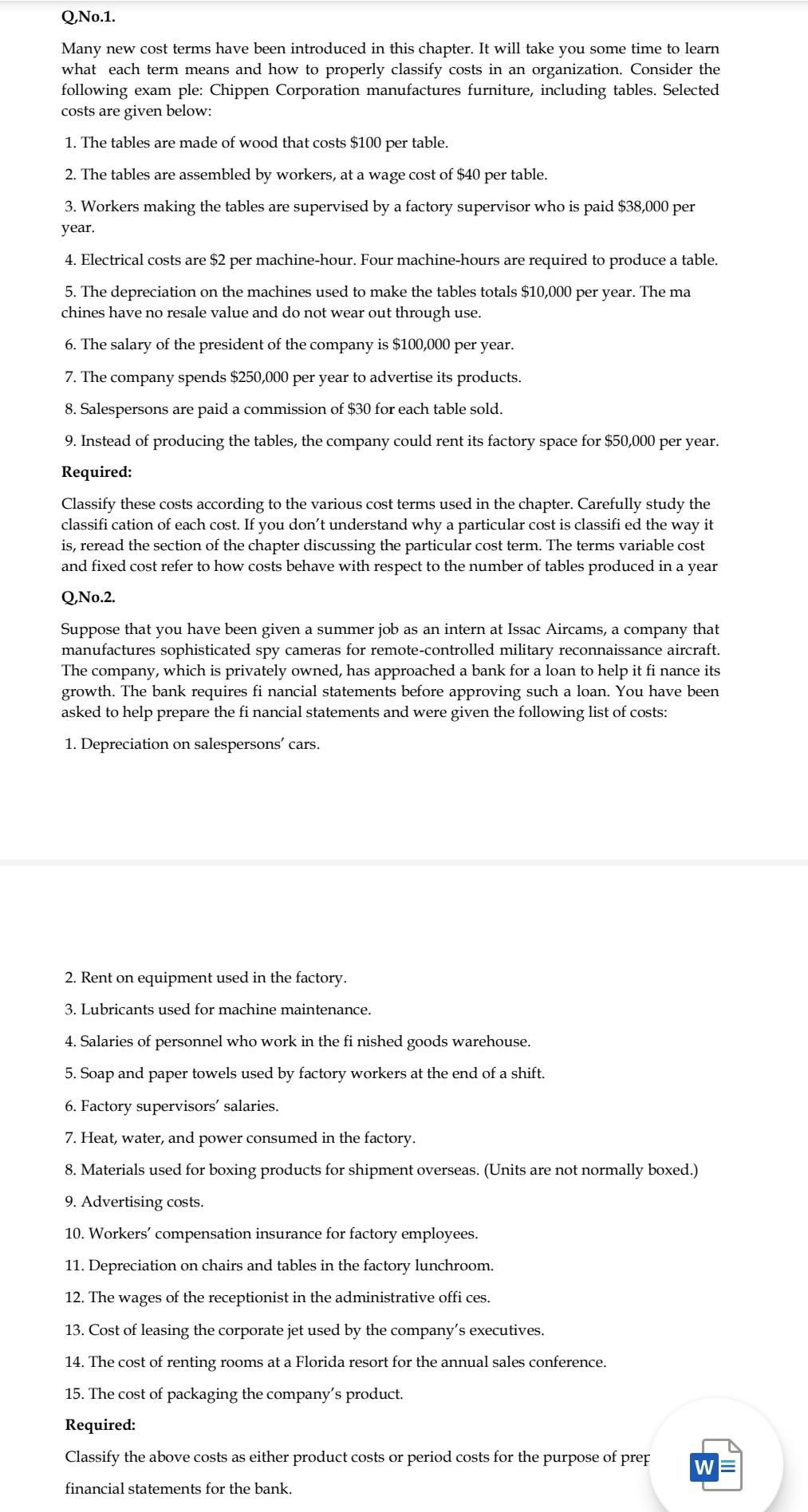

Q,No.1. Many new cost terms have been introduced in this chapter. It will take you some time to learn what each term means and how to properly classify costs in an organization. Consider the following exam ple: Chippen Corporation manufactures furniture, including tables. Selected costs are given below: 1. The tables are made of wood that costs $100 per table. 2. The tables are assembled by workers, at a wage cost of $40 per table. 3. Workers making the tables are supervised by a factory supervisor who is paid $38,000 per year. 4. Electrical costs are $2 per machine-hour. Four machine-hours are required to produce a table. 5. The depreciation on the machines used to make the tables totals $10,000 per year. The ma chines have no resale value and do not wear out through use. 6. The salary of the president of the company is $100,000 per year. 7. The company spends $250,000 per year to advertise its products. 8. Salespersons are paid a commission of $30 for each table sold. 9. Instead of producing the tables, the company could rent its factory space for $50,000 per year. Required: Classify these costs according to the various cost terms used in the chapter. Carefully study the classifi cation of each cost. If you don't understand why a particular cost is classifi ed the way it is, reread the section of the chapter discussing the particular cost term. The terms variable cost and fixed cost refer to how costs behave with respect to the number of tables produced in a year QNo.2. Suppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help it fi nance its growth. The bank requires fi nancial statements before approving such a loan. You have been asked to help prepare the financial statements and were given the following list of costs: 1. Depreciation on salespersons' cars. 2. Rent on equipment used in the factory. 3. Lubricants used for machine maintenance. 4. Salaries of personnel who work in the finished goods warehouse. 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors' salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.) 9. Advertising costs. 10. Workers' compensation insurance for factory employees. 11. Depreciation on chairs and tables in the factory lunchroom. 12. The wages of the receptionist in the administrative offi ces. 13. Cost of leasing the corporate jet used by the company's executives. 14. The cost of renting rooms at a Florida resort for the annual sales conference. 15. The cost of packaging the company's product. Required: = Classify the above costs as either product costs or period costs for the purpose of pref W financial statements for the bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started