Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just secured an accounting internship at Divo Ltd (Divo), one of Singapore's public-listed companies. Assume that FY2019 (i.e. financial year ended 31

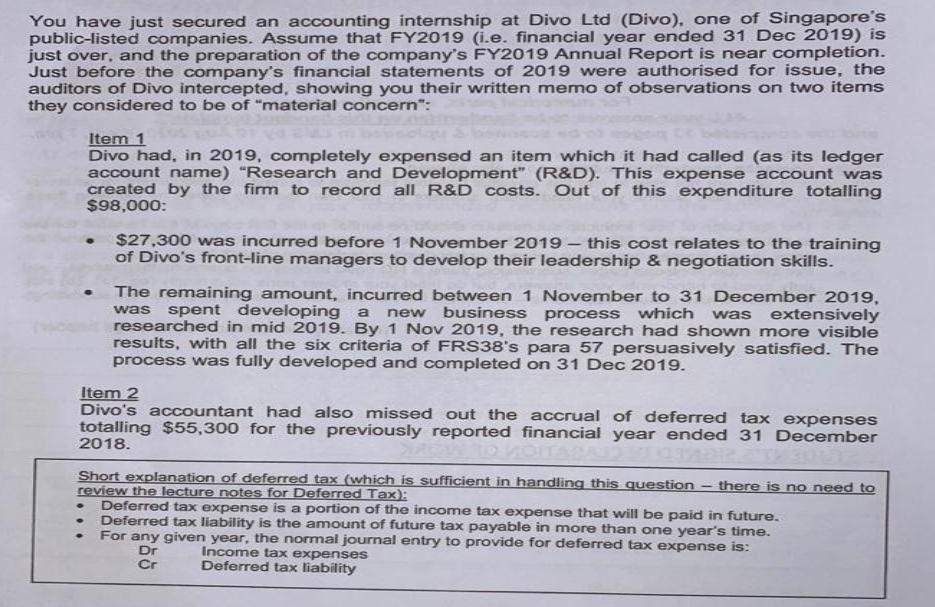

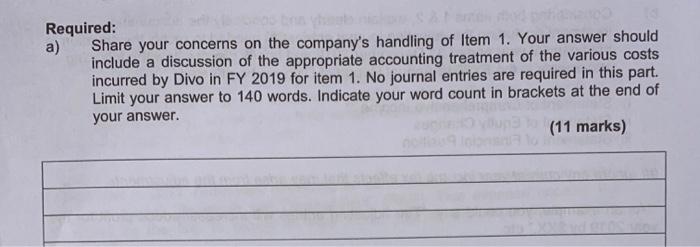

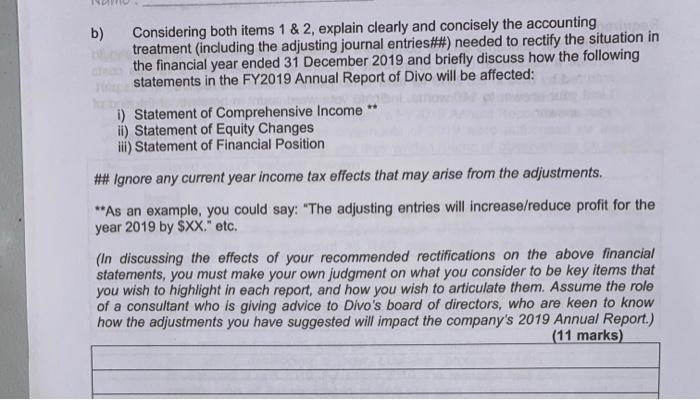

You have just secured an accounting internship at Divo Ltd (Divo), one of Singapore's public-listed companies. Assume that FY2019 (i.e. financial year ended 31 Dec 2019) is just over, and the preparation of the company's FY2019 Annual Report is near completion. Just before the company's financial statements of 2019 were authorised for issue, the auditors of Divo intercepted, showing you their written memo of observations on two items they considered to be of "material concern": Item 1 Divo had, in 2019, completely expensed an item which it had called (as its ledger account name) "Research and Development" (R&D). This expense account was created by the firm to record alL R&D costs. Out of this expenditure totalling $98,000: $27,300 was incurred before 1 November 2019 this cost relates to the training of Divo's front-line managers to develop their leadership & negotiation skills. The remaining amount, incurred between 1 November to 31 December 2019, was spent developing a new business process which extensively was researched in mid 2019. By 1Nov 2019, the research had shown more visible results, with all the six criteria of FRS38's para 57 persuasively satisfied. The process was fully developed and completed on 31 Dec 2019. Item 2 Divo's accountant had also missed out the accrual of deferred tax expenses totalling $55,300 for the previously reported financial year ended 31 December 2018. Short explanation of deferred tax (which is sufficient in handling this question review the lecture notes for Deferred Tax): Deferred tax expense is a portion of the income tax expense that will be paid in future. Deferred tax liability is the amount of future tax payable in more than one year's time. For any given year, the normal journal entry to provide for deferred tax expense is: there is no need to Dr Cr Income tax expenses Deferred tax liability Required: a) Share your concerns on the company's handling of Item 1. Your answer should include a discussion of the appropriate accounting treatment of the various costs incurred by Divo in FY 2019 for item 1. No journal entries are required in this part. Limit your answer to 140 words. Indicate your word count in brackets at the end of your answer. (11 marks) Considering both items 1 & 2, explain clearly and concisely the accounting b) treatment (including the adjusting journal entries##) needed to rectify the situation in the financial year ended 31 December 2019 and briefly discuss how the following statements in the FY2019 Annual Report of Divo will be affected: i) Statement of Comprehensive Income ** ii) Statement of Equity Changes i) Statement of Financial Position ## Ignore any current year income tax effects that may arise from the adjustments. **As an example, you could say: "The adjusting entries will increase/reduce profit for the year 2019 by $XX." etc. (In discussing the effects of your recommended rectifications on the above financial statements, you must make your own judgment on what you consider to be key items that you wish to highlight in each report, and how you wish to articulate them. Assume the role of a consultant who is giving advice to Divo's board of directors, who are keen to know how the adjustments you have suggested will impact the company's 2019 Annual Report.) (11 marks)

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Item 1 RD expense treatment The company is right in treating the training expenses as an expense ite...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started