Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you open a 150 shares short position in UTAR Inc. common stock at the bid-ask price of RM34.00-RM34.50 on 1 September 2019.

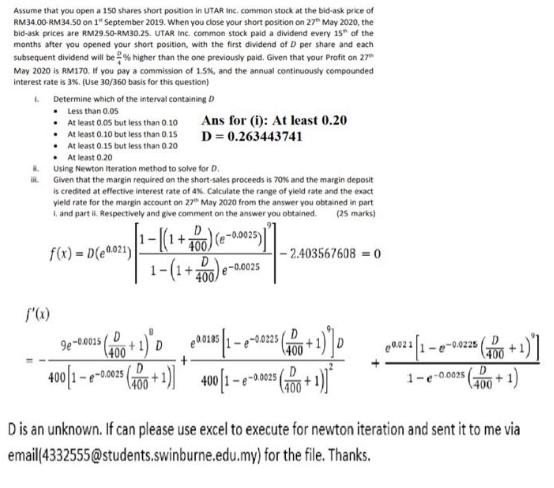

Assume that you open a 150 shares short position in UTAR Inc. common stock at the bid-ask price of RM34.00-RM34.50 on 1" September 2019. When you close your short position on 27 May 2020, the bid-ask prices are RM29.50-RM30.25. UTAR Inc. common stock paid a dividend every 15" of the months after you opened your short position, with the first dividend of D per share and each subsequent dividend will be higher than the one previously paid. Given that your Profit on 27th May 2020 is RM170. If you pay a commission of 1.5%, and the annual continuously compounded interest rate is 3%. (Use 30/360 basis for this question) L K. IR. Determine which of the interval containing D Less than 0.05 At least 0.05 but less than 0.10 f'(x) . . At least 0.10 but less than 0.15 At least 0.15 but less than 0.20 At least 0.20 Using Newton Iteration method to solve for D. Given that the margin required on the short-sales proceeds is 70% and the margin deposit is credited at effective interest rate of 4%. Calculate the range of yield rate and the exact yield rate for the margin account on 27 May 2020 from the answer you obtained in part I, and partii. Respectively and give comment on the answer you obtained. (25 marks) f(x)=D(e0.021) Ans for (i): At least 0.20 D = 0.263443741 1-[(1 + 0) (e-00025)) 400 -0.0025 9e 98-00015 (400+1) D 400 1-e-0.0025 (400+1)] 400 -2.403567608 = 0 e00185 1--00225 ( 00/1-8-0.0025( $(400 + 1))* 0.021 -0.0225 $ (200 + 1)"] 1) 400 1-e-0.0025 D is an unknown. If can please use excel to execute for newton iteration and sent it to me via email(4332555@students.swinburne.edu.my) for the file. Thanks.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started