Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? For each of the statements below, indicate whether the statement is True or False AND provide one or two explanatory sentences to support

?

?

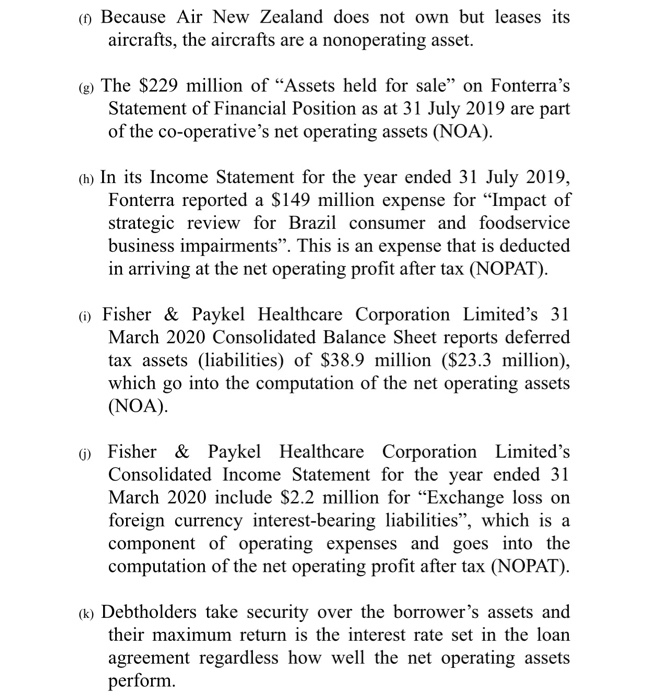

For each of the statements below, indicate whether the statement is True or False AND provide one or two explanatory sentences to support your answer. (f) Because Air New Zealand does not own but leases its aircrafts, the aircrafts are a nonoperating asset. (g) The $229 million of "Assets held for sale" on Fonterra's Statement of Financial Position as at 31 July 2019 are part of the co-operative's net operating assets (NOA). (h) In its Income Statement for the year ended 31 July 2019, Fonterra reported a $149 million expense for "Impact of strategic review for Brazil consumer and foodservice business impairments". This is an expense that is deducted in arriving at the net operating profit after tax (NOPAT). (1) Fisher & Paykel Healthcare Corporation Limited's 31 March 2020 Consolidated Balance Sheet reports deferred tax assets (liabilities) of $38.9 million ($23.3 million), which go into the computation of the net operating assets (NOA). Fisher & Paykel Healthcare Corporation Limited's Consolidated Income Statement for the year ended 31 March 2020 include $2.2 million for "Exchange loss on foreign currency interest-bearing liabilities", which is a component of operating expenses and goes into the computation of the net operating profit after tax (NOPAT). (k) Debtholders take security over the borrower's assets and their maximum return is the interest rate set in the loan agreement regardless how well the net operating assets perform.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Ansf True because here the main business of Air New Zealand is not leasing air craft so thes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started