Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ponyfish Limited acquired 70% of the issued shares of Seahorse Limited for $23,000,000 on 1 January 2017. The shareholders' equity of Seahorse Limited on

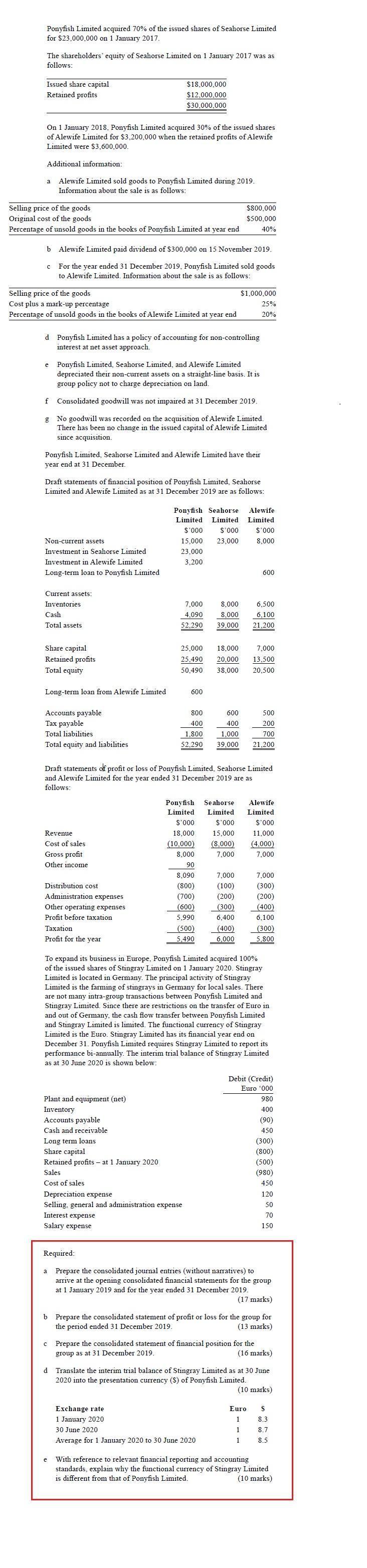

Ponyfish Limited acquired 70% of the issued shares of Seahorse Limited for $23,000,000 on 1 January 2017. The shareholders' equity of Seahorse Limited on 1 January 2017 was as follows: Issued share capital Retained profits On 1 January 2018, Ponyfish Limited acquired 30% of the issued shares of Alewife Limited for $3,200,000 when the retained profits of Alewife Limited were $3,600,000. Additional information: a Alewife Limited sold goods to Ponyfish Limited during 2019. Information about the sale is as follows: Selling price of the goods Original cost of the goods Percentage of unsold goods in the books of Ponyfish Limited at year end b Alewife Limited paid dividend of $300,000 on 15 November 2019. c For the year ended 31 December 2019, Ponyfish Limited sold goods to Alewife Limited. Information about the sale is as follows: Selling price of the goods Cost plus a mark-up percentage Percentage of unsold goods in the books of Alewife Limited at year end e d Ponyfish Limited has a policy of accounting for non-controlling interest at net asset approach. Ponyfish Limited, Seahorse Limited, and Alewife Limited depreciated their non-current assets on a straight-line basis. It is group policy not to charge depreciation on land. $18,000,000 $12,000,000 $30,000,000 f Consolidated goodwill was not impaired at 31 December 2019. g No goodwill was recorded on the acquisition of Alewife Limited. There has been no change in the issued capital of Alewife Limited since acquisition. Non-current assets Investment in Seahorse Limited Investment in Alewife Limited Long-term loan to Ponyfish Limited Ponyfish Limited, Seahorse Limited and Alewife Limited have their year end at 31 December. Current assets: Inventories Draft statements of financial position of Ponyfish Limited, Seahorse Limited and Alewife Limited as at 31 December 2019 are as follows: Cash Total assets Share capital Retained profits Total equity Long-term loan from Alewife Limited Accounts payable Tax payable Total liabilities Total equity and liabilities Revenue Cost of sales Gross profit Other income Distribution cost Administration expenses Other operating expenses Profit before taxation Taxation Profit for the year 23,000 3,200 Ponyfish Seahorse Alewife Limited Limited Limited $'000 $'000 $'000 15,000 23,000 8.000 $800,000 $500,000 40% $1,000,000 25% 20% 7,000 8.000 6,500 4,090 8,000 6,100 52,290 39.000 21,200 600 800 400 1,800 52,290 25,000 7,000 18,000 25,490 20,000 13,500 50,490 38,000 20,500 Draft statements of profit or loss of Ponyfish Limited, Seahorse Limited and Alewife Limited for the year ended 31 December 2019 are as follows: (500) 5.490 Plant and equipment (net) Inventory Accounts payable Cash and receivable Long term loans Share capital Retained profits - at 1 January 2020 Sales Cost of sales Depreciation expense Selling, general and administration expense Interest expense Salary expense 600 400 500 200 1,000 700 39.000 21,200 Ponyfish Seahorse Alewife Limited Limited Limited. $'000 $'000 $'000 18,000 15,000 11.000 (10,000) (8,000) (4.000) 8,000 7,000 7,000 90 8,090 (800) (700) (600) 5,990 600 7,000 (100) (200) (300) 6.400 (400) 6.000 Exchange rate 1 January 2020 30 June 2020 Average for 1 January 2020 to 30 June 2020. 7,000 (300) (200) To expand its business in Europe, Ponyfish Limited acquired 100% of the issued shares of Stingray Limited on 1 January 2020. Stingray Limited is located in Germany. The principal activity of Stingray Limited is the farming of stingrays in Germany for local sales. There are not many intra-group transactions between Ponyfish Limited and Stingray Limited. Since there are restrictions on the transfer of Euro in and out of Germany, the cash flow transfer between Ponyfish Limited and Stingray Limited is limited. The functional currency of Stingray Limited is the Euro. Stingray Limited has its financial year end on December 31. Ponyfish Limited requires Stingray Limited to report its performance bi-annually. The interim trial balance of Stingray Limited as at 30 June 2020 is shown below: (400) 6,100 (300) 5,800 Debit (Credit) Euro '000 980 400 (90) 450 Required: a Prepare the consolidated journal entries (without narratives) to arrive at the opening consolidated financial statements for the group at 1 January 2019 and for the year ended 31 December 2019. (300) (800) (500) (980) 450 120 50 70 150 (17 marks) b Prepare the consolidated statement of profit or loss for the group for the period ended 31 December 2019. (13 marks) 1 1 c Prepare the consolidated statement of financial position for the group as at 31 December 2019. (16 marks) d Translate the interim trial balance of Stingray Limited as at 30 June 2020 into the presentation currency (S) of Ponyfish Limited. (10 marks) Euro $ 1 8.3 8.7 8.5 e With reference to relevant financial reporting and accounting standards, explain why the functional currency of Stingray Limited is different from that of Ponyfish Limited. (10 marks)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Consolidated Journal Entries 1 To eliminate investment in Seahorse Limited and recognize the noncontrolling interest Dr Investment in Seahorse Limited NCA 23000000 Cr Retained profits Seahorse Limit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started