Answered step by step

Verified Expert Solution

Question

1 Approved Answer

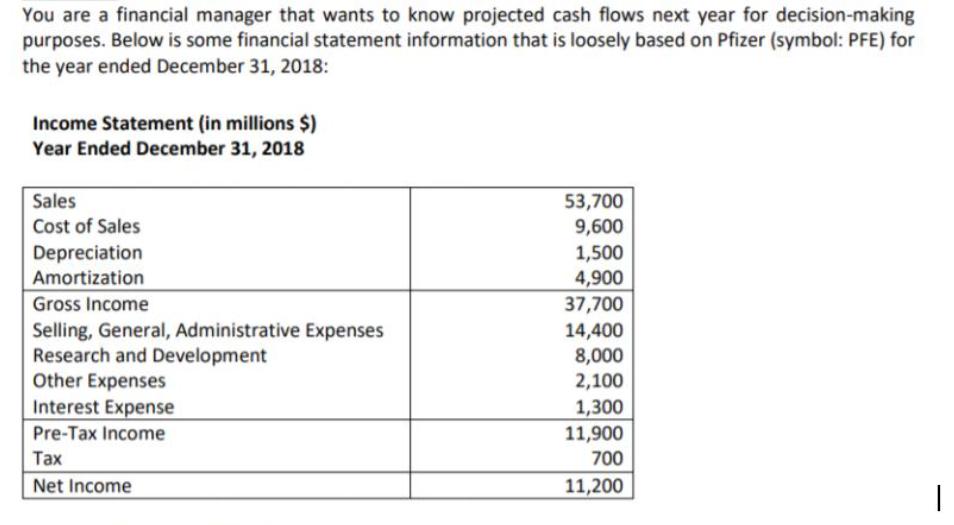

You are a financial manager that wants to know projected cash flows next year for decision-making purposes. Below is some financial statement information that

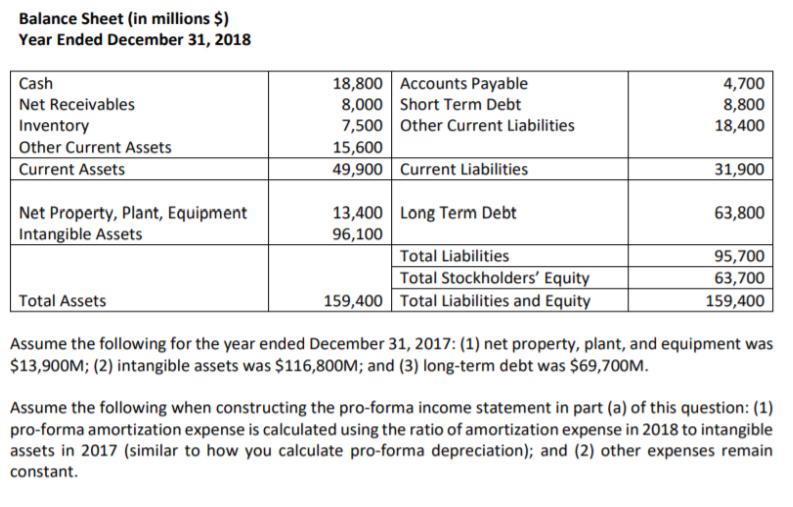

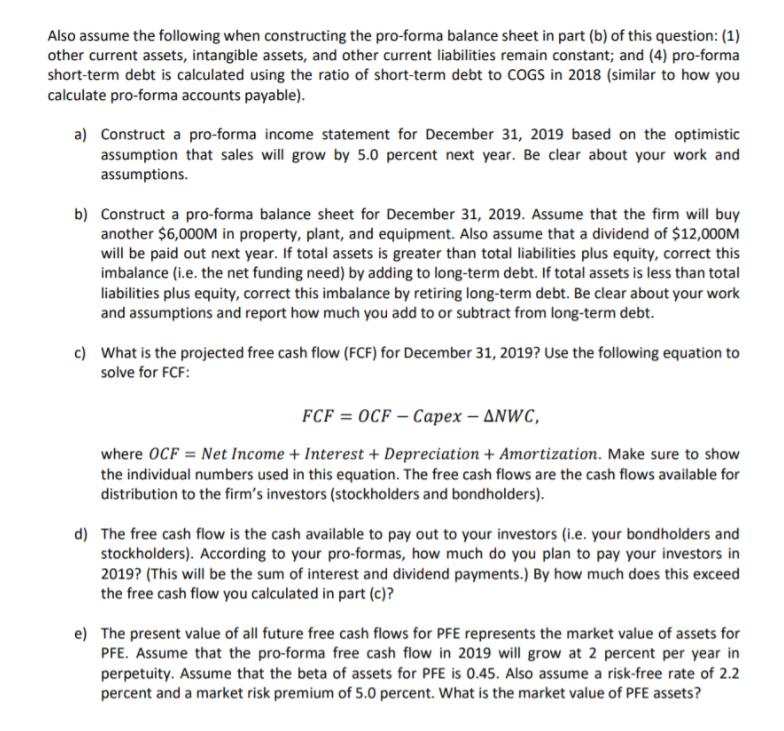

You are a financial manager that wants to know projected cash flows next year for decision-making purposes. Below is some financial statement information that is loosely based on Pfizer (symbol: PFE) for the year ended December 31, 2018: Income Statement (in millions $) Year Ended December 31, 2018 Sales 53,700 9,600 Cost of Sales Depreciation 1,500 Amortization 4,900 37,700 Gross Income Selling, General, Administrative Expenses Research and Development Other Expenses Interest Expense 14,400 8,000 2,100 1,300 11,900 Pre-Tax Income x 700 Net Income 11,200 Balance Sheet (in millions $) Year Ended December 31, 2018 18,800 Accounts Payable 8,000 Short Term Debt 7,500 Other Current Liabilities Cash 4,700 8,800 18,400 Net Receivables Inventory Other Current Assets Current Assets 15,600 49,900 Current Liabilities 31,900 Net Property, Plant, Equipment Intangible Assets 13,400 Long Term Debt 96,100 63,800 Total Liabilities 95,700 63,700 Total Stockholders' Equity 159,400 Total Liabilities and Equity Total Assets 159,400 Assume the following for the year ended December 31, 2017: (1) net property, plant, and equipment was $13,900M; (2) intangible assets was $116,800M; and (3) long-term debt was $69,700M. Assume the following when constructing the pro-forma income statement in part (a) of this question: (1) pro-forma amortization expense is calculated using the ratio of amortization expense in 2018 to intangible assets in 2017 (similar to how you calculate pro-forma depreciation); and (2) other expenses remain constant. Also assume the following when constructing the pro-forma balance sheet in part (b) of this question: (1) other current assets, intangible assets, and other current liabilities remain constant; and (4) pro-forma short-term debt is calculated using the ratio of short-term debt to COGS in 2018 (similar to how you calculate pro-forma accounts payable). a) Construct a pro-forma income statement for December 31, 2019 based on the optimistic assumption that sales will grow by 5.0 percent next year. Be clear about your work and assumptions. b) Construct a pro-forma balance sheet for December 31, 2019. Assume that the firm will buy another $6,000M in property, plant, and equipment. Also assume that a dividend of $12,000M will be paid out next year. If total assets is greater than total liabilities plus equity, correct this imbalance (i.e. the net funding need) by adding to long-term debt. If total assets is less than total liabilities plus equity, correct this imbalance by retiring long-term debt. Be clear about your work and assumptions and report how much you add to or subtract from long-term debt. c) What is the projected free cash flow (FCF) for December 31, 2019? Use the following equation to solve for FCF: FCF = OCF Capex ANWC, where OCF = Net Income + Interest + Depreciation + Amortization. Make sure to show the individual numbers used in this equation. The free cash flows are the cash flows available for distribution to the firm's investors (stockholders and bondholders). d) The free cash flow is the cash available to pay out to your investors (i.e. your bondholders and stockholders). According to your pro-formas, how much do you plan to pay your investors in 2019? (This will be the sum of interest and dividend payments.) By how much does this exceed the free cash flow you calculated in part (c)? e) The present value of all future free cash flows for PFE represents the market value of assets for PFE. Assume that the pro-forma free cash flow in 2019 will grow at 2 percent per year in perpetuity. Assume that the beta of assets for PFE is 0.45. Also assume a risk-free rate of 2.2 percent and a market risk premium of 5.0 percent. What is the market value of PFE assets?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started