Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crate & Barrel Pty Ltd (Crate), a NSW-based company, specializes in selling office furniture to businesses. During the year ended 30 June 2018, Crate

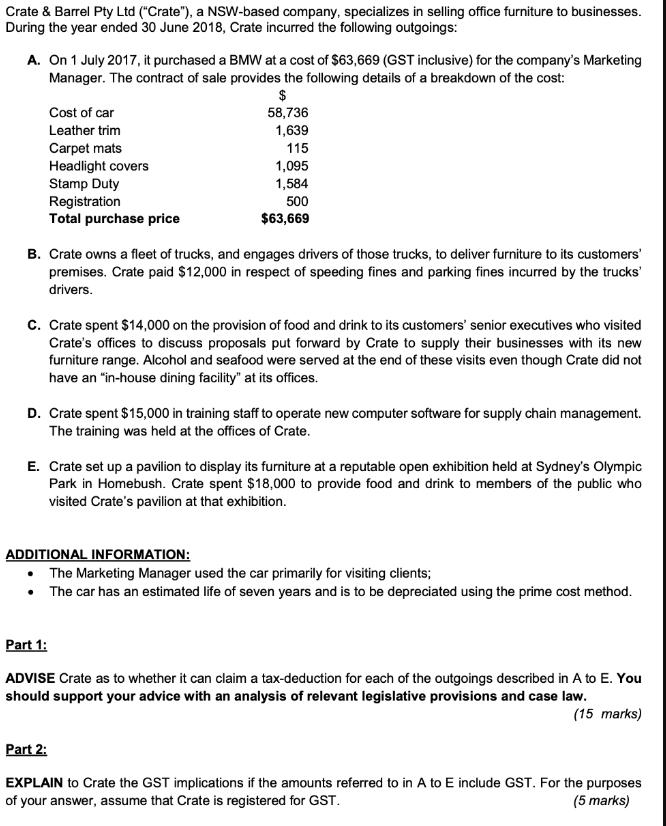

Crate & Barrel Pty Ltd ("Crate"), a NSW-based company, specializes in selling office furniture to businesses. During the year ended 30 June 2018, Crate incurred the following outgoings: A. On 1 July 2017, it purchased a BMW at a cost of $63,669 (GST inclusive) for the company's Marketing Manager. The contract of sale provides the following details of a breakdown of the cost: $ 58,736 Cost of car Leather trim Carpet mats Headlight covers Stamp Duty Registration Total purchase price 1,639 115 1,095 1,584 500 $63,669 B. Crate owns a fleet of trucks, and engages drivers of those trucks, to deliver furniture to its customers' premises. Crate paid $12,000 in respect of speeding fines and parking fines incurred by the trucks' drivers. C. Crate spent $14,000 on the provision of food and drink to its customers' senior executives who visited Crate's offices to discuss proposals put forward by Crate to supply their businesses with its new furniture range. Alcohol and seafood were served at the end of these visits even though Crate did not have an "in-house dining facility" at its offices. D. Crate spent $15,000 in training staff to operate new computer software for supply chain management. The training was held at the offices of Crate. E. Crate set up a pavilion to display its furniture at a reputable open exhibition held at Sydney's Olympic Park in Homebush. Crate spent $18,000 to provide food and drink to members of the public who visited Crate's pavilion at that exhibition. ADDITIONAL INFORMATION: The Marketing Manager used the car primarily for visiting clients; The car has an estimated life of seven years and is to be depreciated using the prime cost method. Part 1: ADVISE Crate as to whether it can claim a tax-deduction for each of the outgoings described in A to E. You should support your advice with an analysis of relevant legislative provisions and case law. (15 marks) Part 2: EXPLAIN to Crate the GST implications if the amounts referred to in A to E include GST. For the purposes of your answer, assume that Crate is registered for GST. (5 marks)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 ADVISE Crate as to whether it can claim a taxdeduction for each of the outgoings described in A to E You should support your advice with an ana...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started