Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kalgoorlie Ltd acquired 75% of the shares of Geraldton Ltd on 1 July 2040 for $7,800,000. Kalgoorlie Ltd uses the partial goodwill method. The

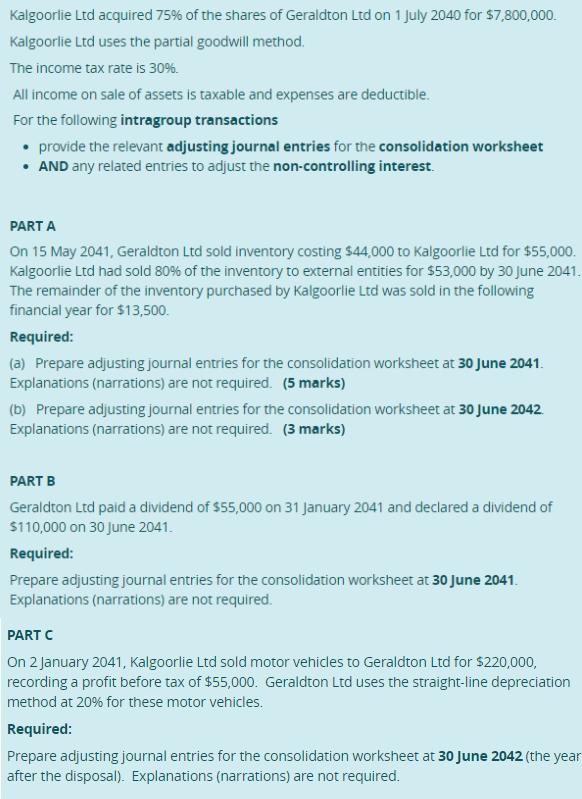

Kalgoorlie Ltd acquired 75% of the shares of Geraldton Ltd on 1 July 2040 for $7,800,000. Kalgoorlie Ltd uses the partial goodwill method. The income tax rate is 30%. All income on sale of assets is taxable and expenses are deductible. For the following intragroup transactions provide the relevant adjusting journal entries for the consolidation worksheet AND any related entries to adjust the non-controlling interest. PART A On 15 May 2041, Geraldton Ltd sold inventory costing $44,000 to Kalgoorlie Ltd for $55,000. Kalgoorlie Ltd had sold 80% of the inventory to external entities for $53,000 by 30 June 2041. The remainder of the inventory purchased by Kalgoorlie Ltd was sold in the following financial year for $13,500. Required: (a) Prepare adjusting journal entries for the consolidation worksheet at 30 June 2041. Explanations (narrations) are not required. (5 marks) (b) Prepare adjusting journal entries for the consolidation worksheet at 30 June 2042. Explanations (narrations) are not required. (3 marks) PART B Geraldton Ltd paid a dividend of $55,000 on 31 January 2041 and declared a dividend of $110,000 on 30 June 2041. Required: Prepare adjusting journal entries for the consolidation worksheet at 30 June 2041. Explanations (narrations) are not required. PART C On 2 January 2041, Kalgoorlie Ltd sold motor vehicles to Geraldton Ltd for $220,000, recording a profit before tax of $55,000. Geraldton Ltd uses the straight-line depreciation method at 20% for these motor vehicles. Required: Prepare adjusting journal entries for the consolidation worksheet at 30 June 2042 (the year after the disposal). Explanations (narrations) are not required.

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

PART A Year 2041 Sales 11000 To cost of Goods sold 8800 To inventory 2200 or Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started