Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beatrice and Doris are friends from Singapore Polytechnic and have been doing fashion designing since graduation and started a boutique at Orchard Road. They

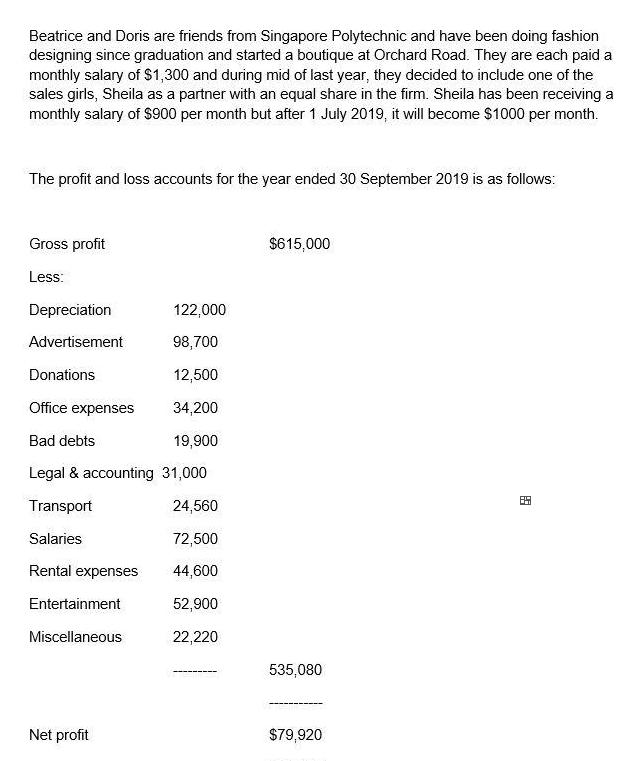

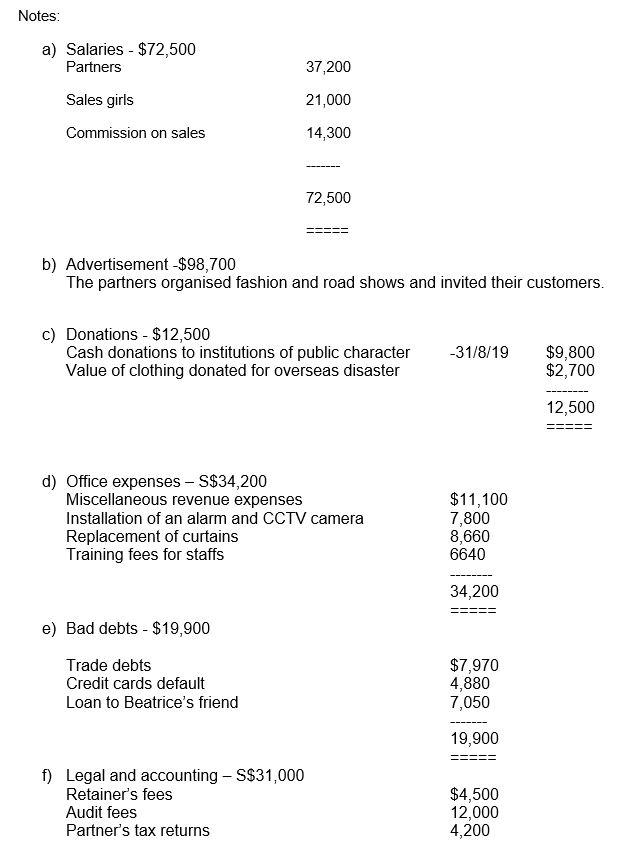

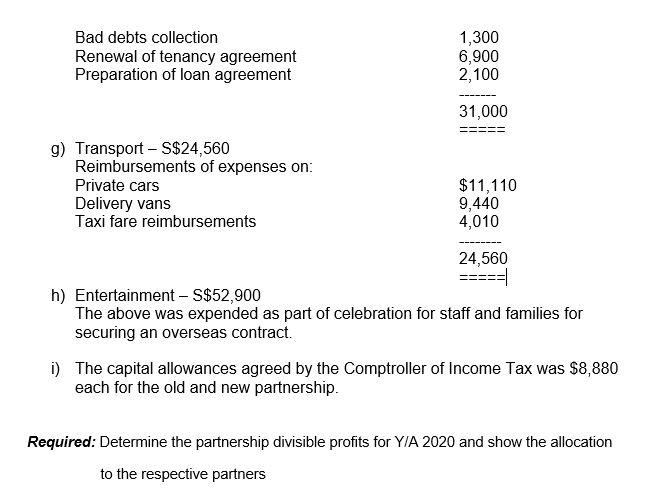

Beatrice and Doris are friends from Singapore Polytechnic and have been doing fashion designing since graduation and started a boutique at Orchard Road. They are each paid a monthly salary of $1,300 and during mid of last year, they decided to include one of the sales girls, Sheila as a partner with an equal share in the firm. Sheila has been receiving a monthly salary of $900 per month but after 1 July 2019, it will become $1000 per month. The profit and loss accounts for the year ended 30 September 2019 is as follows: Gross profit $615,000 Less: Depreciation 122,000 Advertisement 98,700 Donations 12,500 Office expenses 34,200 Bad debts 19,900 Legal & accounting 31,000 Transport 24,560 Salaries 72,500 Rental expenses 44,600 Entertainment 52,900 Miscellaneous 22,220 535,080 Net profit $79,920 Notes: a) Salaries - $72,500 Partners 37,200 Sales girls 21,000 Commission on sales 14,300 72,500 b) Advertisement -$98,700 The partners organised fashion and road shows and invited their customers. c) Donations - $12,500 Cash donations to institutions of public character Value of clothing donated for overseas disaster $9,800 $2,700 -31/8/19 12,500 d) Office expenses - S$34,200 Miscellaneous revenue expenses Installation of an alarm and CCTV camera $11,100 7,800 8,660 6640 Replacement of curtains Training fees for staffs 34,200 e) Bad debts - $19,900 Trade debts Credit cards default $7,970 4,880 7,050 Loan to Beatrice's friend 19,900 ) Legal and accounting - S$31,000 Retainer's fees Audit fees Partner's tax returns $4,500 12,000 4,200 1,300 6,900 2,100 Bad debts collection Renewal of tenancy agreement Preparation of loan agreement 31,000 == g) Transport S$24,560 Reimbursements of expenses on: $11,110 9,440 4,010 Private cars Delivery vans Taxi fare reimbursements 24,560 =====| h) Entertainment - S$52,900 The above was expended as part of celebration for staff and families for securing an overseas contract. i) The capital allowances agreed by the Comptroller of Income Tax was $8,880 each for the old and new partnership. Required: Determine the partnership divisible profits for YIA 2020 and show the allocation to the respective partners

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

All the business expenses are shown in Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started