QUESTION 2 Investments (15 Marks) Sprott Corporation made the following purchases on January 15, 2017. Purchased 12% of the 250,000 common shares of Nico

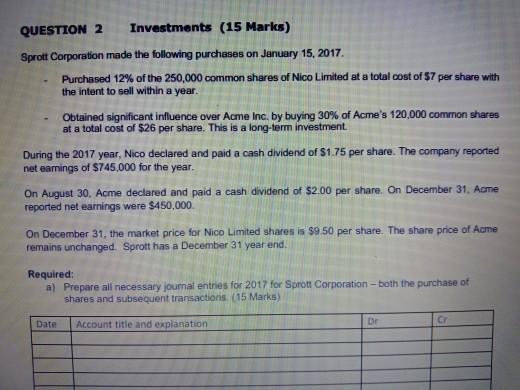

QUESTION 2 Investments (15 Marks) Sprott Corporation made the following purchases on January 15, 2017. Purchased 12% of the 250,000 common shares of Nico Limited at a total cost of $7 per share with the intent to sell within a year. Obtained significant influence over Acme Inc. by buying 30% of Acme's 120,000 common shares at a total cost of $26 per share. This is a long-term investment. During the 2017 year, Nico declared and paid a cash dividend of $1.75 per share. The company reported net earnings of $745,000 for the year. On August 30, Acme declared and paid a cash dividend of $2.00 per share. On December 31, Acme reported net earnings were $450,000. On December 31, the market price for Nico Limited shares is $9.50 per share. The share price of Acme remains unchanged. Sprott has a December 31 year end. Required: a) Prepare all necessary journal entries for 2017 for Sprott Corporation - both the purchase of shares and subsequent transactions (15 Marks) Account title and explanation Date De Cr b) Explain how the income statement can be impacted when an investment is recorded under the Equity method and the investment company experiences a loss (2 marks) Date Account title and explanation Dr Cr

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

28 Required a Prepare all necessary journal entries for 2017 for Spro...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started