Question: QUESTION 2 Kwan Yin owns several properties which include the following: . An apartment block which has 20 tenants paying rent purchased in November

![CB13 Has the work commenced? Is the work of a major’ nature as described in the Act? [Cite relevant case law] Do any exemp](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2020/10/5f805dfc89be6_1602248196006.jpg)

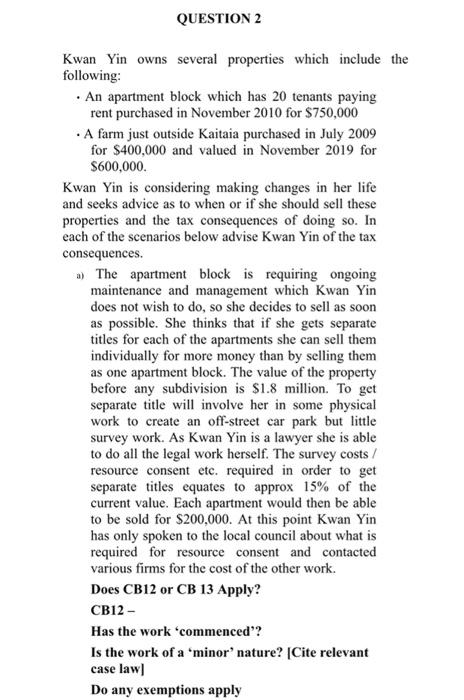

QUESTION 2 Kwan Yin owns several properties which include the following: . An apartment block which has 20 tenants paying rent purchased in November 2010 for $750,000 A farm just outside Kaitaia purchased in July 2009 for $400,000 and valued in November 2019 for $600,000. Kwan Yin is considering making changes in her life and seeks advice as to when or if she should sell these properties and the tax consequences of doing so. In each of the scenarios below advise Kwan Yin of the tax consequences. a) The apartment block is requiring ongoing maintenance and management which Kwan Yin does not wish to do, so she decides to sell as soon as possible. She thinks that if she gets separate titles for each of the apartments she can sell them individually for more money than by selling them as one apartment block. The value of the property before any subdivision is $1.8 million. To get separate title will involve her in some physical work to create an off-street car park but little survey work. As wan Yin is a lawyer she is able to do all the legal work herself. The survey costs / resource consent etc. required in order to get separate titles equates to approx 15% of the current value. Each apartment would then be able to be sold for $200,000. At this point Kwan Yin has only spoken to the local council about what is required for resource consent and contacted various firms for the cost of the other work. Does CB12 or CB 13 Apply? CB12- Has the work 'commenced'? Is the work of a 'minor' nature? [Cite relevant case law] Do any exemptions apply CB13 Has the work 'commenced'? Is the work of a 'major' nature as described in the Act? [Cite relevant case law] Do any exemptions apply? b) EXTRA PRACTICE OPTIONAL Q In May 2018 Kwan Yin and her brother Ed inherited a piece of prime real estate valued at $800,000 from their father. Kwan Yin immediately decides she would like to sell the property, and as Ed needs money desperately Kwan Yin buys out his share for $350,000. Kwan Yin then sells the whole property for $950,000 in March 2019. Does CB6 or CB6A apply?

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

CB12 applies because Kwan Yin is selling the property within 2 years of purchase If she had held the ... View full answer

Get step-by-step solutions from verified subject matter experts