Answered step by step

Verified Expert Solution

Question

1 Approved Answer

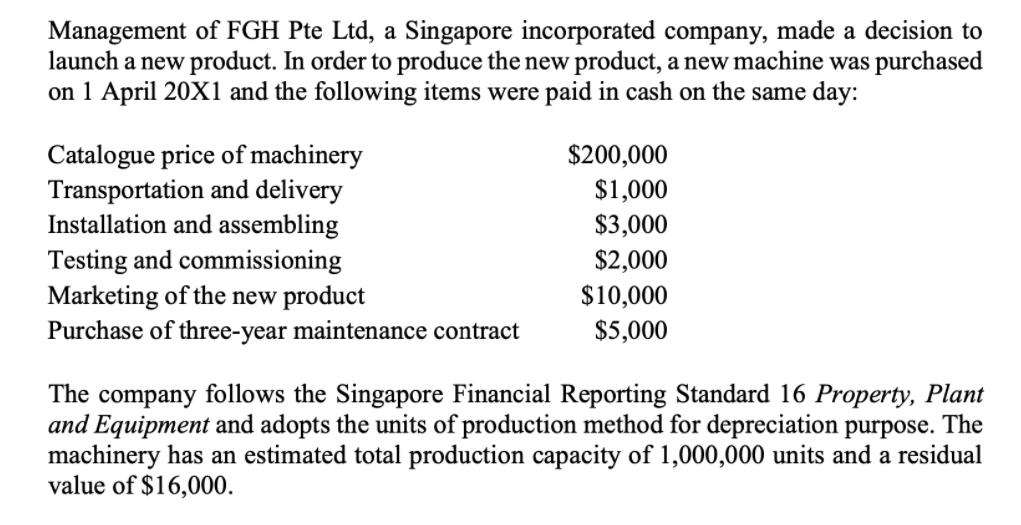

Management of FGH Pte Ltd, a Singapore incorporated company, made a decision to launch a new product. In order to produce the new product,

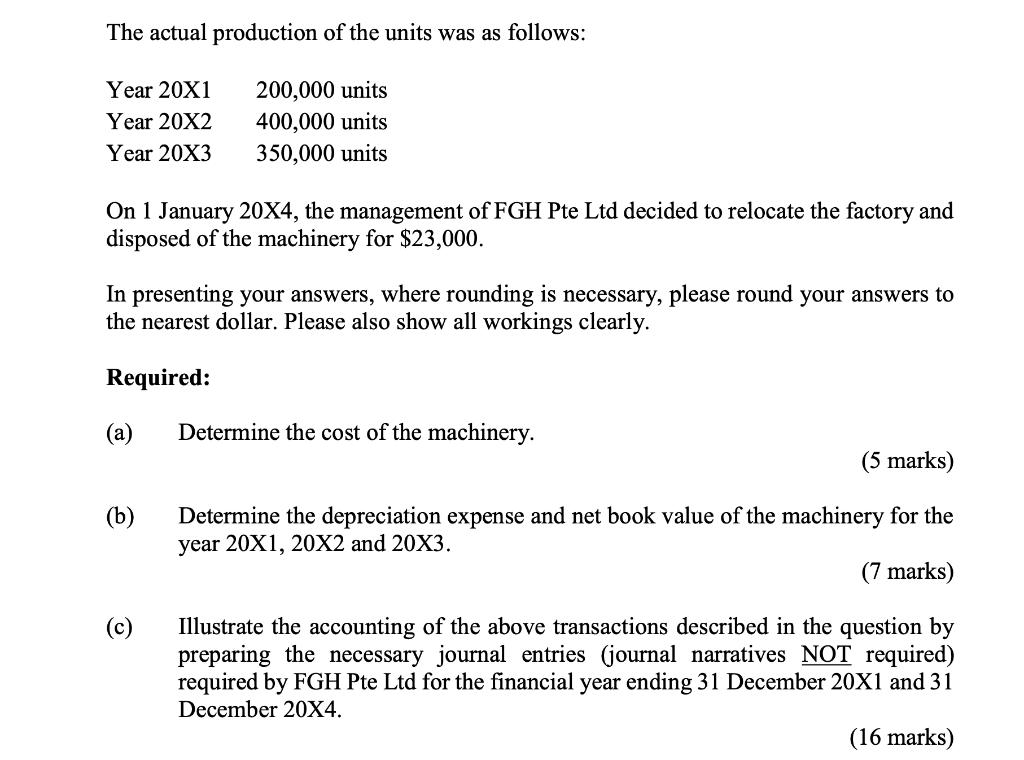

Management of FGH Pte Ltd, a Singapore incorporated company, made a decision to launch a new product. In order to produce the new product, a new machine was purchased on 1 April 20X1 and the following items were paid in cash on the same day: Catalogue price of machinery Transportation and delivery Installation and assembling $200,000 $1,000 $3,000 Testing and commissioning Marketing of the new product Purchase of three-year maintenance contract $2,000 $10,000 $5,000 The company follows the Singapore Financial Reporting Standard 16 Property, Plant and Equipment and adopts the units of production method for depreciation purpose. The machinery has an estimated total production capacity of 1,000,000 units and a residual value of $16,000. The actual production of the units was as follows: Year 20X1 200,000 units 400,000 units 350,000 units Year 20X2 Year 20X3 On 1 January 20X4, the management of FGH Pte Ltd decided to relocate the factory and disposed of the machinery for $23,000. In presenting your answers, where rounding is necessary, please round your answers to the nearest dollar. Please also show all workings clearly. Required: (a) Determine the cost of the machinery. (5 marks) Determine the depreciation expense and net book value of the machinery for the year 20X1, 20X2 and 20X3. (b) (7 marks) (c) Illustrate the accounting of the above transactions described in the question by preparing the necessary journal entries (journal narratives NOT required) required by FGH Pte Ltd for the financial year ending 31 December 20X1 and 31 December 20X4. (16 marks)

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of the Machinery Catalogue price of machinery 200000 Transportation and delivery 1000 Install...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started