Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On a scrap paper, make the calculations necessary to answer the questions below. Then use your draft to fill the following multiple blanks. The

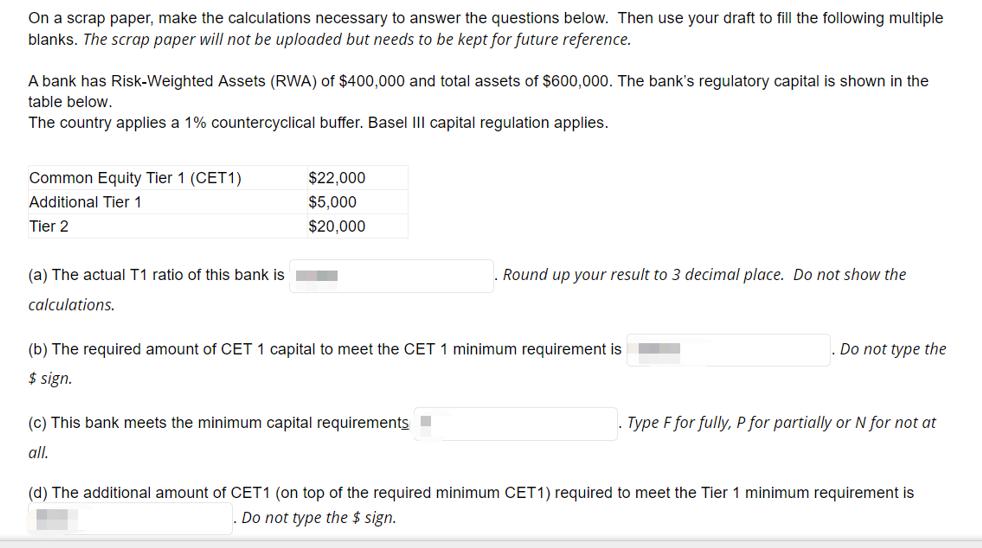

On a scrap paper, make the calculations necessary to answer the questions below. Then use your draft to fill the following multiple blanks. The scrap paper will not be uploaded but needs to be kept for future reference. A bank has Risk-Weighted Assets (RWA) of $400,000 and total assets of $600,000. The bank's regulatory capital is shown in the table below. The country applies a 1% countercyclical buffer. Basel III capital regulation applies. Common Equity Tier 1 (CET1) $22,000 Additional Tier 1 $5,000 Tier 2 $20,000 (a) The actualT1 ratio of this bank is . Round up your result to 3 decimal place. Do not show the calculations. (b) The required amount of CET 1 capital to meet the CET 1 minimum requirement is Do not type the $ sign. (c) This bank meets the minimum capital requirements Type F for fully, P for partially or N for not at all. (d) The additional amount of CET1 (on top of the required minimum CET1) required to meet the Tier 1 minimum requirement is . Do not type the $ sign.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Total capital ratio tier1 capital tier 2 capitalrisk weighted assets 550010003000100000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started