Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You wish to buy a house that will require you to borrow $120,000. The amortized payments noted below do not include the monthly insurance

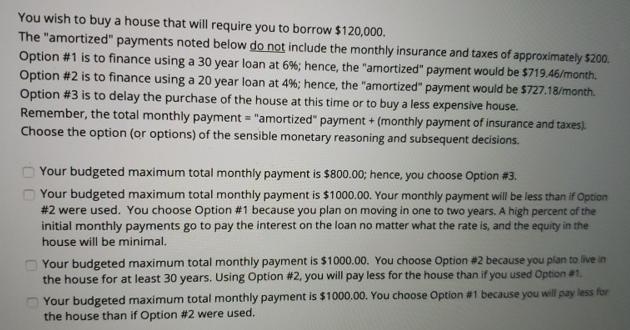

You wish to buy a house that will require you to borrow $120,000. The "amortized" payments noted below do not include the monthly insurance and taxes of approximately $200. Option #1 is to finance using a 30 year loan at 6%; hence, the "amortized" payment would be $719.46/month. Option #2 is to finance using a 20 year loan at 4%; hence, the "amortized" payment would be $727.18/month. Option #3 is to delay the purchase of the house at this time or to buy a less expensive house. Remember, the total monthly payment = "amortized" payment + (monthly payment of insurance and taxes). Choose the option (or options) of the sensible monetary reasoning and subsequent decisions. Your budgeted maximum total monthly payment is $800.00; hence, you choose Option # 3. Your budgeted maximum total monthly payment is $1000.00. Your monthly payment will be less than if Option #2 were used. You choose Option #1 because you plan on moving in one to two years. A high percent of the initial monthly payments go to pay the interest on the loan no matter what the rate is, and the equity in the house will be minimal. Your budgeted maximum total monthly payment is $1000.00. You choose Option #2 because you plan to live in the house for at least 30 years. Using Option #2, you will pay less for the house than if you used Option #1 Your budgeted maximum total monthly payment is $1000.00. You choose Option #1 because you will pay less for the house than if Option #2 were used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Your Budgeted maximum total monthly payment is 100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started