Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (35 MARKS) On 1 August 2015, Yellow purchased 15% of ordinary shares in Grape for RM4.00 each. For the shares, Yellow paid

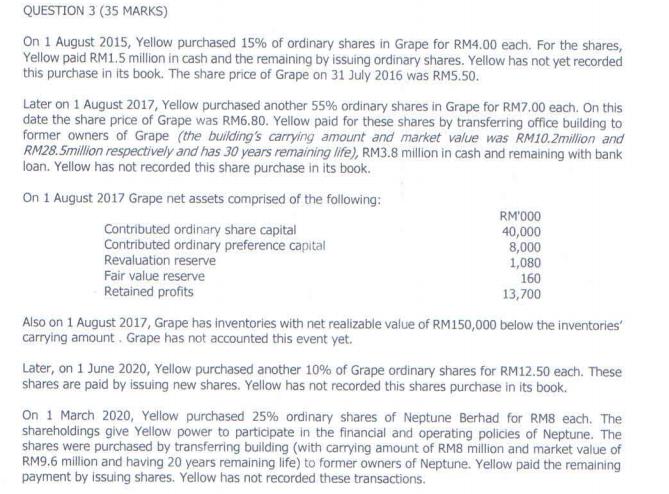

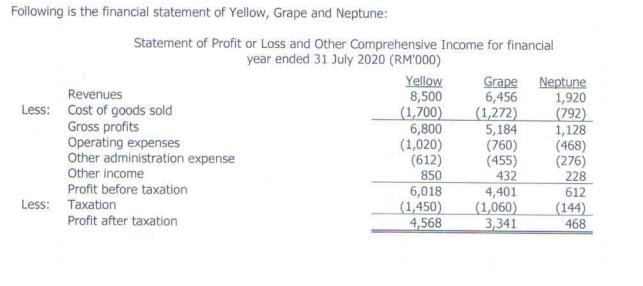

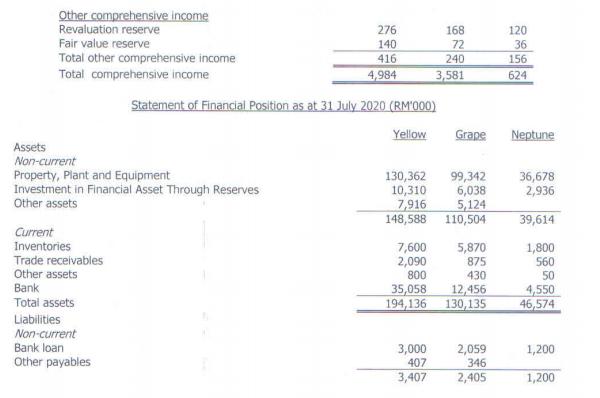

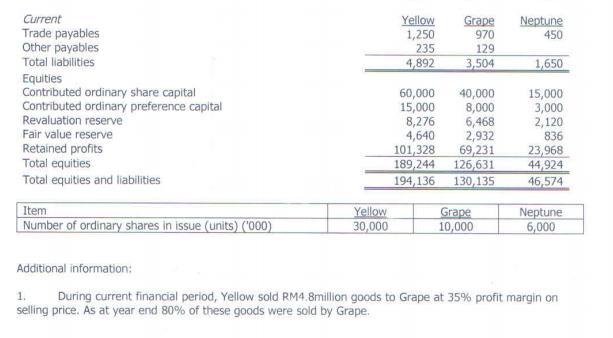

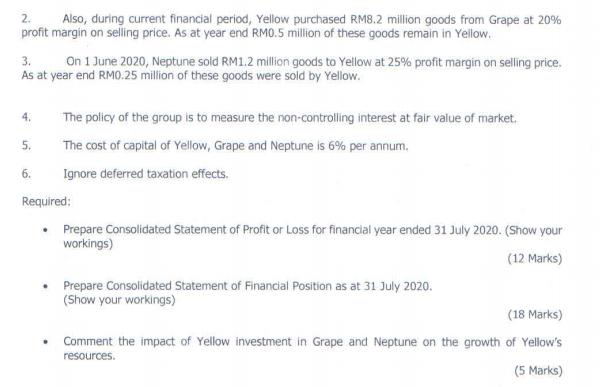

QUESTION 3 (35 MARKS) On 1 August 2015, Yellow purchased 15% of ordinary shares in Grape for RM4.00 each. For the shares, Yellow paid RM1.5 million in cash and the remaining by issuing ordinary shares. Yellow has not yet recorded this purchase in its book. The share price of Grape on 31 July 2016 was RM5.50. Later on 1 August 2017, Yellow purchased another 55% ordinary shares in Grape for RM7.00 each. On this date the share price of Grape was RM6.80. Yellow paid for these shares by transferring office building to former owners of Grape (the building's carrying amount and market value was RM10.2million and RM28.5million respectively and has 30 years remaining life), RM3.8 million in cash and remaining with bank loan. Yellow has not recorded this share purchase in its book. On 1 August 2017 Grape net assets comprised of the following: Contributed ordinary share capital Contributed ordinary preference capital Revaluation reserve Fair value reserve Retained profits RM'000 40,000 8,000 1,080 160 13,700 Also on 1 August 2017, Grape has inventories with net realizable value of RM150,000 below the inventories' carrying amount. Grape has not accounted this event yet. Later, on 1 June 2020, Yellow purchased another 10% of Grape ordinary shares for RM12.50 each. These shares are paid by issuing new shares. Yellow has not recorded this shares purchase in its book. On 1 March 2020, Yellow purchased 25% ordinary shares of Neptune Berhad for RM8 each. The shareholdings give Yellow power to participate in the financial and operating policies of Neptune. The shares were purchased by transferring building (with carrying amount of RM8 million and market value of RM9.6 million and having 20 years remaining life) to former owners of Neptune. Yellow paid the remaining payment by issuing shares. Yellow has not recorded these transactions. Following is the financial statement of Yellow, Grape and Neptune: Statement of Profit or Loss and Other Comprehensive Income for financial year ended 31 July 2020 (RM'000) Revenues Less: Cost of goods sold Gross profits Operating expenses Other administration expense Other income Profit before taxation Less: Taxation Profit after taxation Yellow 8,500 (1,700) 6,800 (1,020) (612) 850 6,018 (1,450) 4,568 Grape 6,456 (1,272) 5,184 (760) (455) 432 4,401 (1,060) 3,341 Neptune 1,920 (792) 1,128 (468) (276) 228 612 (144) 468 Other comprehensive income Revaluation reserve Fair value reserve Total other comprehensive income Total comprehensive income Assets Non-current Property, Plant and Equipment Investment in Financial Asset Through Reserves Other assets Current Inventories Trade receivables Other assets Bank Total assets Liabilities Non-current Bank loan Other payables 276 140 416 4,984 Statement of Financial Position as at 31 July 2020 (RM000) Yellow 7,600 2,090 800 168 72 240 3,581 130,362 99,342 10,310 6,038 7,916 5,124 148,588 110,504 35,058 194,136 3,000 407 3,407 Grape 5,870 875 430 12,456 130,135 2,059 346 2,405 120 36 156 624 Neptune 36,678 2,936 39,614 1,800 560 50 4,550 46,574 1,200 1,200 Current Trade payables Other payables Total liabilities Equities Contributed ordinary share capital Contributed ordinary preference capital Revaluation reserve Fair value reserve Retained profits Total equities Total equities and liabilities Item Number of ordinary shares in issue (units) ('000) Yellow 30,000 Yellow 1,250 235 4,892 Grape 970 129 3,504 60,000 15,000 8,276 4,640 101,328 189,244 194,136 130,135 40,000 8,000 6,468 2,932 69,231 126,631 Grape 10,000 Neptune 450 1,650 15,000 3,000 2,120 836 23,968 44,924 46,574 Neptune 6,000 Additional information: 1. During current financial period, Yellow sold RM4.8million goods to Grape at 35% profit margin on selling price. As at year end 80% of these goods were sold by Grape. 2. Also, during current financial period, Yellow purchased RM8.2 million goods from Grape at 20% profit margin on selling price. As at year end RM0.5 million of these goods remain in Yellow. 3. On 1 June 2020, Neptune sold RM1.2 million goods to Yellow at 25% profit margin on selling price. As at year end RM0.25 million of these goods were sold by Yellow. 4. 5. 6. The policy of the group is to measure the non-controlling interest at fair value of market. The cost of capital of Yellow, Grape and Neptune is 6% per annum. Ignore deferred taxation effects. Required: Prepare Consolidated Statement of Profit or Loss for financial year ended 31 July 2020. (Show your workings) (12 Marks) Prepare Consolidated Statement of Financial Position as at 31 July 2020. (Show your workings) (18 Marks) Comment the impact of Yellow investment in Grape and Neptune on the growth of Yellow's resources. (5 Marks)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Consolidated Statement of Profit or Loss for Financial Year Ended 31 July 2020 RM000 Revenues 2334...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started