Answered step by step

Verified Expert Solution

Question

1 Approved Answer

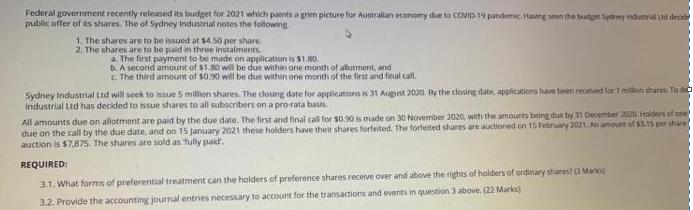

Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget

Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks) Federal government recently released its budget for 2021 which paints a grim picture for Australian economy due to COVID-19 pandemic. Having seen the budget Sydney industrial decide public offer of its shares. The of Sydney Industrial notes the following 1. The shares are to be issued at $4.50 per share 2. The shares are to be paid in three instalments a. The first payment to be made on application is $1,80 b. A second amount of $1.80 will be due within one month of allotment, and c. The third amount of $0.90 will be due within one month of the first and final call Sydney Industrial Ltd will seek to issue 5 million shares. The cloung date for applications is 31 August 2020. By the closing date, applications have been received for 7 million shares. To de Industrial Ltd has decided to issue shares to all subscribers on a pro-rata basis. All amounts due on allotment are paid by the due date. The first and final call for $0.90 is made on 30 November 2020, with the amounts being due by 31 December 2020 Holders of one due on the call by the due date, and on 15 January 2021 these holders have their shares forfeited. The forfeited shares are auctioned on 15 February 2021. An amount of $3.15 per share auction is $7,875. The shares are sold as Tully paid. REQUIRED: 3.1. What forms of preferential treatment can the holders of preference shares receive over and above the rights of holders of ordinary shares? Marks 3.2. Provide the accounting journal entries necessary to account for the transactions and events in question 3 above. (22 Marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

31 Preference shares are a type of stock that gives shareholders preferenti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started