Answered step by step

Verified Expert Solution

Question

1 Approved Answer

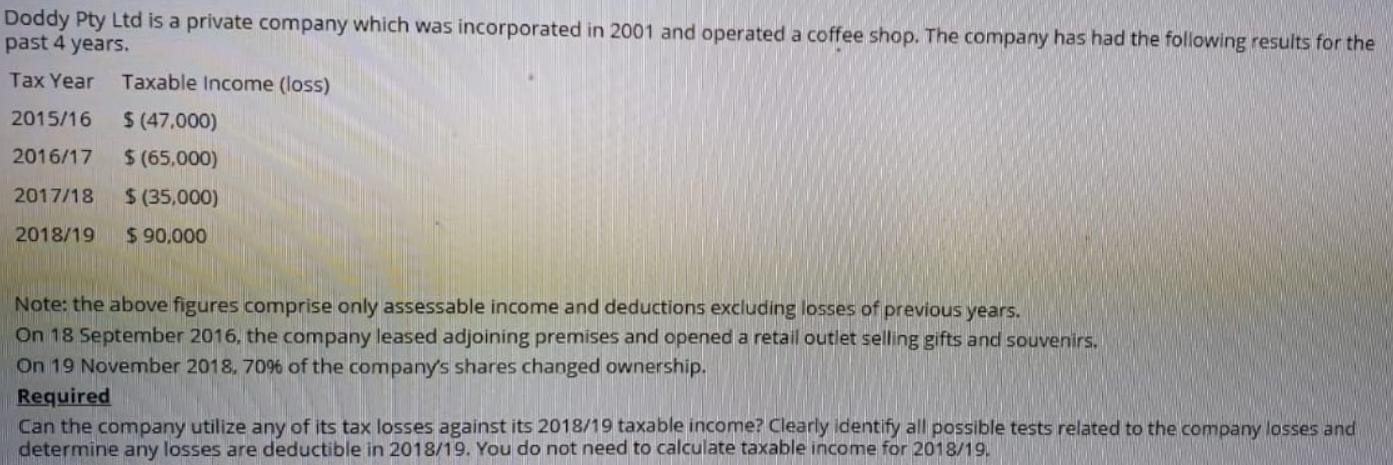

Doddy Pty Ltd is a private company which was incorporated in 2001 and operated a coffee shop. The company has had the following results

Doddy Pty Ltd is a private company which was incorporated in 2001 and operated a coffee shop. The company has had the following results for the past 4 years. Tax Year Taxable Income (loss) 2015/16 $ (47,000) 2016/17 $ (65,000) 2017/18 $ (35,000) 2018/19 $ 90.000 Note: the above figures comprise only assessable income and deductions excluding losses of previous years. On 18 September 2016, the company leased adjoining premises and opened a retail outlet selling gifts and souvenirs. On 19 November 2018, 70%6 of the company's shares changed ownership. Required Can the company utilize any of its tax losses against its 2018/19 taxable income? Clearly identify all possible tests related to the company losses and determine any losses are deductible in 2018/19. You do not need to calculate taxable income for 2018/19.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The company can only utilize taxable income of the current year t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started