Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Jane Smith and Nia Johnson formed a home security sales and installation company, in Mountain Valley, California by investing $85,000

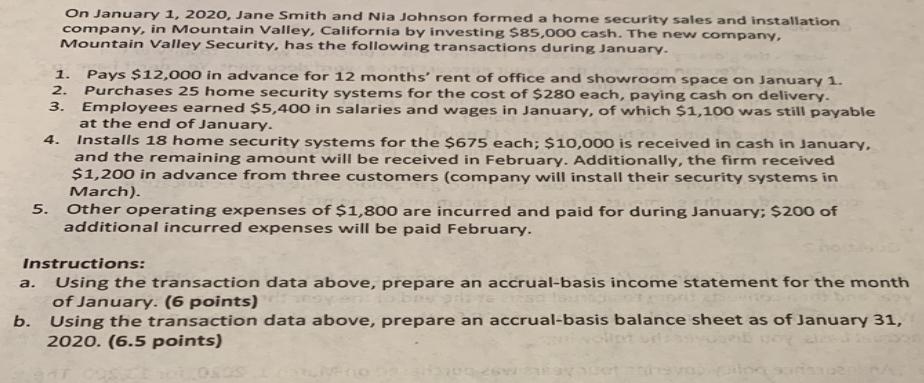

On January 1, 2020, Jane Smith and Nia Johnson formed a home security sales and installation company, in Mountain Valley, California by investing $85,000 cash. The new company, Mountain Valley Security, has the following transactions during January. Pays $12,000 in advance for 12 months' rent of office and showroom space on January 1. Purchases 25 home security systems for the cost of $280 each, paying cash on delivery. 3. Employees earned $5,400 in salaries and wages in January, of which $1,100 was still payable at the end of January. Installs 18 home security systems for the $675 each; $10,000 is received in cash in January, and the remaining amount will be received in February. Additionally, the firm received $1,200 in advance from three customers (company will install their security systems in March). 1. 2. 4. 5. Other operating expenses of $1,800 are incurred and paid for during January; $200 of additional incurred expenses will be paid February. Instructions: Using the transaction data above, prepare an accrual-basis income statement for the month of January. (6 points) b. Using the transaction data above, prepare an accrual-basis balance sheet as of January 31, 2020. (6.5 points) a.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Accrualbasis Income Statement for the month of January 31 2020 Particulars Amount Revenue 1215000 Ot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started