Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Sharifah Begum is working in London, United Kingdom since the beginning of last year. She has not filed any tax return to

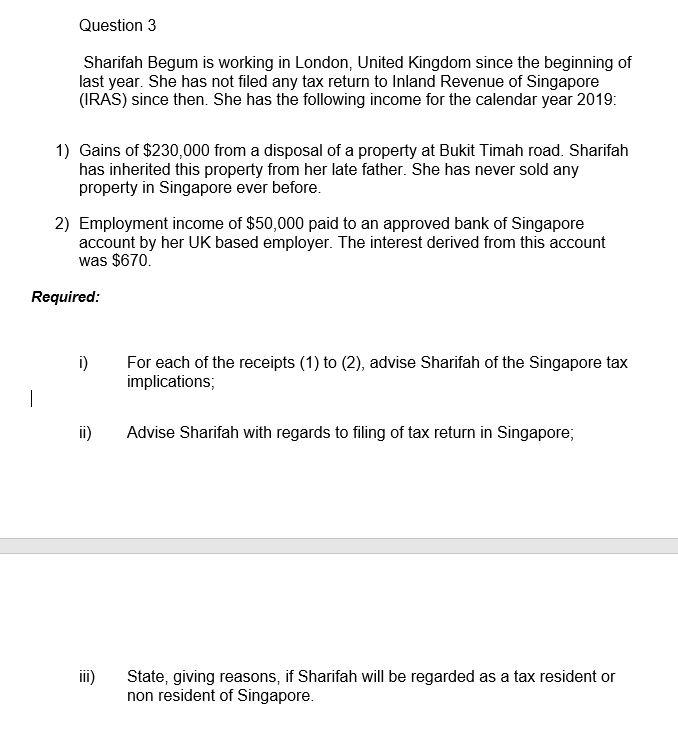

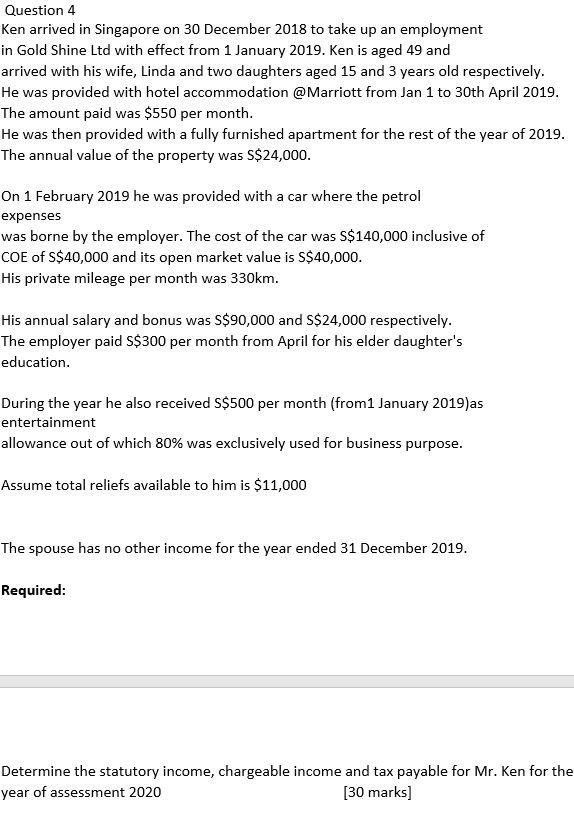

Question 3 Sharifah Begum is working in London, United Kingdom since the beginning of last year. She has not filed any tax return to Inland Revenue of Singapore (IRAS) since then. She has the following income for the calendar year 2019: 1) Gains of $230,000 from a disposal of a property at Bukit Timah road. Sharifah has inherited this property from her late father. She has never sold any property in Singapore ever before. 2) Employment income of $50,000 paid to an approved bank of Singapore account by her UK based employer. The interest derived from this account was $670. Required: i) ii) III) For each of the receipts (1) to (2), advise Sharifah of the Singapore tax implications; Advise Sharifah with regards to filing of tax return in Singapore; State, giving reasons, if Sharifah will be regarded as a tax resident or non resident of Singapore. Question 4 Ken arrived in Singapore on 30 December 2018 to take up an employment in Gold Shine Ltd with effect from 1 January 2019. Ken is aged 49 and arrived with his wife, Linda and two daughters aged 15 and 3 years old respectively. He was provided with hotel accommodation @Marriott from Jan 1 to 30th April 2019. The amount paid was $550 per month. He was then provided with a fully furnished apartment for the rest of the year of 2019. The annual value of the property was S$24,000. On 1 February 2019 he was provided with a car where the petrol expenses was borne by the employer. The cost of the car was S$140,000 inclusive of COE of S$40,000 and its open market value is $$40,000. His private mileage per month was 330km. His annual salary and bonus was S$90,000 and S$24,000 respectively. The employer paid $$300 per month from April for his elder daughter's education. During the year he also received S$500 per month (from1 January 2019)as entertainment allowance out of which 80% was exclusively used for business purpose. Assume total reliefs available to him is $11,000 The spouse has no other income for the year ended 31 December 2019. Required: Determine the statutory income, chargeable income and tax payable for Mr. Ken for the year of assessment 2020 [30 marks]

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Question 3 1 1 The gains from the disposal of the property at Bukit Timah road are not taxable in Singapore as Sharifah is not a Singapore resident Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started