Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Sentosa Berhad is considering two alternatives to finance its purchase of a new $4,000,000 office building. Issue 400,000 ordinary shares at $10 per

![Required Calculate each of the following for each alternative: i. Net income. ii. Earnings per share. [4 marks) [2 marks] b.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/06/60bdab1476b4a_1623172433519.jpg)

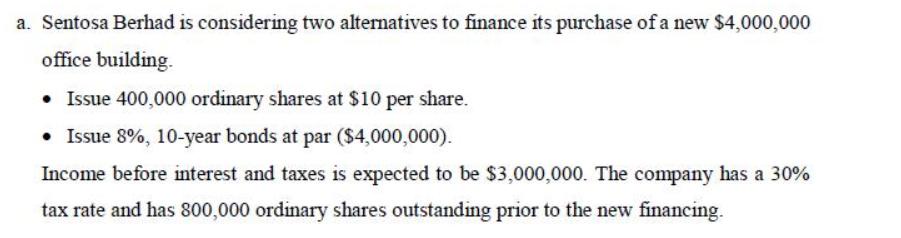

a. Sentosa Berhad is considering two alternatives to finance its purchase of a new $4,000,000 office building. Issue 400,000 ordinary shares at $10 per share. Issue 8%, 10-year bonds at par ($4,000,000). Income before interest and taxes is expected to be $3,000,000. The company has a 30% tax rate and has 800,000 ordinary shares outstanding prior to the new financing. Required Calculate each of the following for each alternative: i Net income. [4 marks] ii. Earnings per share. [2 marks] b. The equity accounts of Sunsuria Berhad on January 1, 2020, were as follows. Share Capital-Preference (9%, RM100 par, cumulative, 5,000 shares authorized) Share Capital-Ordinary (RM3 stated value, 300,000 shares authorized) RM300,000 660,000 Share Premium-Preference 20,000 Share Premium- Ordinary Retained Earnings Treasury Shares-Ordinary (5,000 shares) 396,000 488,000 30,000 During 2020, the company had the following transactions and events pertaining to its equity. Feb. 1 Issued 2,800 ordinary shares for RM18,200. Purchased 1,200 additional treasury shares (ordinary) at RM6 per share. Sold 4,000 treasury shares (ordinary) for RM26,000. Issued 2,000 ordinary shares for a patent valued at RM14,000. Determined that net income for the year was RM365,000. Mar. 20 June 14 Sept. 3 Dec. 31 No dividends were declared during the year. Required i. Journalize the transactions and the closing entry for net income. [13 marks] ii Prepare an equity section at December 31, 2020, including the disclosure of the preference dividends in arrears. [6 marks]

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Complete solution is given below ans a Alternative 1 Alternative 2 Income before Interest taxes 3000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started