Question 4: You are the financial controller of Fresco Ltd, and its financial statements for the year ended 30 April 2020 are being prepared.

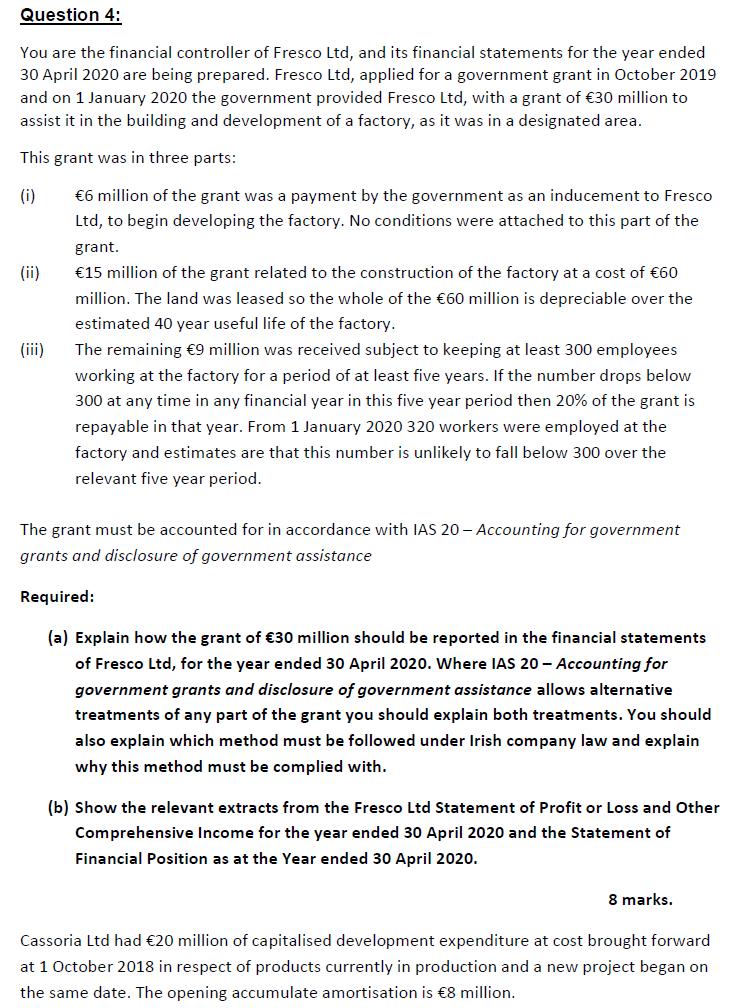

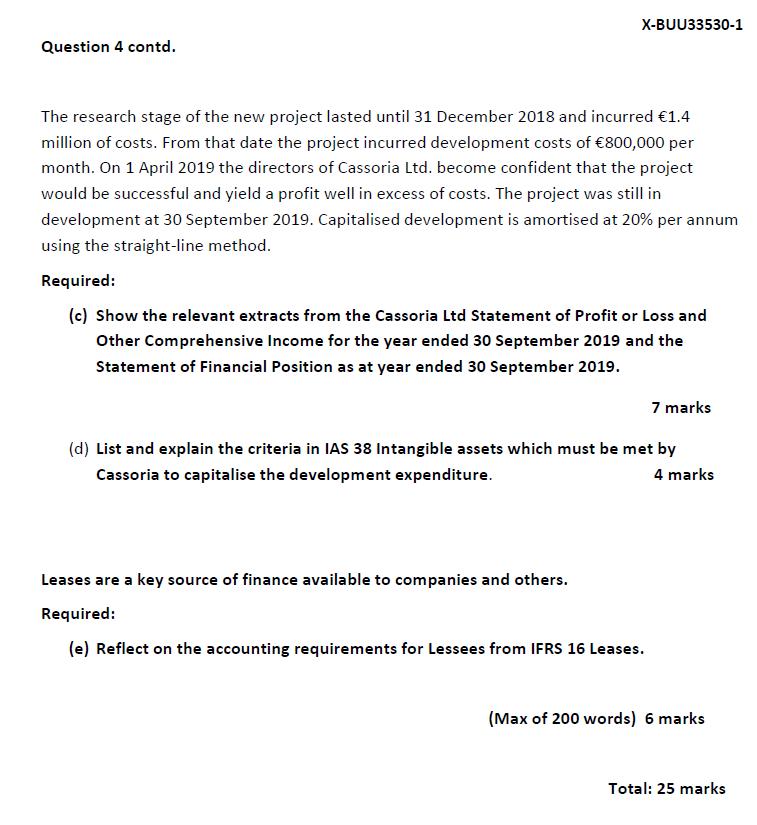

Question 4: You are the financial controller of Fresco Ltd, and its financial statements for the year ended 30 April 2020 are being prepared. Fresco Ltd, applied for a government grant in October 2019 and on 1 January 2020 the government provided Fresco Ltd, with a grant of 30 million to assist it in the building and development of a factory, as it was in a designated area. This grant was in three parts: (i) (iii) 6 million of the grant was a payment by the government as an inducement to Fresco Ltd, to begin developing the factory. No conditions were attached to this part of the grant. 15 million of the grant related to the construction of the factory at a cost of 60 million. The land was leased so the whole of the 60 million is depreciable over the estimated 40 year useful life of the factory. The remaining 9 million was received subject to keeping at least 300 employees working at the factory for a period of at least five years. If the number drops below 300 at any time in any financial year in this five year period then 20% of the grant is repayable in that year. From 1 January 2020 320 workers were employed at the factory and estimates are that this number is unlikely to fall below 300 over the relevant five year period. The grant must be accounted for in accordance with IAS 20- Accounting for government grants and disclosure of government assistance Required: (a) Explain how the grant of 30 million should be reported in the financial statements of Fresco Ltd, for the year ended 30 April 2020. Where IAS 20- Accounting for government grants and disclosure of government assistance allows alternative treatments of any part of the grant you should explain both treatments. You should also explain which method must be followed under Irish company law and explain why this method must be complied with. (b) Show the relevant extracts from the Fresco Ltd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 April 2020 and the Statement of Financial Position as at the Year ended 30 April 2020. 8 marks. Cassoria Ltd had 20 million of capitalised development expenditure at cost brought forward at 1 October 2018 in respect of products currently in production and a new project began on the same date. The opening accumulate amortisation is 8 million. Question 4 contd. X-BUU33530-1 The research stage of the new project lasted until 31 December 2018 and incurred 1.4 million of costs. From that date the project incurred development costs of 800,000 per month. On 1 April 2019 the directors of Cassoria Ltd. become confident that the project would be successful and yield a profit well in excess of costs. The project was still in development at 30 September 2019. Capitalised development is amortised at 20% per annum using the straight-line method. Required: (c) Show the relevant extracts from the Cassoria Ltd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2019 and the Statement of Financial Position as at year ended 30 September 2019. 7 marks (d) List and explain the criteria in IAS 38 Intangible assets which must be met by Cassoria to capitalise the development expenditure. 4 marks Leases are a key source of finance available to companies and others. Required: (e) Reflect on the accounting requirements for Lessees from IFRS 16 Leases. (Max of 200 words) 6 marks Total: 25 marks

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a i The 6 million received as an inducement to begin developing the factory should be recognised as income in the period in which it is received ii The 15 million received for the construction of the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started