Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AAA Star Pty Ltd buys new chairs for $50 each (plus 10% GST) and then sells them for $80 each (plus 10% GST). On

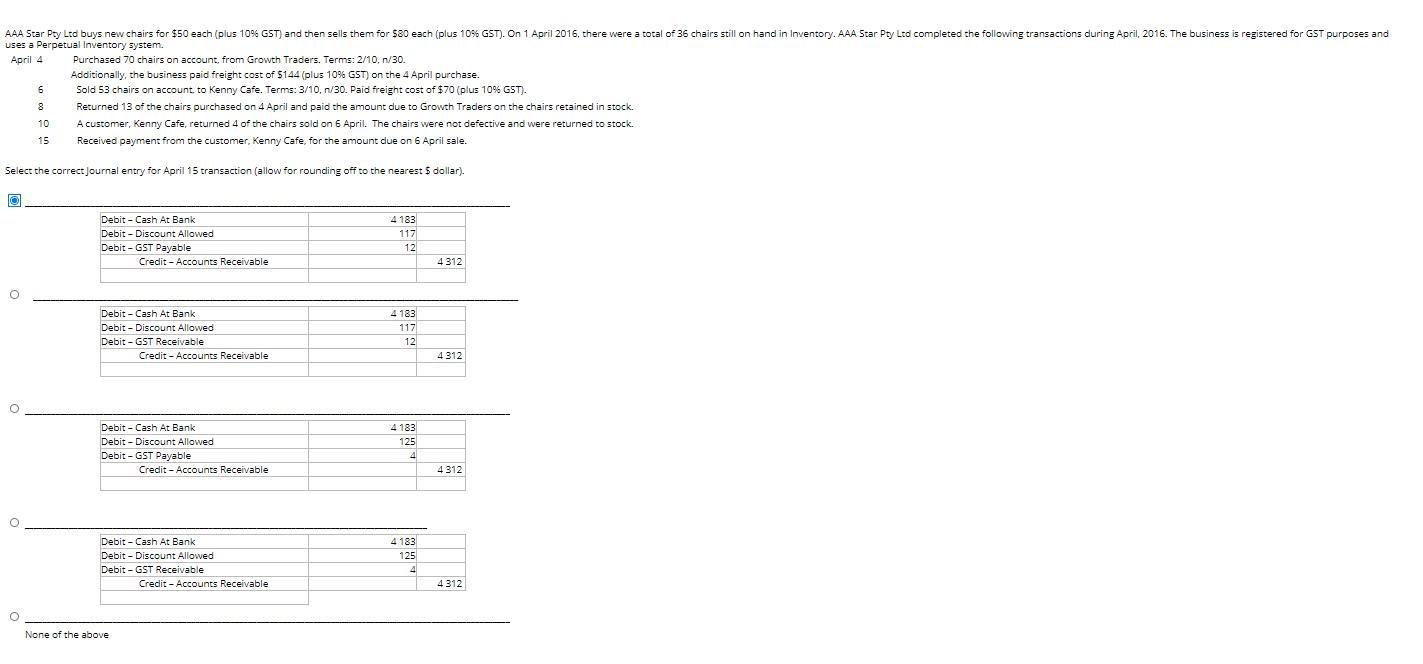

AAA Star Pty Ltd buys new chairs for $50 each (plus 10% GST) and then sells them for $80 each (plus 10% GST). On 1 April 2016, there were a total of 36 chairs still on hand in Inventory. AAA Star Pty Ltd completed the following transactions during April, 2016. The business is registered for GST purposes and uses a Perpetual Inventory system. April 4 Purchased 70 chairs on account, from Growth Traders. Terms: 2/10, n/30. Additionally, the business paid freight cost of 5144 (plus 10% GST) on the 4 April purchase. Sold 53 chairs on account, to Kenny Cafe. Terms: 3/10, n/30. Paid freight cost of $70 (plus 10% GST). 8. Returned 13 of the chairs purchased on 4 April and paid the amount due to Growth Traders on the chairs retained in stock. 10 A customer, Kenny Cafe, returned 4 of the chairs sold on 6 April. The chairs were not defective and were returned to stock. 15 Received payment from the customer, Kenny Cafe, for the amount due on 6 April sale. Select the correct Journal entry for April 15 transaction (allow for rounding off to the nearest $ dollar). 4 183 117 Debit - Cash At Bank Debit - Discount Allowed Debit - GST Payable 12 Credit - Accounts Receivable 4 312 Debit - Cash At Bank 4 183 Debit - Discount Allowed 117 Debit - GST Receivable 12 Credit - Accounts Receivable 4312 Debit - Cash At Bank 4 183 Debit - Discount Allowed 125 Debit - GST Payable 4. Credit - Accounts Receivable 4312 Debit - Cash At Bank 4 183 Debit - Discount Allowed 125 Debit - GST Receivable 4 Credit - Accounts Receivable 4312 None of the above

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started