Question

John's Tees sells only fully taxable t-shirts to customers in Ontario where the HST rate is 13%. In Ontario, the Quick Rate for businesses

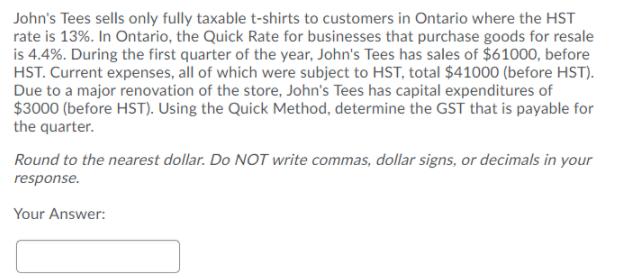

John's Tees sells only fully taxable t-shirts to customers in Ontario where the HST rate is 13%. In Ontario, the Quick Rate for businesses that purchase goods for resale is 4.4%. During the first quarter of the year, John's Tees has sales of $61000, before HST. Current expenses, all of which were subject to HST, total $41000 (before HST). Due to a major renovation of the store, John's Tees has capital expenditures of $3000 (before HST). Using the Quick Method, determine the GST that is payable for the quarter. Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your Answer:

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer is 2262 Working NOte John Tees On Output 13 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance Services Understanding the Integrated Audit

Authors: Karen L. Hooks

1st edition

471726346, 978-0471726340

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App