Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently joined an investment management firm V. This firm has a broad range of clients, including employee benefit plans, wealthy individuals and

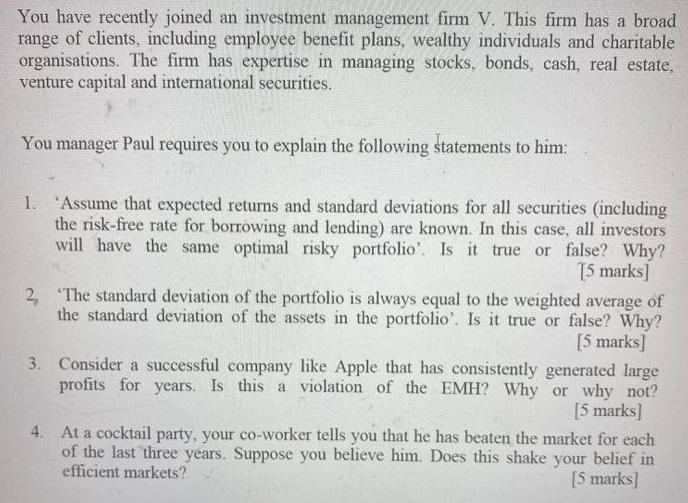

You have recently joined an investment management firm V. This firm has a broad range of clients, including employee benefit plans, wealthy individuals and charitable organisations. The firm has expertise in managing stocks, bonds, cash, real estate, venture capital and international securities. You manager Paul requires you to explain the following statements to him: 1. 'Assume that expected returns and standard deviations for all securities (including the risk-free rate for borrowing and lending) are known. In this case, all investors will have the same optimal risky portfolio'. Is it true or false? Why? [5 marks] 2, The standard deviation of the portfolio is always equal to the weighted average of the standard deviation of the assets in the portfolio'., Is it true or false? Why? [5 marks] 3. Consider a successful company like Apple that has consistently generated large profits for years. Is this a violation of the EMH? Why or why not? [5 marks] 4. At a cocktail party, your co-worker tells you that he has beaten the market for each of the last three years. Suppose you believe him. Does this shake your belief in [5 marks] efficient markets?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes it is true that all the investors will have the same optimal risky portfolio As the optimal ri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started