Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (30 points) Wonka Industries, which previously specialized in chocolates, has decided to diversify and has just acquired a sweets company, Just Sweets.

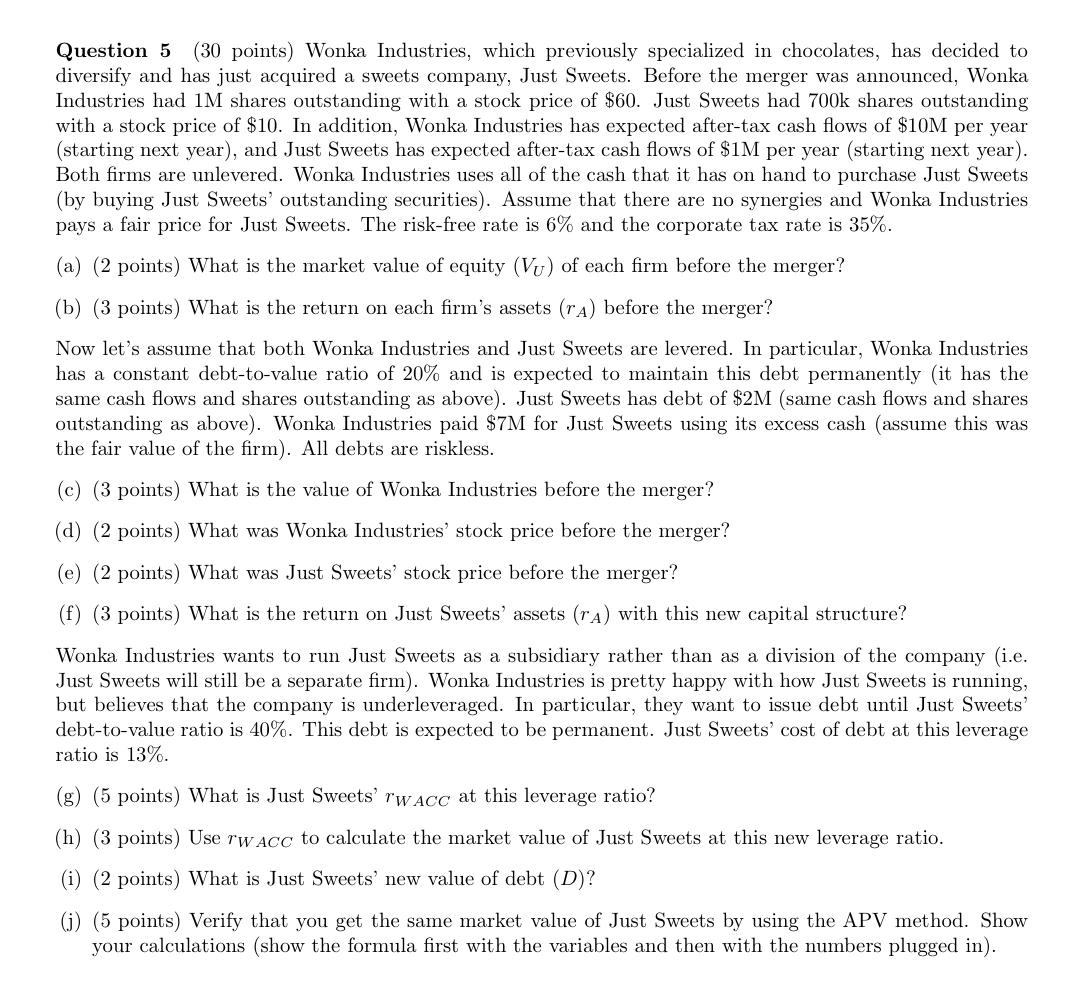

Question 5 (30 points) Wonka Industries, which previously specialized in chocolates, has decided to diversify and has just acquired a sweets company, Just Sweets. Before the merger was announced, Wonka Industries had 1M shares outstanding with a stock price of $60. Just Sweets had 700k shares outstanding with a stock price of $10. In addition, Wonka Industries has expected after-tax cash flows of $10M per year (starting next year), and Just Sweets has expected after-tax cash flows of $1M per year (starting next year). Both firms are unlevered. Wonka Industries uses all of the cash that it has on hand to purchase Just Sweets (by buying Just Sweets' outstanding securities). Assume that there are no synergies and Wonka Industries. pays a fair price for Just Sweets. The risk-free rate is 6% and the corporate tax rate is 35%. (a) (2 points) What is the market value of equity (Vu) of each firm before the merger? (b) (3 points) What is the return on each firm's assets (rA) before the merger? Now let's assume that both Wonka Industries and Just Sweets are levered. In particular, Wonka Industries has a constant debt-to-value ratio of 20% and is expected to maintain this debt permanently (it has the same cash flows and shares outstanding as above). Just Sweets has debt of $2M (same cash flows and shares outstanding as above). Wonka Industries paid $7M for Just Sweets using its excess cash (assume this was the fair value of the firm). All debts are riskless. (c) (3 points) What is the value of Wonka Industries before the merger? (d) (2 points) What was Wonka Industries' stock price before the merger? (e) (2 points) What was Just Sweets' stock price before the merger? (f) (3 points) What is the return on Just Sweets' assets (rA) with this new capital structure? Wonka Industries wants to run Just Sweets as a subsidiary rather than as a division of the company (i.e. Just Sweets will still be a separate firm). Wonka Industries is pretty happy with how Just Sweets is running, but believes that the company is underleveraged. In particular, they want to issue debt until Just Sweets' debt-to-value ratio is 40%. This debt is expected to be permanent. Just Sweets' cost of debt at this leverage ratio is 13%. (g) (5 points) What is Just Sweets' rwACC at this leverage ratio? (h) (3 points) Use TWACC to calculate the market value of Just Sweets at this new leverage ratio. (i) (2 points) What is Just Sweets' new value of debt (D)? (j) (5 points) Verify that you get the same market value of Just Sweets by using the APV method. Show your calculations (show the formula first with the variables and then with the numbers plugged in).

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a 2 points What is the market value of equity Vu of each firm before the merger Wonka Industries 1M ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started