Answered step by step

Verified Expert Solution

Question

1 Approved Answer

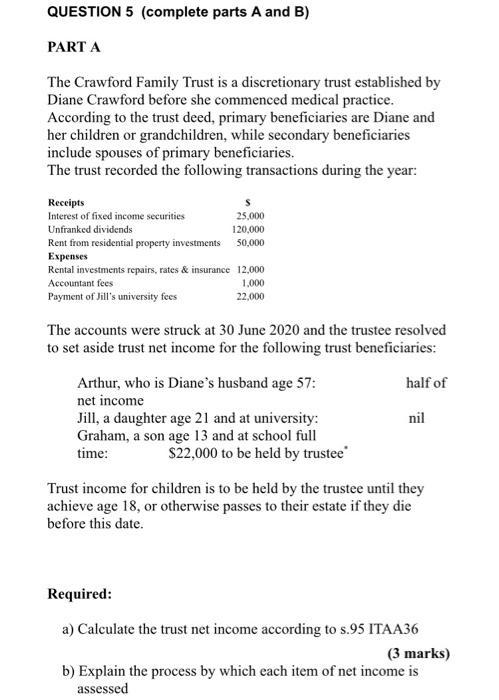

QUESTION 5 (complete parts A and B) PART A The Crawford Family Trust is a discretionary trust established by Diane Crawford before she commenced

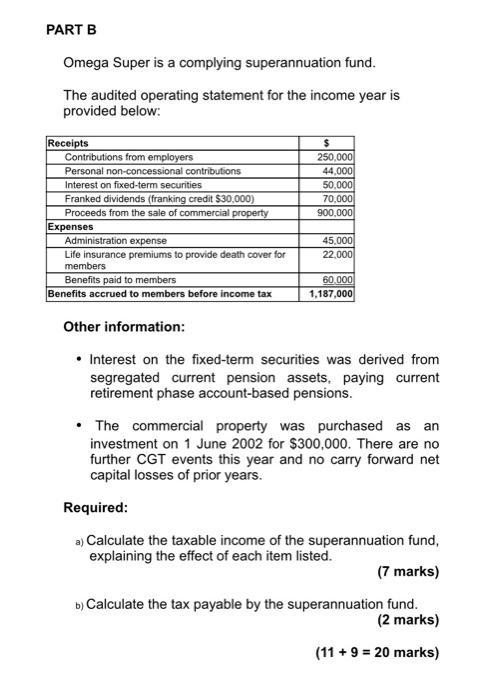

QUESTION 5 (complete parts A and B) PART A The Crawford Family Trust is a discretionary trust established by Diane Crawford before she commenced medical practice. According to the trust deed, primary beneficiaries are Diane and her children or grandchildren, while secondary beneficiaries include spouses of primary beneficiaries. The trust recorded the following transactions during the year: Receipts Interest of fixed income securities Unfranked dividends Rent from residential property investments Expenses Rental investments repairs, rates & insurance Accountant fees Payment of Jill's university fees 25,000 120,000 50,000 12,000 1,000 22,000 The accounts were struck at 30 June 2020 and the trustee resolved to set aside trust net income for the following trust beneficiaries: Arthur, who is Diane's husband age 57: net income Jill, a daughter age 21 and at university: Graham, a son age 13 and at school full time: $22,000 to be held by trustee half of nil Trust income for children is to be held by the trustee until they achieve age 18, or otherwise passes to their estate if they die before this date. Required: a) Calculate the trust net income according to s.95 ITAA36 (3 marks) b) Explain the process by which each item of net income is assessed PART B Omega Super is a complying superannuation fund. The audited operating statement for the income year is provided below: Receipts Contributions from employers Personal non-concessional contributions Interest on fixed-term securities Franked dividends (franking credit $30,000) Proceeds from the sale of commercial property Expenses Administration expense Life insurance premiums to provide death cover for members Benefits paid to members Benefits accrued to members before income tax $ 250,000 44,000 50,000 70,000 900,000 45,000 22,000 60,000 1,187,000 Other information: Interest on the fixed-term securities was derived from segregated current pension assets, paying current retirement phase account-based pensions. The commercial property was purchased as an investment on 1 June 2002 for $300,000. There are no further CGT events this year and no carry forward net capital losses of prior years. Required: a) Calculate the taxable income of the superannuation fund, explaining the effect of each item listed. (7 marks) b) Calculate the tax payable by the superannuation fund. (2 marks) (11 + 9 = 20 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

QUEST ION 5 complete parts A and B PART A Required a Calculate the trust net income according to s95 ITAA36 3 marks ANSWER Trust net income Receipts Expenses 195000 33000 162000 EXPLANATION Trust net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started