Alpha and Beta are two countries. Alpha uses dollars ($) and Beta uses pounds (). Treat Alpha as the home country and define the

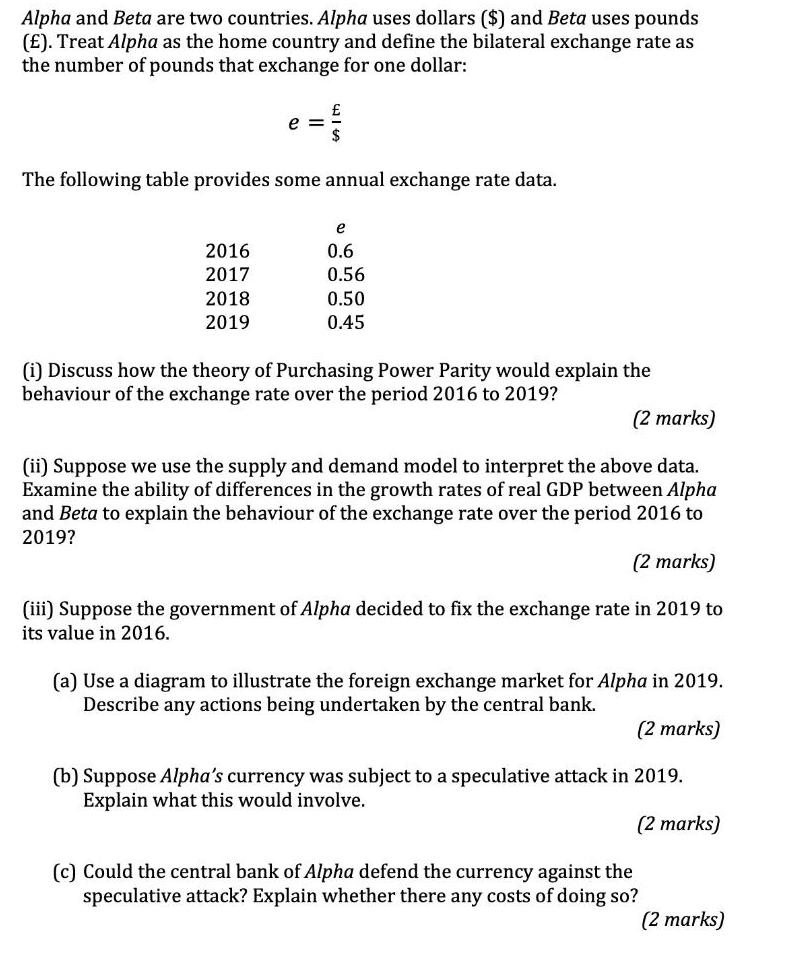

Alpha and Beta are two countries. Alpha uses dollars ($) and Beta uses pounds (). Treat Alpha as the home country and define the bilateral exchange rate as the number of pounds that exchange for one dollar: co || GA | M The following table provides some annual exchange rate data. 2016 2017 2018 2019 e 0.6 0.56 0.50 0.45 (i) Discuss how the theory of Purchasing Power Parity would explain the behaviour of the exchange rate over the period 2016 to 2019? (2 marks) (ii) Suppose we use the supply and demand model to interpret the above data. Examine the ability of differences in the growth rates of real GDP between Alpha and Beta to explain the behaviour of the exchange rate over the period 2016 to 2019? (2 marks) (iii) Suppose the government of Alpha decided to fix the exchange rate in 2019 to its value in 2016. (a) Use a diagram to illustrate the foreign exchange market for Alpha in 2019. Describe any actions being undertaken by the central bank. (2 marks) (b) Suppose Alpha's currency was subject to a speculative attack in 2019. Explain what this would involve. (2 marks) (c) Could the central bank of Alpha defend the currency against the speculative attack? Explain whether there any costs of doing so? (2 marks)

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i The theory of Purchasing Power Parity PPP suggests that in the long run the exchange rate between two countries should adjust such that the price ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started