Answered step by step

Verified Expert Solution

Question

1 Approved Answer

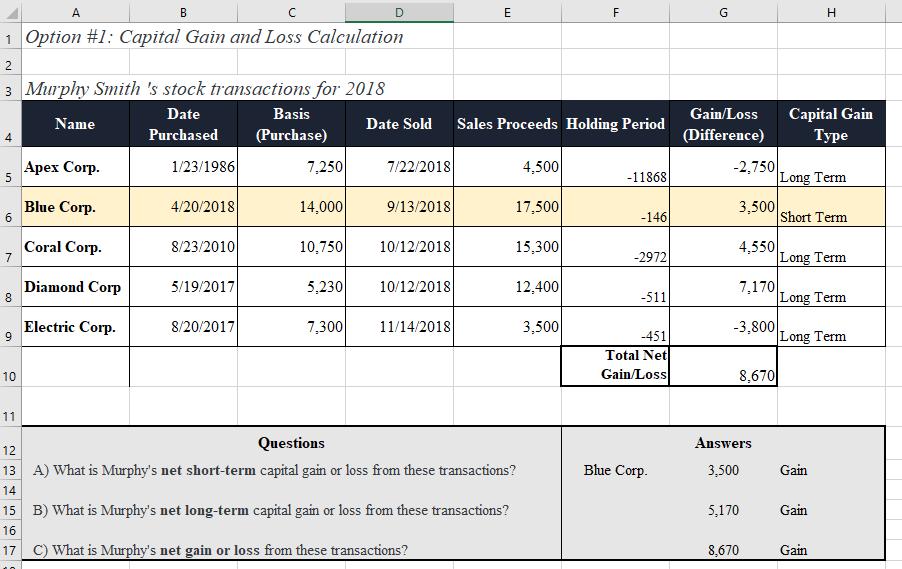

Based on (a) through (c), complete Murphy's Schedule D using the IRS fillable tax forms. 5 1 Option #1: Capital Gain and Loss Calculation 2

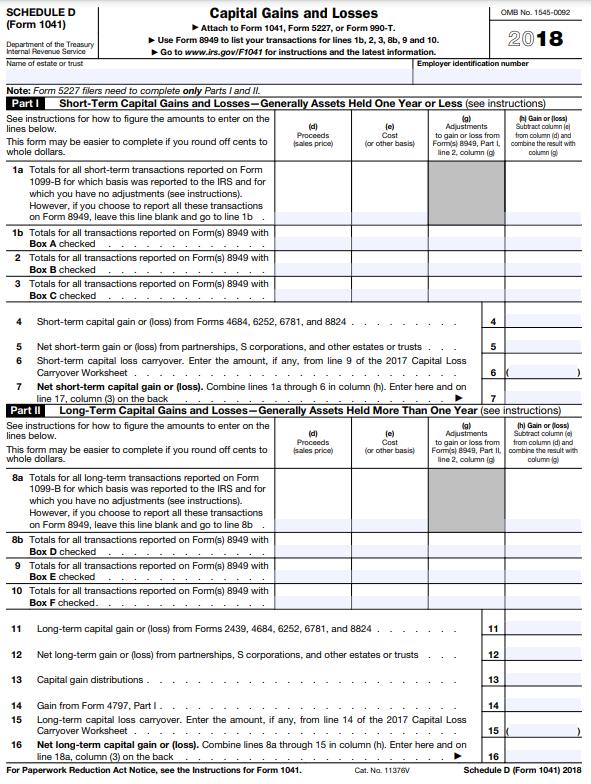

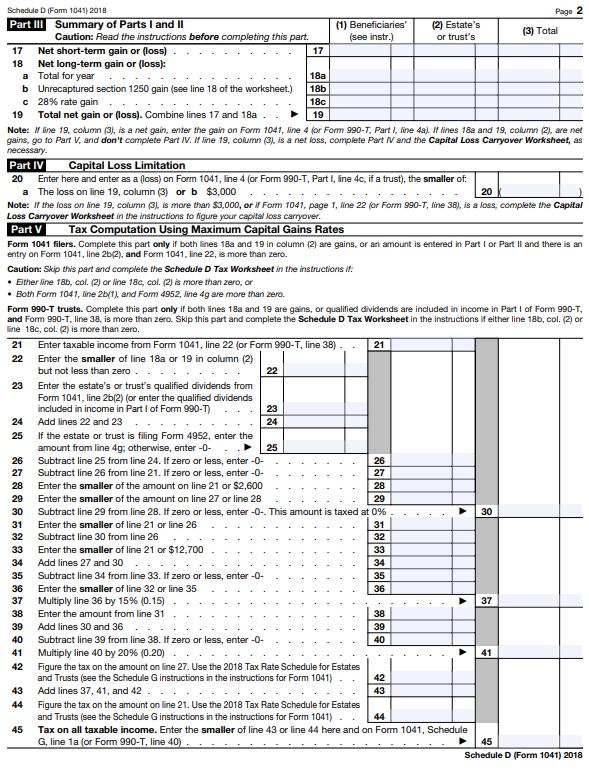

Based on (a) through (c), complete Murphy's Schedule D using the IRS fillable tax forms.

5 1 Option #1: Capital Gain and Loss Calculation 2 3 Murphy Smith 's stock transactions for 2018 Date Purchased 6 7 8 9 10 A 11 Name Apex Corp. Blue Corp. Coral Corp. Diamond Corp Electric Corp. 1/23/1986 4/20/2018 8/23/2010 5/19/2017 8/20/2017 Basis (Purchase) 7,250 14,000 10,750 D 7,300 7/22/2018 Date Sold Sales Proceeds Holding Period 9/13/2018 10/12/2018 5,230 10/12/2018 E 11/14/2018 4,500 17,500 15,300 12,400 Questions 12 13 A) What is Murphy's net short-term capital gain or loss from these transactions? 14 15 B) What is Murphy's net long-term capital gain or loss from these transactions? 16 17 C) What is Murphy's net gain or loss from these transactions? F 3,500 -11868 -146 -2972 -511 -451 Total Net Gain/Loss Blue Corp. G Gain/Loss (Difference) -2,750 3,500 4,550 7,170 -3,800 8,670 Answers 3,500 5,170 8,670 Capital Gain Type Long Term H Short Term Long Term Long Term Long Term Gain Gain Gain

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Murphys net shortterm capital Gain 3500 Murphys ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started