Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cayanan Protection Services Ltd. has been awarded a 4-year contract in Fort McMurray to apply fire coatings for a new oil-sand refinery. The company

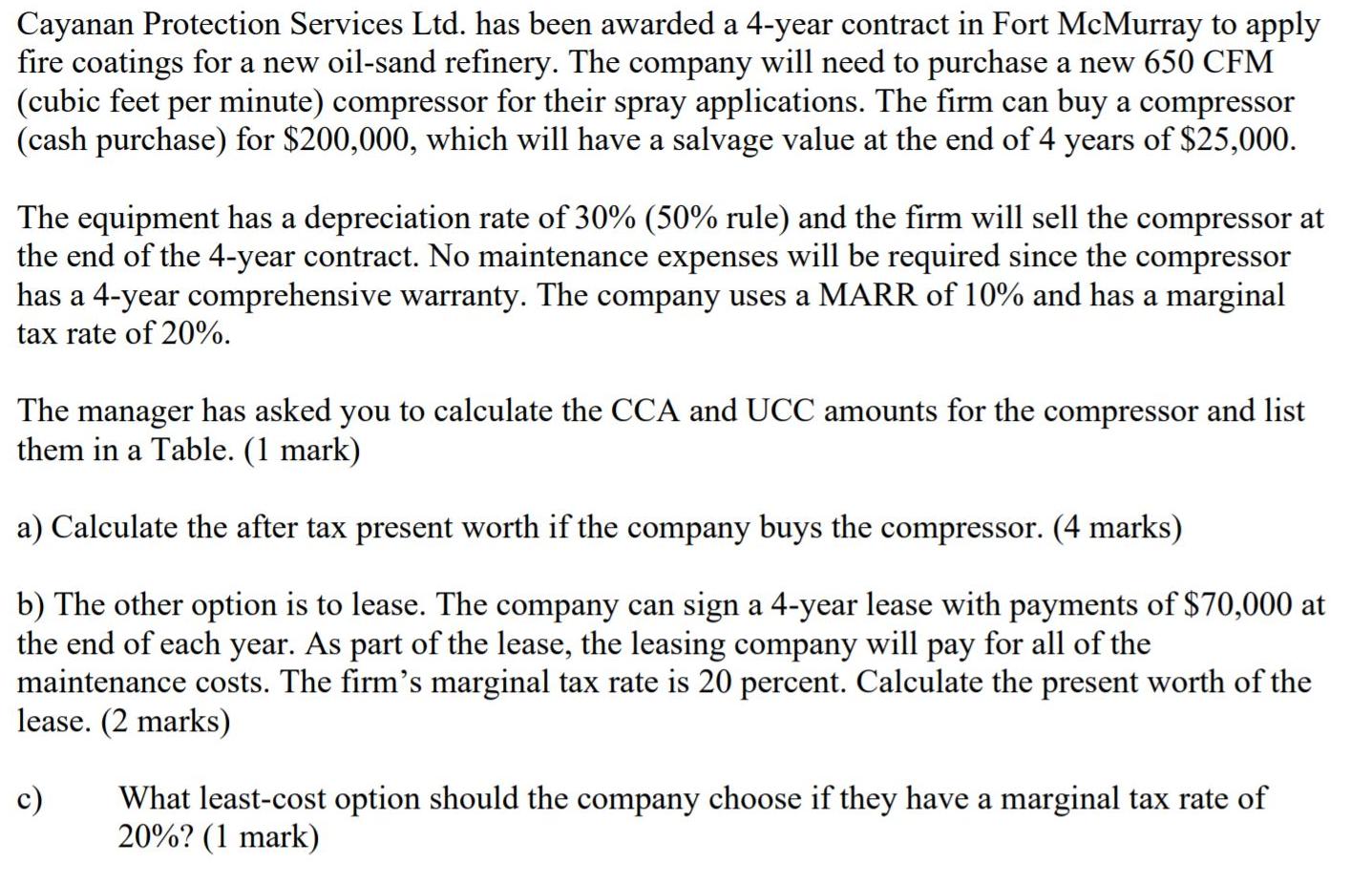

Cayanan Protection Services Ltd. has been awarded a 4-year contract in Fort McMurray to apply fire coatings for a new oil-sand refinery. The company will need to purchase a new 650 CFM (cubic feet per minute) compressor for their spray applications. The firm can buy a compressor (cash purchase) for $200,000, which will have a salvage value at the end of 4 years of $25,000. The equipment has a depreciation rate of 30% (50% rule) and the firm will sell the compressor at the end of the 4-year contract. No maintenance expenses will be required since the compressor has a 4-year comprehensive warranty. The company uses a MARR of 10% and has a marginal tax rate of 20%. The manager has asked you to calculate the CCA and UCC amounts for the compressor and list them in a Table. (1 mark) a) Calculate the after tax present worth if the company buys the compressor. (4 marks) b) The other option is to lease. The company can sign a 4-year lease with payments of $70,000 at the end of each year. As part of the lease, the leasing company will pay for all of the maintenance costs. The firm's marginal tax rate is 20 percent. Calculate the present worth of the lease. (2 marks) What least-cost option should the company choose if they have a marginal tax rate of 20%? (1 mark) c)

Step by Step Solution

★★★★★

3.66 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a The table below shows the CCA and UCC amounts for the compressor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started