Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three Independent situations follow: 1. Day One Ltd. (DOL) issued $10,000,000 in stripped (zero-coupon) bonds that mature in 6 years. The market rate of interest

Three Independent situations follow:

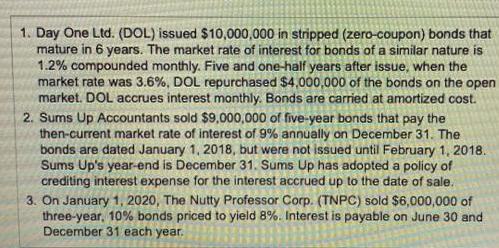

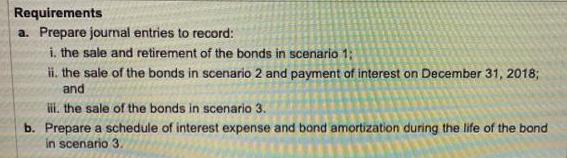

1. Day One Ltd. (DOL) issued $10,000,000 in stripped (zero-coupon) bonds that mature in 6 years. The market rate of interest for bonds of a similar nature is 1.2% compounded monthly. Five and one-half years after issue, when the market rate was 3.6%, DOL repurchased $4,000,000 of the bonds on the open market. DOL accrues interest monthly. Bonds are carried at amortized cost. 2. Sums Up Accountants sold $9,000,000 of five-year bonds that pay the then-current market rate of interest of 9% annually on December 31. The bonds are dated January 1, 2018, but were not issued until February 1, 2018. Sums Up's year-end is December 31. Sums Up has adopted a policy of crediting interest expense for the interest accrued up to the date of sale. 3. On January 1, 2020, The Nutty Professor Corp. (TNPC) sold $6,000,000 of three-year, 10% bonds priced to yield 8%. Interest is payable on June 30 and December 31 each year.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a i The Nutty Professor Corp Journal Entry Date Accounts Debit Credit 112020 Cash 6000000 Bonds Paya...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started