Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. You returned to Mr. Jell for for a further update. The discussion now swung towards the subject of the shareholder equity transactions which had

.

.

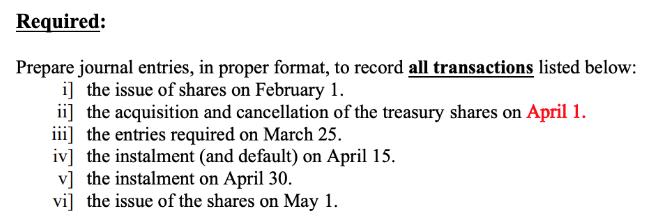

You returned to Mr. Jell for for a further update. The discussion now swung towards the subject of the shareholder equity transactions which had occurred during the year [these were briefly mentioned in Question I above]. Mr. Jell suddenly fell silent and began to be evasive toward offering you any further information. After several minutes of awkward silence, he explained to you in a very low tone of voice, "You see we have just about no information whatsoever on this transaction. I mean, we had recruited a great young accountant a few months ago and we were looking at a very promising career for him. However, he was sort of an outdoor type with a perchant for adventure. We warned him to be careful on this planet but alas, he ignored our advice. Ten days ago, he went out on a jog on the Jupiter plains. It was a bit windy and foggy that day, and the young man sort of disappeared into one of those black hole things. The rescue squad tried to locate him but alas to no avail. Finally his beeper went beep, be .. ep, be . e . e and then silent. Of course we do miss him at times but honestly speaking, what we dearly miss is his brief case. It contained a lot of valuable files which we are now desperately trying to reconstruct. This issue of new shares was one such file lost." Upon some further questioning on your part, he provided what he knew in bits and pieces. * The 560,000 outstanding common shares on January 1 had been reported at an amount of $7,959,840. * The additional 84,000 common shares had been issued on February 1 for cash at $11.50 each. * 12,000 common shares had been acquired on April 1. "Why did we buy the shares if all we did was to cancel them right after acquiring them on the same day? I had opposed this acquisition till the very last but what could I do against the insistence of the head office. We lost $9,300 on that deal," lamented Mr. Jell. a On March 25, the company had issued subscriptions for some additional common shares. It received S172,000 upon application at $2.00 per subscription. Thereafter, the subscribers were required to pay $4.00 on April 15 and the balance, being the final instalment, on April 30. The issue was fully subscribed. * On April 15, subscribers for 8,000 subscribers failed to pay the required instalment. The company received the cash from all of the other subscribers. The defaulting subscribers forfeited the first instalment paid. On April 30, the company received $468,000 from the remaining subscribers and on May 1, it issued shares to all subscribers in good standing. Now you get to work on the second list of questions posed by Mr. Jell. These are listed on the following page.

Step by Step Solution

★★★★★

3.22 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer The journal entry to record the transactions are provided below 1 The entry to record the issue of shares is February 1 Cash ac Dr 966000 To common stock ac 966000 Being issued 84000 shares for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started