Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shaju died on 20 May 2019 leaving the following assets at its market value on the date of death: He had Cash of 30,000,

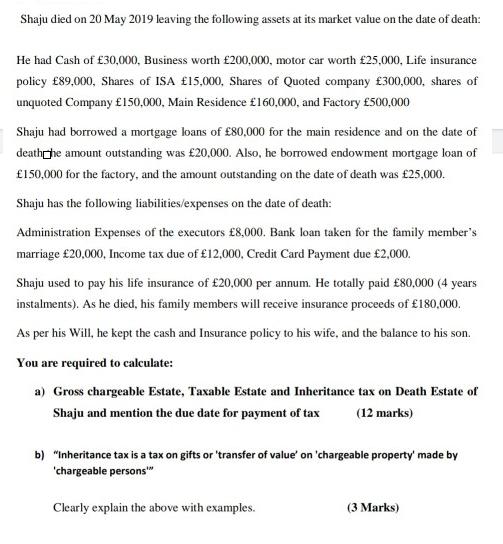

Shaju died on 20 May 2019 leaving the following assets at its market value on the date of death: He had Cash of 30,000, Business worth 200,000, motor car worth 25,000, Life insurance policy 89,000, Shares of ISA 15,000, Shares of Quoted company 300,000, shares of unquoted Company 150,000, Main Residence 160,000, and Factory 500,000 Shaju had borrowed a mortgage loans of 80,000 for the main residence and on the date of deathhe amount outstanding was 20,000. Also, he borrowed endowment mortgage loan of 150,000 for the factory, and the amount outstanding on the date of death was 25,000. Shaju has the following liabilities/expenses on the date of death: Administration Expenses of the executors 8,000. Bank loan taken for the family member's marriage 20,000, Income tax due of 12,000, Credit Card Payment due 2,000. Shaju used to pay his life insurance of 20,000 per annum. He totally paid 80,000 (4 years instalments). As he died, his family members will receive insurance proceeds of 180,000. As per his Will, he kept the cash and Insurance policy to his wife, and the balance to his son. You are required to calculate: a) Gross chargeable Estate, Taxable Estate and Inheritance tax on Death Estate of Shaju and mention the due date for payment of tax (12 marks) b) "Inheritance tax is a tax on gifts or 'transfer of value' on 'chargeable property' made by 'chargeable persons" Clearly explain the above with examples. (3 Marks)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Gross chargeable estate Gross chargeable estate is the total fair market value of assets a deceden...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started