Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One: (25 marks) Al-Hawaj & Sons (AHS) is registered trader for VAT with NBR of Ministry of Finance of Bahrain. AHS is dealing

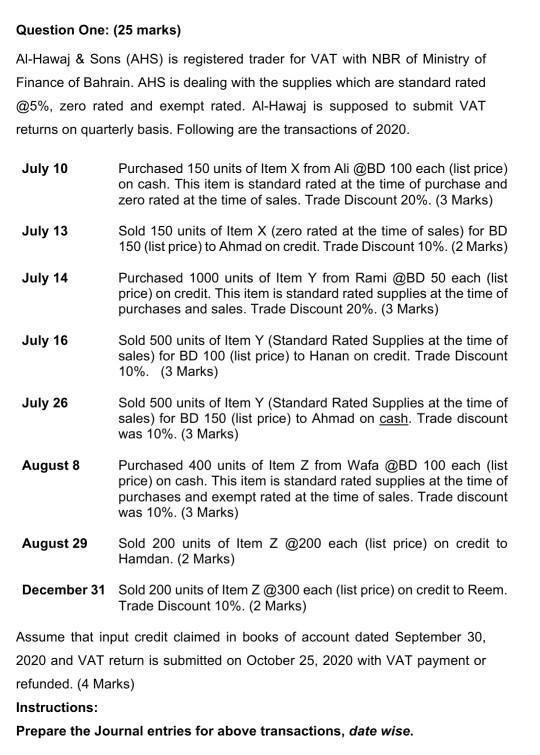

Question One: (25 marks) Al-Hawaj & Sons (AHS) is registered trader for VAT with NBR of Ministry of Finance of Bahrain. AHS is dealing with the supplies which are standard rated @5%, zero rated and exempt rated. Al-Hawaj is supposed to submit VAT returns on quarterly basis. Following are the transactions of 2020. July 10 July 13 July 14 July 16 July 26 August 8 August 29 Purchased 150 units of Item X from Ali @BD 100 each (list price) on cash. This item is standard rated at the time of purchase and zero rated at the time of sales. Trade Discount 20%. (3 Marks) Sold 150 units of Item X (zero rated at the time of sales) for BD 150 (list price) to Ahmad on credit. Trade Discount 10%. (2 Marks) Purchased 1000 units of Item Y from Rami @BD 50 each (list price) on credit. This item is standard rated supplies at the time of purchases and sales. Trade Discount 20%. (3 Marks) Sold 500 units of Item Y (Standard Rated Supplies at the time of sales) for BD 100 (list price) to Hanan on credit. Trade Discount 10%. (3 Marks) Sold 500 units of Item Y (Standard Rated Supplies at the time of sales) for BD 150 (list price) to Ahmad on cash. Trade discount was 10%. (3 Marks) Purchased 400 units of Item Z from Wafa @BD 100 each (list price) on cash. This item is standard rated supplies at the time of purchases and exempt rated at the time of sales. Trade discount was 10%. (3 Marks) Sold 200 units of Item Z @200 each (list price) on credit to Hamdan. (2 Marks) December 31 Sold 200 units of Item Z @300 each (list price) on credit to Reem. Trade Discount 10%. (2 Marks) Assume that input credit claimed in books of account dated September 30, 2020 and VAT return is submitted on October 25, 2020 with VAT payment or refunded. (4 Marks) Instructions: Prepare the Journal entries for above transactions, date wise.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry Jul 10 Inventory X Ac Dr 12000 Input VAT Ac Dr 600 To Ali Alc 12600 Being output being ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started