Answered step by step

Verified Expert Solution

Question

1 Approved Answer

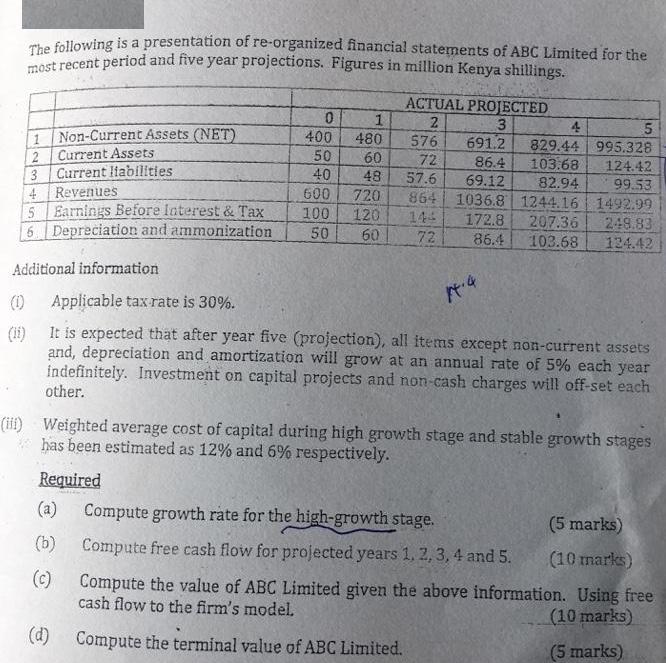

The following is a presentation of re-organized financial statements of ABC Limited for the et recent period and five year projections. Figures in million

The following is a presentation of re-organized financial statements of ABC Limited for the et recent period and five year projections. Figures in million Kenya shillings. ACTUAL PROJECTED 2 3 4 829.44 995.328 103.68 82.94 864| 1036.8 1244.16 1492.99 Non-Current Assets (NET) 400 480 50 576 1. Current Assets Current liabilities 4 Revenues 5 Earnings Before Iaterest & Tax 6 Depreciation and ammonization 691.2 60 72 86.4 124.42 99.53 40 48 57.6 69.12 600 720 100 120 144 172.8 86.4 207.36 103.68 248.83 124.42 50 60 72 Additional information (1) 4.4 Applicable tax rate is 30%. It is expected that after year five (projection), all items except non-current assets (1i) and, depreciation and amortization will grow at an annual rate of 5% each year indefinitely. Investment on capital projects and non-cash charges will off-set each other. (iii) Weighted average cost of capital during high growth stage and stable growth stages has been estimated as 12% and 6% respectively. Required (a) Compute growth rate for the high-growth stage. (5 marks) (b) Compute free cash flow for projected years 1, 2, 3, 4 and 5. (10 marks) (c) Compute the value of ABC Limited given the above information. Using free cash flow to the firm's model. (10 marks) (d) Compute the terminal value of ABC Limited. (5 marks) 23

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Net Working Capital Workings Current assets 50 60 72 864 10368 12442 Current Liabilities 40 48 576 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started