Answered step by step

Verified Expert Solution

Question

1 Approved Answer

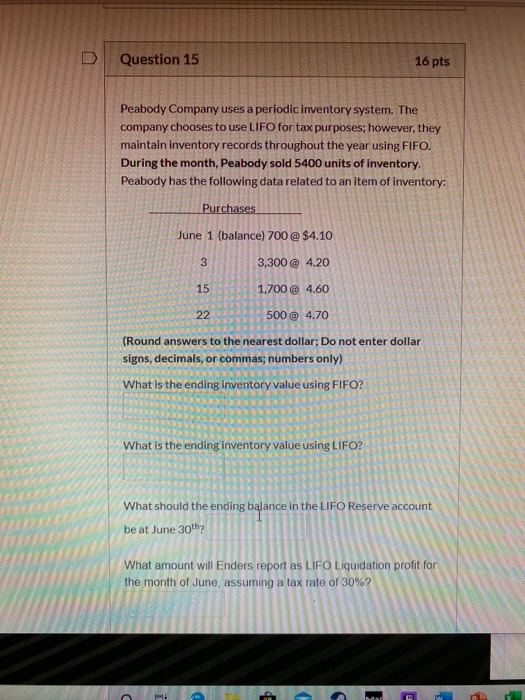

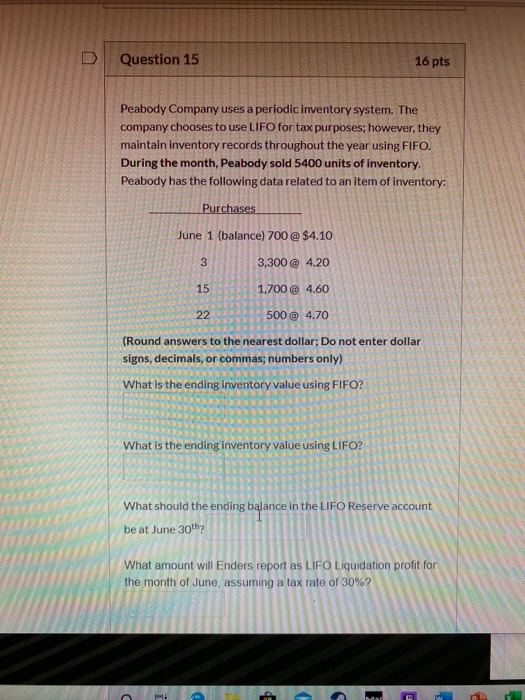

accounting question Question 15 16 pts Peabody Company uses a periodic inventory system. The company chooses to use LIFO for tax purposes; however, they maintain

accounting question  Question 15 16 pts Peabody Company uses a periodic inventory system. The company chooses to use LIFO for tax purposes; however, they maintain inventory records throughout the year using FIFO. During the month, Peabody sold 5400 units of inventory. Peabody has the following data related to an item of inventory: Purchases June 1 (balance) 700 @ $4.10 3 3 151 ,300 @ 4.20 .700 @ 4.60 22 5 00 @ 4.70 (Round answers to the nearest dollar; Do not enter dollar signs, decimals, or commas; numbers only) What is the ending inventory value using FIFO? What is the ending inventory value using LIFO? What should the ending balance in the LIFO Reserve account be at June 30th? What amount Will Enders report as LIFO Liquidation profit for the month of June, assuming a tax rate of 30%? AN

Question 15 16 pts Peabody Company uses a periodic inventory system. The company chooses to use LIFO for tax purposes; however, they maintain inventory records throughout the year using FIFO. During the month, Peabody sold 5400 units of inventory. Peabody has the following data related to an item of inventory: Purchases June 1 (balance) 700 @ $4.10 3 3 151 ,300 @ 4.20 .700 @ 4.60 22 5 00 @ 4.70 (Round answers to the nearest dollar; Do not enter dollar signs, decimals, or commas; numbers only) What is the ending inventory value using FIFO? What is the ending inventory value using LIFO? What should the ending balance in the LIFO Reserve account be at June 30th? What amount Will Enders report as LIFO Liquidation profit for the month of June, assuming a tax rate of 30%? AN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started