Answered step by step

Verified Expert Solution

Question

1 Approved Answer

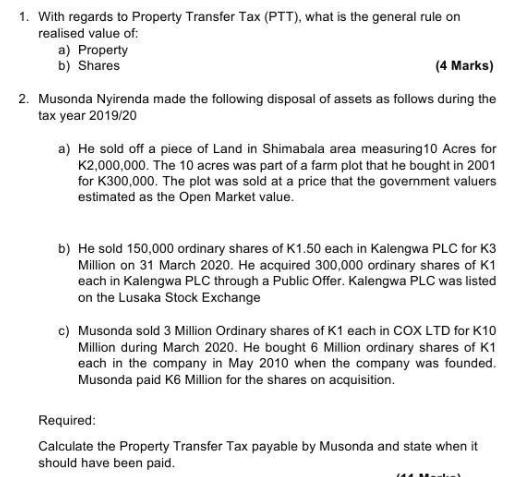

1. With regards to Property Transfer Tax (PTT), what is the general rule on realised value of: a) Property b) Shares (4 Marks) 2.

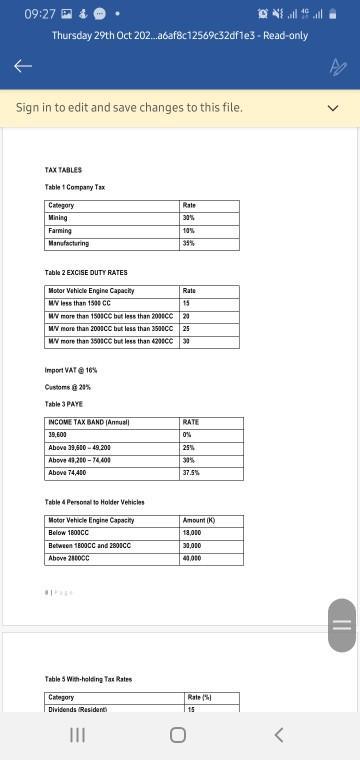

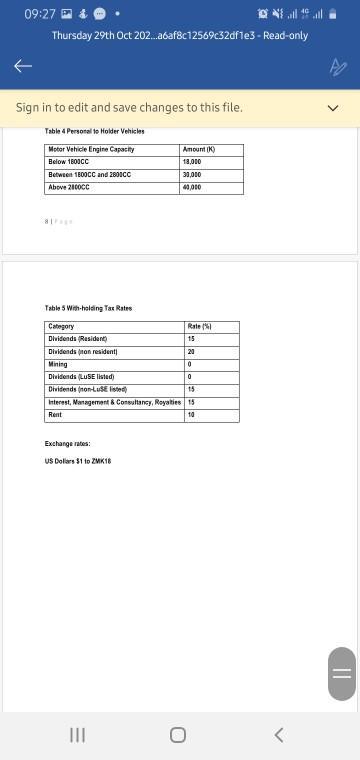

1. With regards to Property Transfer Tax (PTT), what is the general rule on realised value of: a) Property b) Shares (4 Marks) 2. Musonda Nyirenda made the following disposal of assets as follows during the tax year 2019/20 a) He sold off a piece of Land in Shimabala area measuring 10 Acres for K2,000,000. The 10 acres was part of a farm plot that he bought in 2001 for K300,000. The plot was sold at a price that the government valuers estimated as the Open Market value. b) He sold 150,000 ordinary shares of K1.50 each in Kalengwa PLC for K3 Million on 31 March 2020. He acquired 300,000 ordinary shares of K1 each in Kalengwa PLC through a Public Offer. Kalengwa PLC was listed on the Lusaka Stock Exchange c) Musonda sold 3 Million Ordinary shares of K1 each in COX LTD for K10 Million during March 2020. He bought 6 Million ordinary shares of K1 each in the company in May 2010 when the company was founded. Musonda paid K6 Million for the shares on acquisition. Required: Calculate the Property Transfer Tax payable by Musonda and state when it should have been paid. 09:27 Thursday 29th Oct 202...a6af8c12569c32df1e3-Read-only Sign in to edit and save changes to this file. TAX TABLES Table 1 Company Tax Category Mining Farming Manufacturing Table 2 EXCISE DUTY RATES Motor Vehicle Engine Capacity MV less than 1500 CC Import VAT 10% Customs@20% Table 3 PAYE INCOME TAX BAND (Annual) 39.600 Above 39,600-49,200 Above 43,200 -74,400 Above 74,400 15 20 WV more than 1500CC but less than 2000CC MV more than 2000CC but less than 3500CC 25 MV more than 3500CC but less than 4200CC 30 Table 4 Personal to Holder Vehicles Motor Vehicle Engine Capacity Below 1600CC Between 1800CC and 2800CC Above 2800CC #frase Table 5 With-holding Tax Rates Category Dividends Residenti Rate 30% ||| 10% 39% Rate RATE 0% 25% 30% 37.5% Amount (K) 18,000 30,000 40,000 Rate(%) 15 II 09:27 Thursday 29th Oct 202...a6af8c12569c32df1e3-Read-only Sign in to edit and save changes to this file. Table 4 Personal to Holder Vehicles Motor Vehicle Engine Capacity Below 1600CC Between 1800CC and 2800CC Above 2800CC Table 5 With-holding Tax Rates Category Rate(%) Dividends (Resident) 15 Dividends (non resident 20 Mining 0 Dividends (LUSE listed) 0 Dividends (non-LusEisted) 15 Interest, Management & Consultancy, Royalties 15 Rent 10 Exchange rates: US Dollars $1 to ZMK18 Amount (K) 18,000 30,000 40,000 ||| ||

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started