Answered step by step

Verified Expert Solution

Question

1 Approved Answer

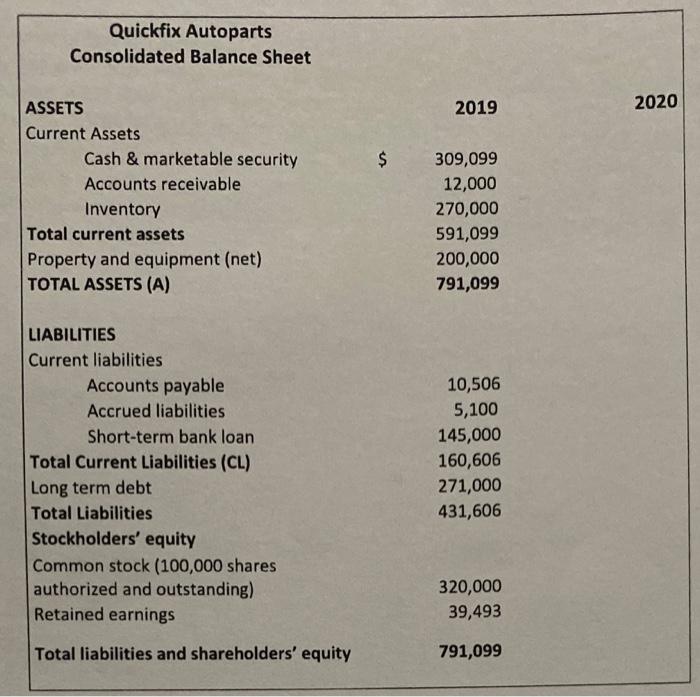

Quickfix Autoparts Consolidated Balance Sheet ASSETS 2019 2020 Current Assets Cash & marketable security 2$ 309,099 Accounts receivable 12,000 270,000 591,099 Inventory Total current

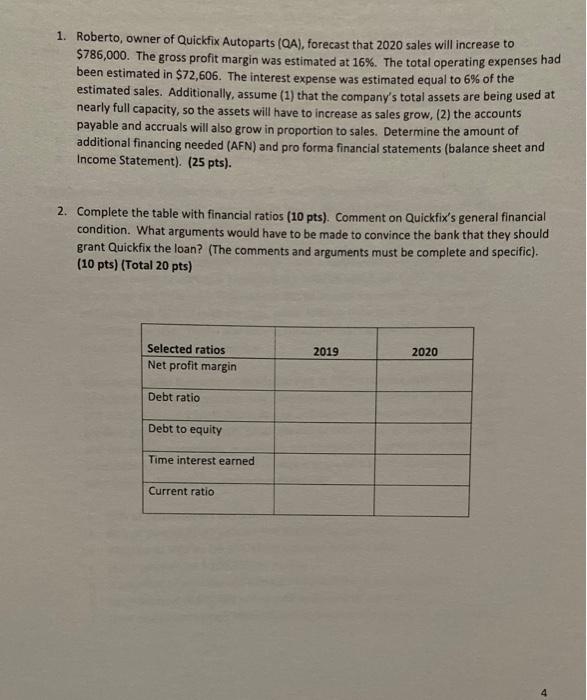

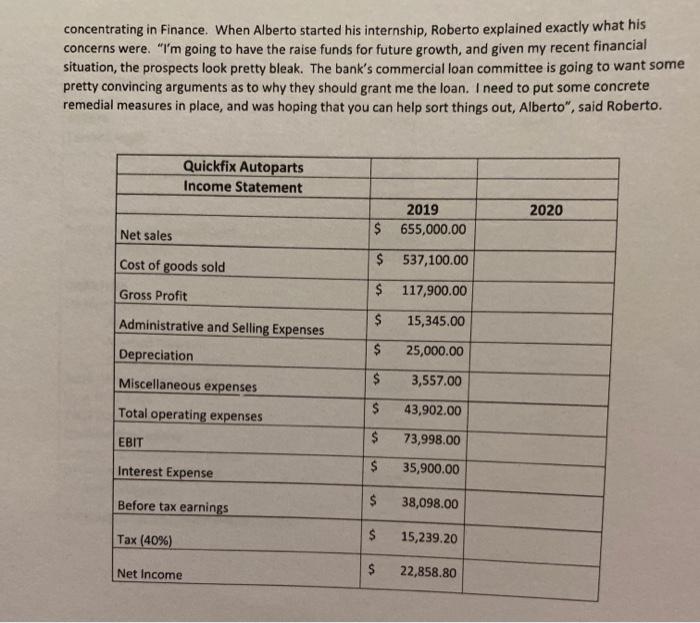

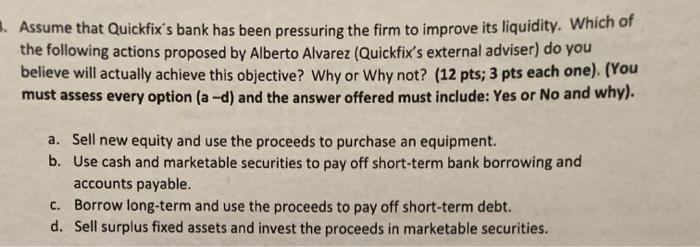

Quickfix Autoparts Consolidated Balance Sheet ASSETS 2019 2020 Current Assets Cash & marketable security 2$ 309,099 Accounts receivable 12,000 270,000 591,099 Inventory Total current assets Property and equipment (net) TOTAL ASSETS (A) 200,000 791,099 LIABILITIES Current liabilities Accounts payable 10,506 5,100 145,000 Accrued liabilities Short-term bank loan Total Current Liabilities (CL) 160,606 Long term debt 271,000 Total Liabilities 431,606 Stockholders' equity Common stock (100,000 shares authorized and outstanding) 320,000 Retained earnings 39,493 Total liabilities and shareholders' equity 791,099 1. Roberto, owner of Quickfix Autoparts (QA), forecast that 2020 sales will increase to $786,000. The gross profit margin was estimated at 16%. The total operating expenses had been estimated in $72,606. The interest expense was estimated equal to 6% of the estimated sales. Additionally, assume (1) that the company's total assets are being used at nearly full capacity, so the assets will have to increase as sales grow, (2) the accounts payable and accruals will also grow in proportion to sales. Determine the amount of additional financing needed (AFN) and pro forma financial statements (balance sheet and Income Statement). (25 pts). 2. Complete the table with financial ratios (10 pts). Comment on Quickfix's general financial condition. What arguments would have to be made to convince the bank that they should grant Quickfix the loan? (The comments and arguments must be complete and specific). (10 pts) (Total 20 pts) Selected ratios 2019 2020 Net profit margin Debt ratio Debt to equity Time interest earned Current ratio concentrating in Finance. When Alberto started his internship, Roberto explained exactly what his concerns were. "I'm going to have the raise funds for future growth, and given my recent financial situation, the prospects look pretty bleak. The bank's commercial loan committee is going to want some pretty convincing arguments as to why they should grant me the loan. I need to put some concrete remedial measures in place, and was hoping that you can help sort things out, Alberto", said Roberto. Quickfix Autoparts Income Statement 2019 2020 $ 655,000.00 Net sales $ 537,100.00 Cost of goods sold 2. 117,900.00 Gross Profit 15,345.00 Administrative and Selling Expenses 25,000.00 Depreciation 2$ 3,557.00 Miscellaneous expenses 43,902.00 Total operating expenses 73,998.00 EBIT 2$ 35,900.00 Interest Expense 2$ 38,098.00 Before tax earnings 2$ 15,239.20 Tax (40%) 22,858.80 Net Income 3. Assume that Quickfix's bank has been pressuring the firm to improve its liquidity. Which of the following actions proposed by Alberto Alvarez (Quickfix's external adviser) do you believe will actually achieve this objective? Why or Why not? (12 pts; 3 pts each one). (You must assess every option (a -d) and the answer offered must include: Yes or No and why). a. Sell new equity and use the proceeds to purchase an equipment. b. Use cash and marketable securities to pay off short-term bank borrowing and accounts payable. c. Borrow long-term and use the proceeds to pay off short-term debt. d. Sell surplus fixed assets and invest the proceeds in marketable securities.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started