Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raquel (who has itemized deductions of $30,000 without considering charitable contributions) owns land used in her trade or business for more than one year.

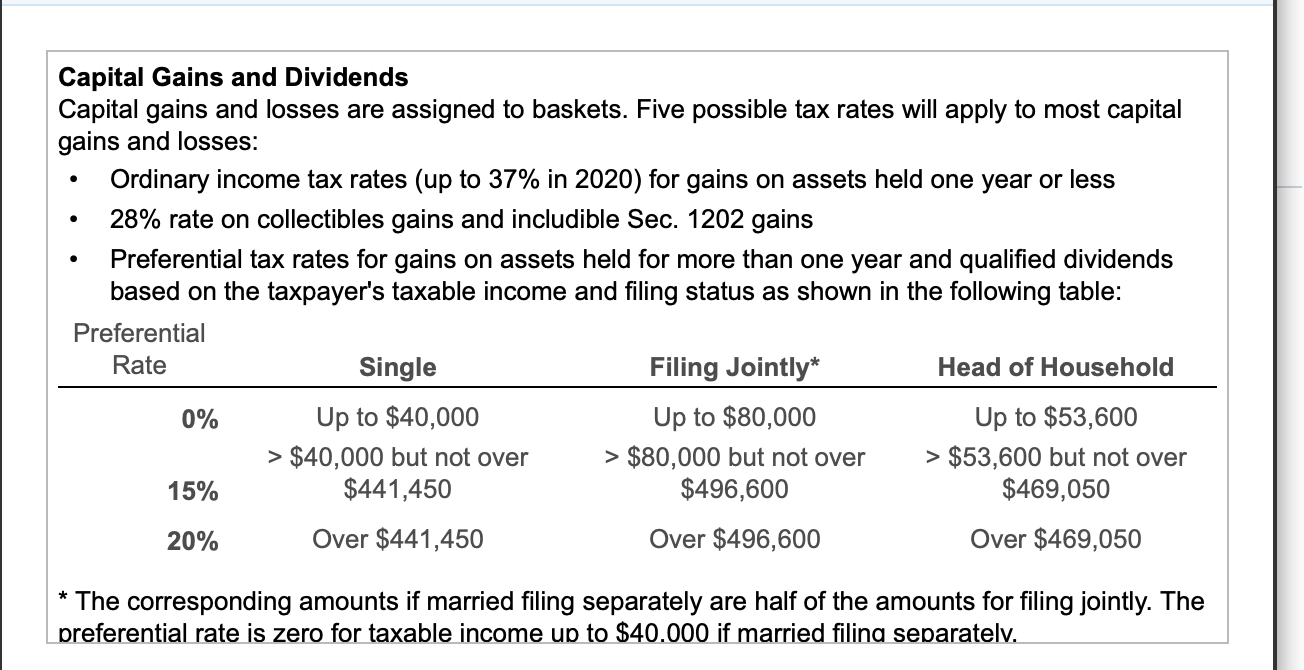

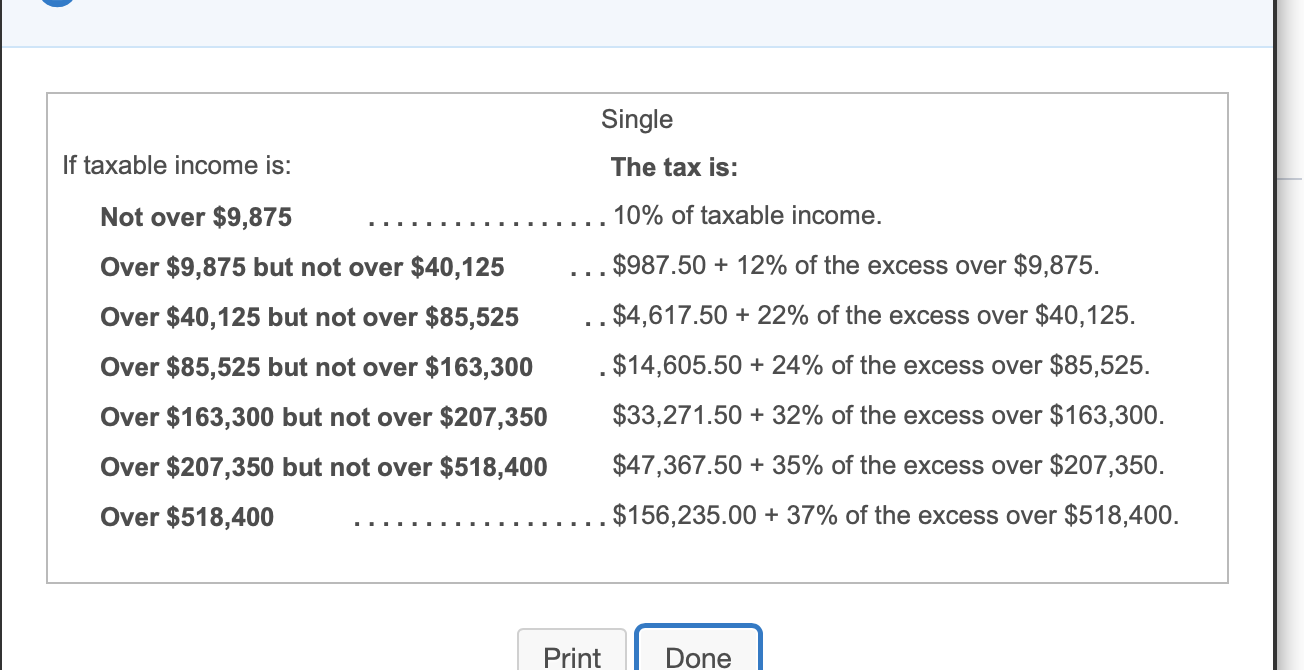

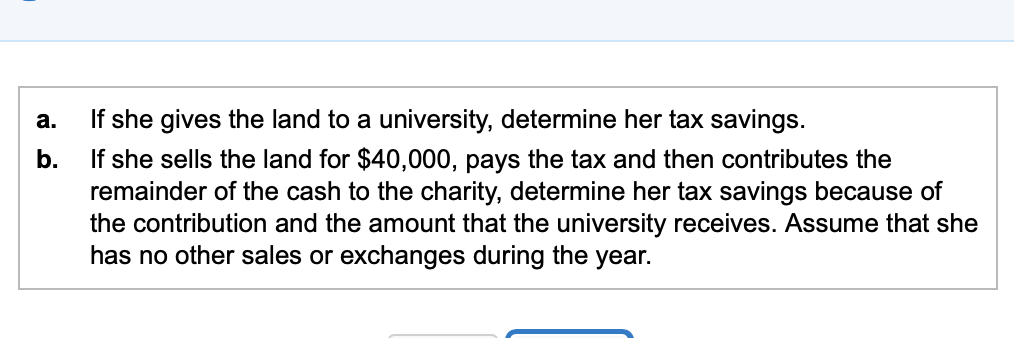

Raquel (who has itemized deductions of $30,000 without considering charitable contributions) owns land used in her trade or business for more than one year. The basis is $10,000 and its FMV is $40,000. Her tax rate is 32% and her AGI is $250,000. She makes no other charitable contributions except for the ones considered below. (Click the icon to view the capital gains and dividends rates table.) (Click the icon to view the tax rates table.) Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2020) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferential Rate Single Filing Jointly* Head of Household 0% Up to $40,000 Up to $80,000 Up to $53,600 > $40,000 but not over $441,450 > $80,000 but not over $496,600 > $53,600 but not over $469,050 15% 20% Over $441,450 Over $496,600 Over $469,050 * The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $40.000 if married filina separatelv. Single If taxable income is: The tax is: Not over $9,875 10% of taxable income. Over $9,875 but not over $40,125 $987.50 + 12% of the excess over $9875. Over $40,125 but not over $85,525 .. $4,617.50 + 22% of the excess over $40,125. Over $85,525 but not over $163,300 . $14,605.50 + 24% of the excess over $85,525. Over $163,300 but not over $207,350 $33,271.50 + 32% of the excess over $163,300. Over $207,350 but not over $518,400 $47,367.50 + 35% of the excess over $207,350. Over $518,400 $156,235.00 + 37% of the excess over $518,400. Print Done . If she gives the land to a university, determine her tax savings. If she sells the land for $40,000, pays the tax and then contributes the remainder of the cash to the charity, determine her tax savings because of the contribution and the amount that the university receives. Assume that she has no other sales or exchanges during the year. b.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a 12800 40000 x 32 b 40000 Cash received due to the sale 4500 Cash n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started