Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2020, Alexa Company is preparing adjusting entries for its annual year-end. The following situations confront the company. 1. Equipment #101 with

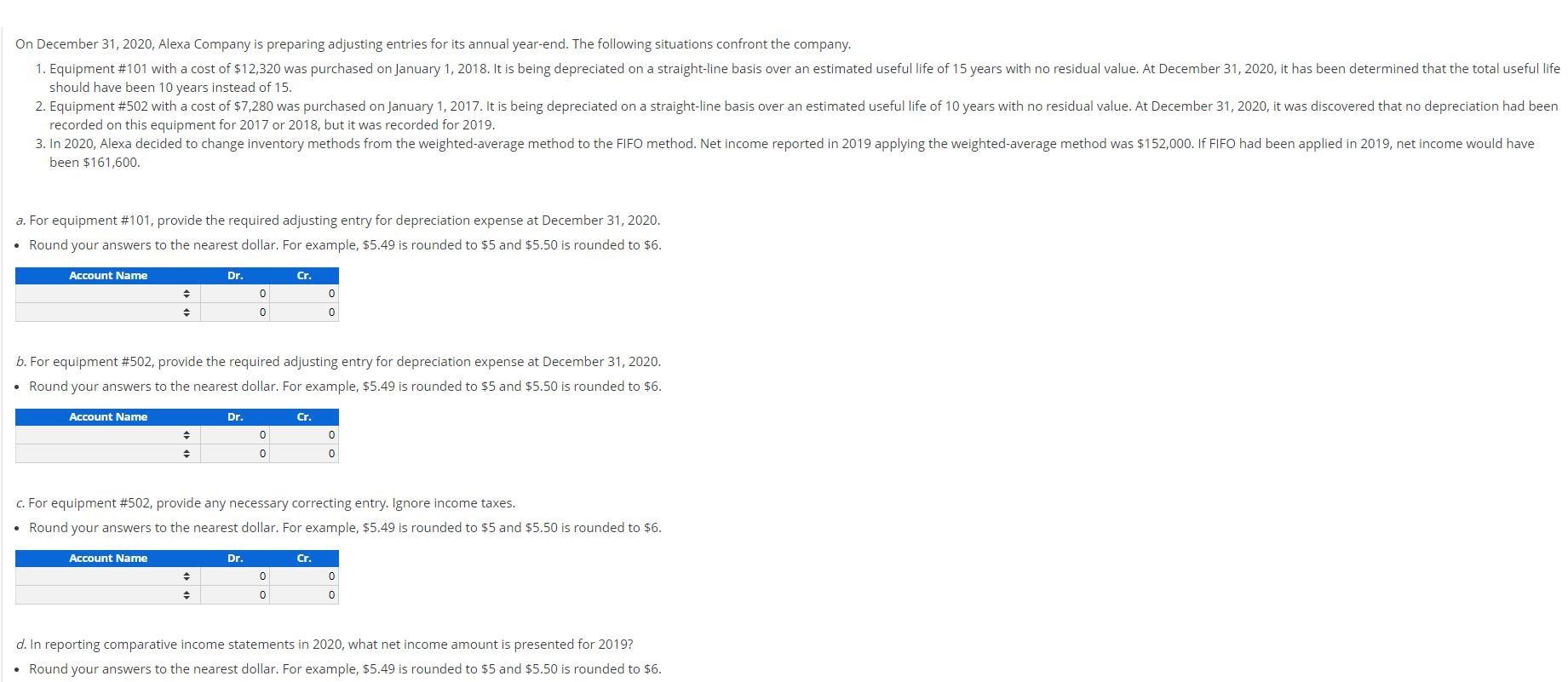

On December 31, 2020, Alexa Company is preparing adjusting entries for its annual year-end. The following situations confront the company. 1. Equipment #101 with a cost of $12,320 was purchased on January 1, 2018. It is being depreciated on a straight-line basis over an estimated useful life of 15 years with no residual value. At December 31, 2020, it has been determined that the total useful life should have been 10 years instead of 15. 2. Equipment #502 with a cost of $7,280 was purchased on January 1, 2017. It is being depreciated on a straight-line basis over an estimated useful life of 10 years with no residual value. At December 31, 2020, it was discovered that no depreciation had been recorded on this equipment for 2017 or 2018, but it was recorded for 2019. 3. In 2020, Alexa decided to change inventory methods from the weighted-average method to the FIFO method. Net income reported in 2019 applying the weighted-average method was $152,000. If FIFO had been applied in 2019, net income would have been $161,600. a. For equipment #101, provide the required adjusting entry for depreciation expense at December 31, 2020. Round your answers to the nearest dollar. For example, $5.49 is rounded to $5 and $5.50 is rounded to $6. Account Name Dr. Cr. b. For equipment #502, provide the required adjusting entry for depreciation expense at December 31, 2020. Round your answers to the nearest dollar. For example, $5.49 is rounded to $5 and $5.50 is rounded to $6. Account Name Dr. Cr. c. For equipment #502, provide any necessary correcting entry. Ignore income taxes. Round your answers to the nearest dollar. For example, $5.49 is rounded to $5 and $5.50 is rounded to $6. Account Name Dr. Cr. d. In reporting comparative income statements in 2020, what net income amount is presented for 2019? Round your answers to the nearest dollar. For example, $5.49 is rounded to $5 and $5.50 is rounded to $6.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

This case pertains to change in accounting estimate Estimate of useful life from 15 years to 10 year...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started