Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of its third year, CSK auto' s share price closed at $6.10 per share. Using the residual income valuation model, calculate the

At the end of its third year, CSK auto' s share price closed at $6.10 per share. Using the residual income valuation model, calculate the equity value of the company. Assume the company cost of equity is 10.4% . Top management think the share price should be considerably higher. How would you explain the situation to management.

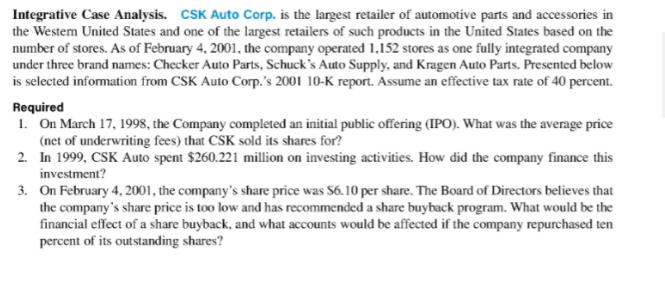

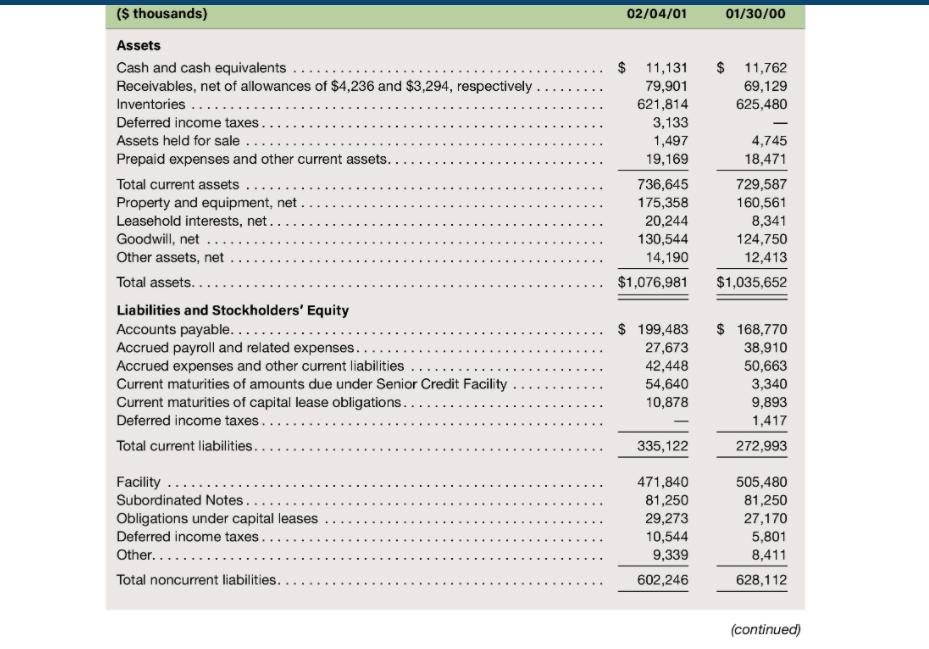

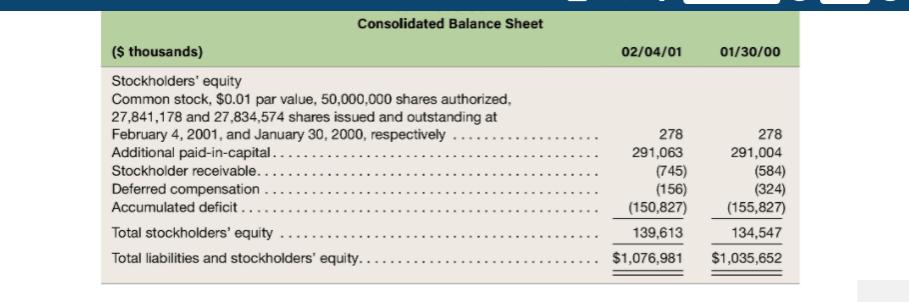

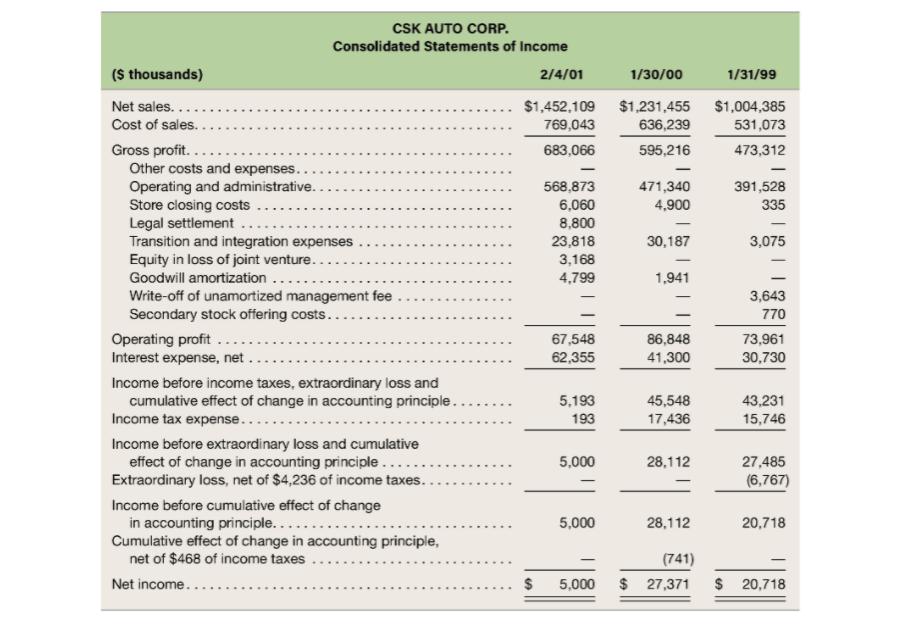

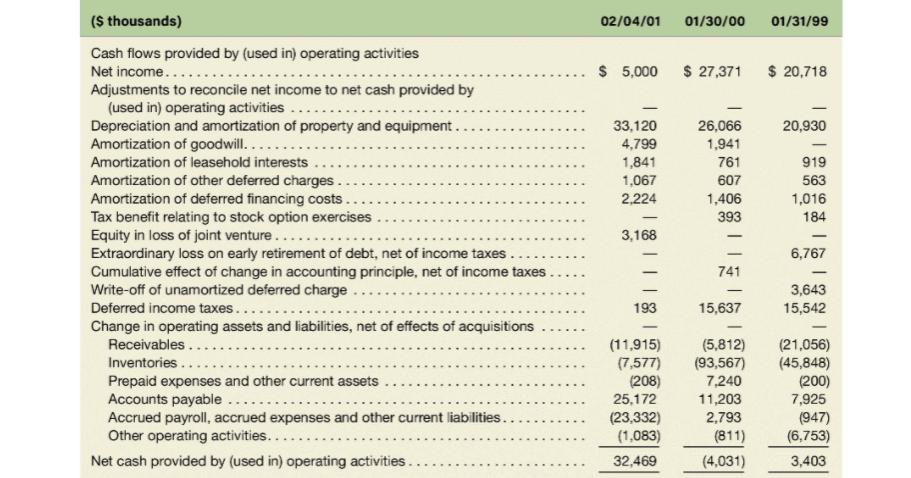

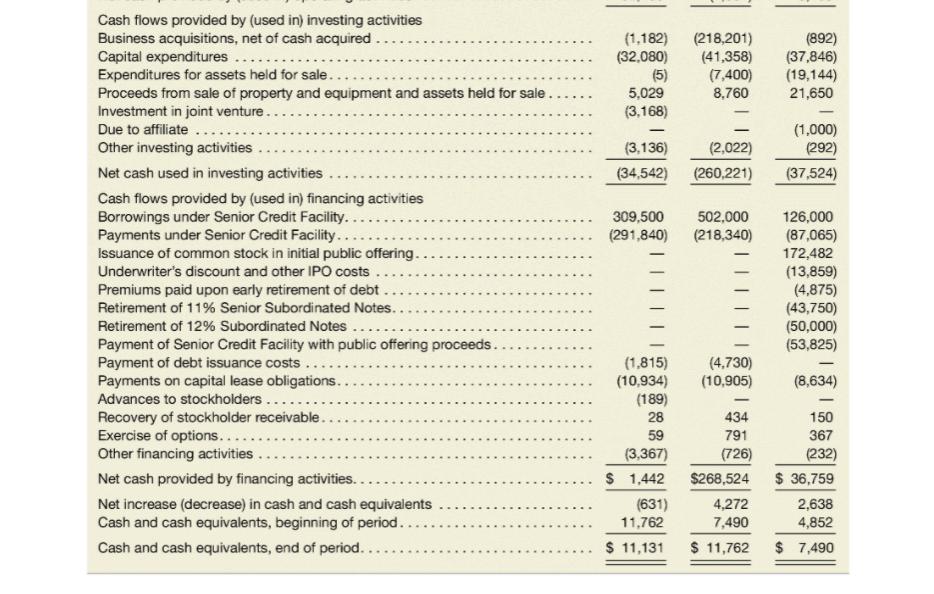

Integrative Case Analysis. CSK Auto Corp. is the largest retailer of automotive parts and accessories in the Westem United States and one of the largest retailers of such products in the United States based on the number of stores. As of February 4, 2001., the company operated 1.152 stores as one fully integrated company under three brand names: Checker Auto Parts, Schuck's Auto Supply, and Kragen Auto Parts. Presented below is selected information from CSK Auto Corp.'s 2001 10-K report. Assume an effective tax rate of 40 percent. Required 1. On March 17, 1998, the Company completed an initial public offering (IPO). What was the average price (net of underwriting fees) that CSK sold its shares for? 2. In 1999, CSK Auto spent $260.221 million on investing activities. How did the company finance this investment? 3. On February 4, 2001, the company's share price was S6.10 per share. The Board of Directors believes that the company's share price is too low and has recommended a share buyback program. What would be the financial effect of a share buyback, and what accounts would be affected if the company repurchased ten percent of its outstanding shares?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Average share price at which CSK sold its shares during IPO a Proceeds received under IPO 172482 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started