Answered step by step

Verified Expert Solution

Question

1 Approved Answer

gany Matthew had to pay $2,800 for emergency services after Sharon's nose suffered serious trauma during a martial arts class. He also paid $13,500

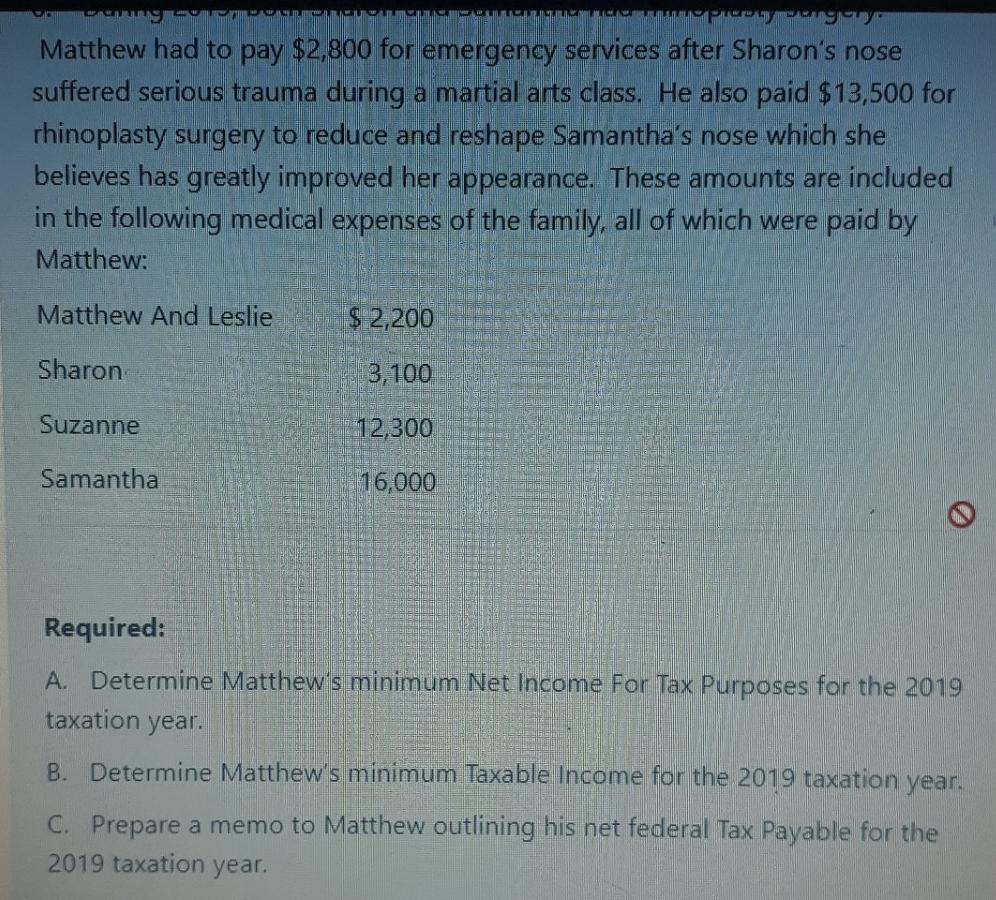

gany Matthew had to pay $2,800 for emergency services after Sharon's nose suffered serious trauma during a martial arts class. He also paid $13,500 for rhinoplasty surgery to reduce and reshape Samantha's nose which she believes has greatly improved her appearance. These amounts are included in the following medical expenses of the family, all of which were paid by Matthew: Matthew And Leslie $ 2,200 Sharon 3,100 Suzanne 12,300 Samantha 16,000 Required: A. Determine Matthew's minimum Net Income For Tax Purposes for the 2019 taxation year. B. Determine Matthew's minimum Taxable Income for the 2019 taxation year. C. Prepare a memo to Matthew outlining his net federal Tax Payable for the 2019 taxation year.

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A Subtract any interest expenses listed on the income statement from the earnings before interest and taxes This gives you the net income for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started