Question

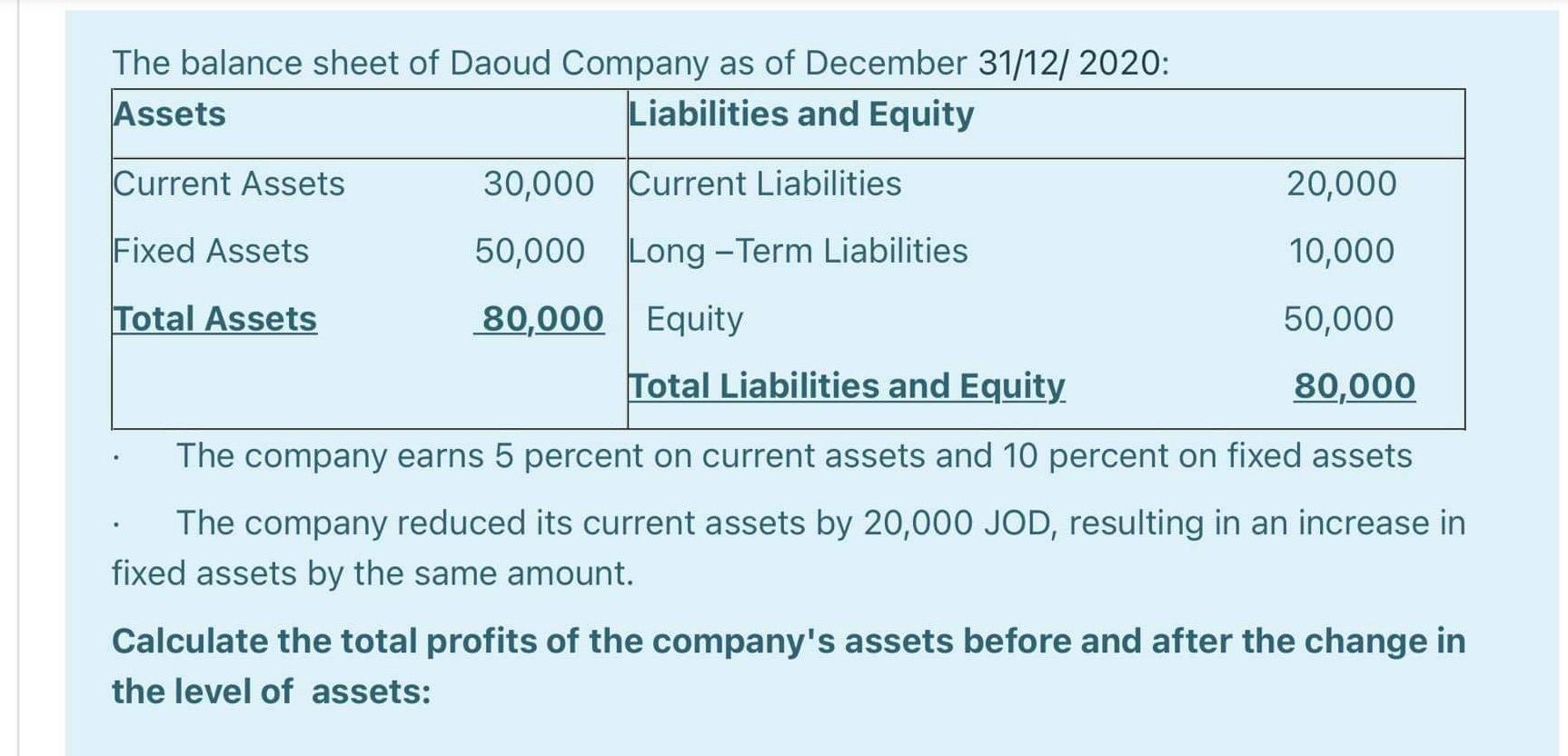

The balance sheet of Daoud Company as of December 31/12/2020: Assets Liabilities and Equity Current Assets Current Liabilities Fixed Assets Total Assets 30,000 50,000

The balance sheet of Daoud Company as of December 31/12/2020: Assets Liabilities and Equity Current Assets Current Liabilities Fixed Assets Total Assets 30,000 50,000 Long-Term Liabilities 80,000 Equity 20,000 10,000 50,000 Total Liabilities and Equity 80,000 The company earns 5 percent on current assets and 10 percent on fixed assets The company reduced its current assets by 20,000 JOD, resulting in an increase in fixed assets by the same amount. Calculate the total profits of the company's assets before and after the change in the level of assets:

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer to the Question Calculation of Net working Capital before change in level of assets Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice

10th edition

324645570, 978-0324645576

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App