Answered step by step

Verified Expert Solution

Question

1 Approved Answer

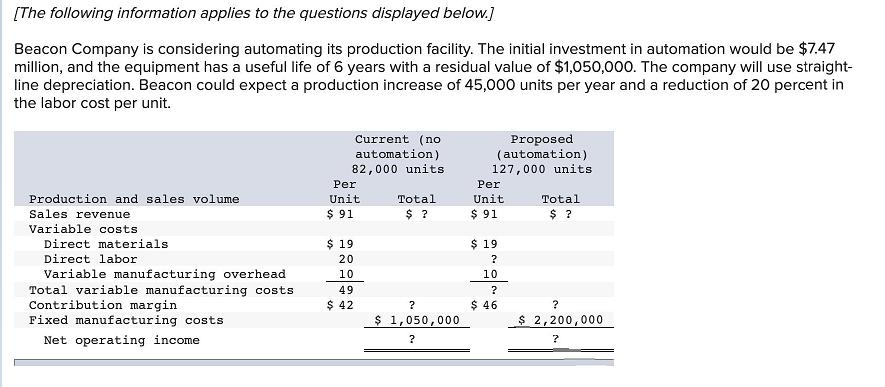

[The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be

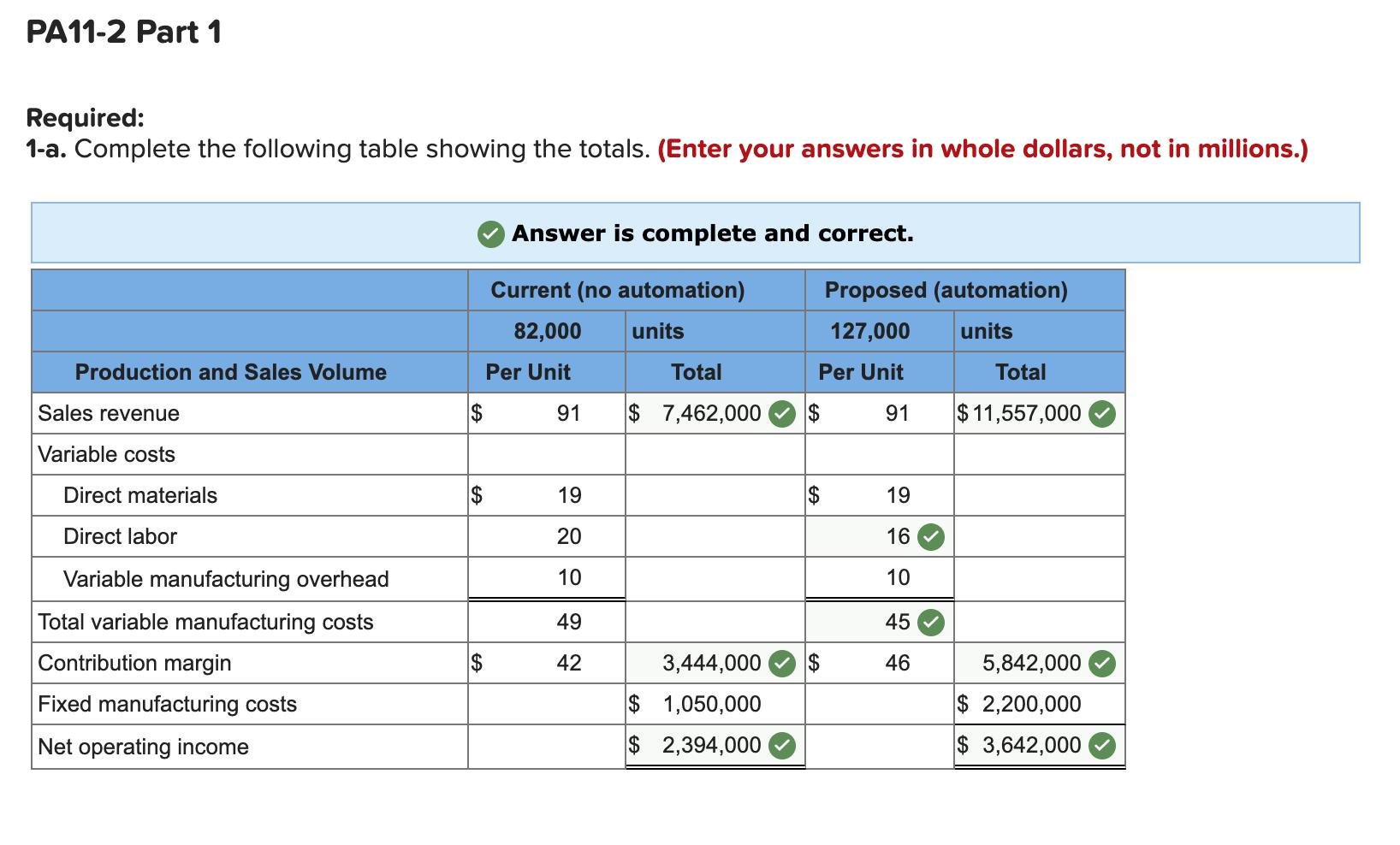

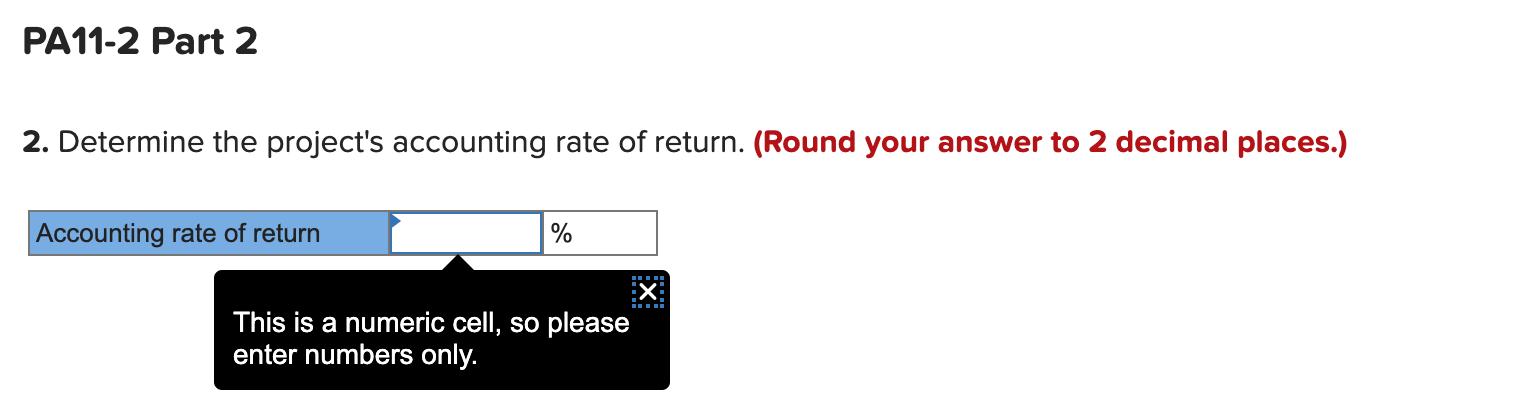

[The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $7.47 million, and the equipment has a useful life of 6 years with a residual value of $1,050,000. The company will use straight- line depreciation. Beacon could expect a production increase of 45,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Proposed (automation) 127,000 units Per Per Production and sales volume Unit Total Unit Total Sales revenue $ 91 $ ? $ 91 $ ? Variable costs Direct materials $ 19 $ 19 Direct labor 20 Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs 10 10 49 $ 42 $ 46 $ 1,050,000 ? $ 2,200,000 Net operating income ? PA11-2 Part 1 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Answer is complete and correct. Current (no automation) Proposed (automation) 82,000 units 127,000 units Production and Sales Volume Per Unit Total Per Unit Total Sales revenue 2$ 91 $ 7,462,000 $ 91 $11,557,000 Variable costs Direct materials 2$ 19 2$ 19 Direct labor 20 16 Variable manufacturing overhead 10 10 Total variable manufacturing costs 49 45 Contribution margin 2$ 42 3,444,000 2$ 46 5,842,000 Fixed manufacturing costs $ 1,050,000 $ 2,200,000 Net operating income $ 2,394,000 $ 3,642,000 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % This is a numeric cell, so please enter numbers only. PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years PA11-2 Part 4 4. Using a discount rate of 14 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value PA11-2 Part 5 5. Recalculate the NPV using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value [The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $7.47 million, and the equipment has a useful life of 6 years with a residual value of $1,050,000. The company will use straight- line depreciation. Beacon could expect a production increase of 45,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Proposed (automation) 127,000 units Per Per Production and sales volume Unit Total Unit Total Sales revenue $ 91 $ ? $ 91 $ ? Variable costs Direct materials $ 19 $ 19 Direct labor 20 Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs 10 10 49 $ 42 $ 46 $ 1,050,000 ? $ 2,200,000 Net operating income ? PA11-2 Part 1 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Answer is complete and correct. Current (no automation) Proposed (automation) 82,000 units 127,000 units Production and Sales Volume Per Unit Total Per Unit Total Sales revenue 2$ 91 $ 7,462,000 $ 91 $11,557,000 Variable costs Direct materials 2$ 19 2$ 19 Direct labor 20 16 Variable manufacturing overhead 10 10 Total variable manufacturing costs 49 45 Contribution margin 2$ 42 3,444,000 2$ 46 5,842,000 Fixed manufacturing costs $ 1,050,000 $ 2,200,000 Net operating income $ 2,394,000 $ 3,642,000 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % This is a numeric cell, so please enter numbers only. PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years PA11-2 Part 4 4. Using a discount rate of 14 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value PA11-2 Part 5 5. Recalculate the NPV using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value [The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $7.47 million, and the equipment has a useful life of 6 years with a residual value of $1,050,000. The company will use straight- line depreciation. Beacon could expect a production increase of 45,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Proposed (automation) 127,000 units Per Per Production and sales volume Unit Total Unit Total Sales revenue $ 91 $ ? $ 91 $ ? Variable costs Direct materials $ 19 $ 19 Direct labor 20 Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs 10 10 49 $ 42 $ 46 $ 1,050,000 ? $ 2,200,000 Net operating income ? PA11-2 Part 1 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Answer is complete and correct. Current (no automation) Proposed (automation) 82,000 units 127,000 units Production and Sales Volume Per Unit Total Per Unit Total Sales revenue 2$ 91 $ 7,462,000 $ 91 $11,557,000 Variable costs Direct materials 2$ 19 2$ 19 Direct labor 20 16 Variable manufacturing overhead 10 10 Total variable manufacturing costs 49 45 Contribution margin 2$ 42 3,444,000 2$ 46 5,842,000 Fixed manufacturing costs $ 1,050,000 $ 2,200,000 Net operating income $ 2,394,000 $ 3,642,000 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % This is a numeric cell, so please enter numbers only. PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years PA11-2 Part 4 4. Using a discount rate of 14 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value PA11-2 Part 5 5. Recalculate the NPV using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value [The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $7.47 million, and the equipment has a useful life of 6 years with a residual value of $1,050,000. The company will use straight- line depreciation. Beacon could expect a production increase of 45,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Proposed (automation) 127,000 units Per Per Production and sales volume Unit Total Unit Total Sales revenue $ 91 $ ? $ 91 $ ? Variable costs Direct materials $ 19 $ 19 Direct labor 20 Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs 10 10 49 $ 42 $ 46 $ 1,050,000 ? $ 2,200,000 Net operating income ? PA11-2 Part 1 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Answer is complete and correct. Current (no automation) Proposed (automation) 82,000 units 127,000 units Production and Sales Volume Per Unit Total Per Unit Total Sales revenue 2$ 91 $ 7,462,000 $ 91 $11,557,000 Variable costs Direct materials 2$ 19 2$ 19 Direct labor 20 16 Variable manufacturing overhead 10 10 Total variable manufacturing costs 49 45 Contribution margin 2$ 42 3,444,000 2$ 46 5,842,000 Fixed manufacturing costs $ 1,050,000 $ 2,200,000 Net operating income $ 2,394,000 $ 3,642,000 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % This is a numeric cell, so please enter numbers only. PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years PA11-2 Part 4 4. Using a discount rate of 14 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value PA11-2 Part 5 5. Recalculate the NPV using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value [The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $7.47 million, and the equipment has a useful life of 6 years with a residual value of $1,050,000. The company will use straight- line depreciation. Beacon could expect a production increase of 45,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Proposed (automation) 127,000 units Per Per Production and sales volume Unit Total Unit Total Sales revenue $ 91 $ ? $ 91 $ ? Variable costs Direct materials $ 19 $ 19 Direct labor 20 Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs 10 10 49 $ 42 $ 46 $ 1,050,000 ? $ 2,200,000 Net operating income ? PA11-2 Part 1 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Answer is complete and correct. Current (no automation) Proposed (automation) 82,000 units 127,000 units Production and Sales Volume Per Unit Total Per Unit Total Sales revenue 2$ 91 $ 7,462,000 $ 91 $11,557,000 Variable costs Direct materials 2$ 19 2$ 19 Direct labor 20 16 Variable manufacturing overhead 10 10 Total variable manufacturing costs 49 45 Contribution margin 2$ 42 3,444,000 2$ 46 5,842,000 Fixed manufacturing costs $ 1,050,000 $ 2,200,000 Net operating income $ 2,394,000 $ 3,642,000 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % This is a numeric cell, so please enter numbers only. PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years PA11-2 Part 4 4. Using a discount rate of 14 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value PA11-2 Part 5 5. Recalculate the NPV using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started